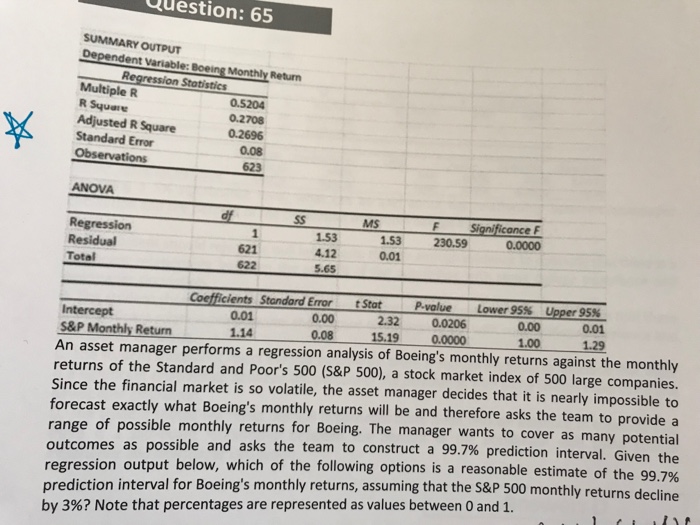

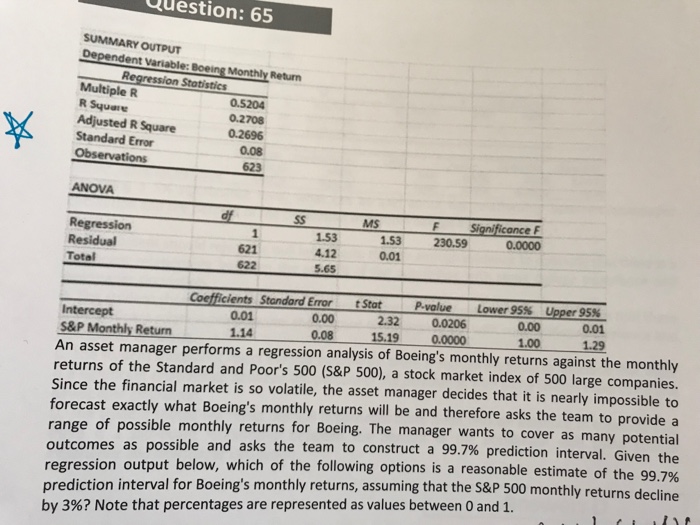

tion: 65 SUMMARY OUTPUT Dependent Variable: Boeing Monthly Return Regression Statistics Multiple R 0.5204 R Square 0.2708 Adjusted R Square 0.2696 Standard Error Observations * 0.08 623 ANOVA SS Regression Residual Total df 1 621 622 MS 1.53 0.01 F Significance F 230.59 0.0000 1.53 4.12 5.65 0.01 0.08 Coefficients Standard Error Stat P-value Lower 95% Upper 95% Intercept 0.01 0.00 2.32 0.0206 0.00 S&P Monthly Return 1.14 15.19 0.0000 1.00 1.29 An asset manager performs a regression analysis of Boeing's monthly returns against the monthly returns of the Standard and Poor's 500 (S&P 500), a stock market index of 500 large companies. Since the financial market is so volatile, the asset manager decides that it is nearly impossible to forecast exactly what Boeing's monthly returns will be and therefore asks the team to provide a range of possible monthly returns for Boeing. The manager wants to cover as many potential outcomes as possible and asks the team to construct a 99.7% prediction interval. Given the regression output below, which of the following options is a reasonable estimate of the 99.7% prediction interval for Boeing's monthly returns, assuming that the S&P 500 monthly returns decline by 3%? Note that percentages are represented as values between 0 and 1. tion: 65 SUMMARY OUTPUT Dependent Variable: Boeing Monthly Return Regression Statistics Multiple R 0.5204 R Square 0.2708 Adjusted R Square 0.2696 Standard Error Observations * 0.08 623 ANOVA SS Regression Residual Total df 1 621 622 MS 1.53 0.01 F Significance F 230.59 0.0000 1.53 4.12 5.65 0.01 0.08 Coefficients Standard Error Stat P-value Lower 95% Upper 95% Intercept 0.01 0.00 2.32 0.0206 0.00 S&P Monthly Return 1.14 15.19 0.0000 1.00 1.29 An asset manager performs a regression analysis of Boeing's monthly returns against the monthly returns of the Standard and Poor's 500 (S&P 500), a stock market index of 500 large companies. Since the financial market is so volatile, the asset manager decides that it is nearly impossible to forecast exactly what Boeing's monthly returns will be and therefore asks the team to provide a range of possible monthly returns for Boeing. The manager wants to cover as many potential outcomes as possible and asks the team to construct a 99.7% prediction interval. Given the regression output below, which of the following options is a reasonable estimate of the 99.7% prediction interval for Boeing's monthly returns, assuming that the S&P 500 monthly returns decline by 3%? Note that percentages are represented as values between 0 and 1