Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tion Completion Status: - Do not use $ signs or commas in your final answer. - Round your final answer to the nearest dollar. Do

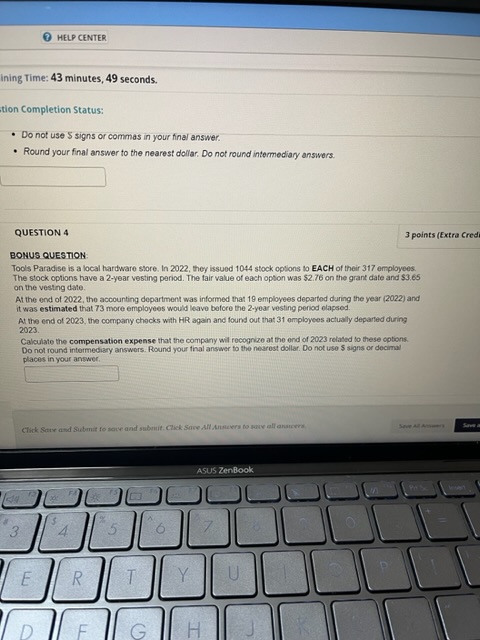

tion Completion Status: - Do not use $ signs or commas in your final answer. - Round your final answer to the nearest dollar. Do not round intermediary answers. QUESTION 4 3 points (E) BONUS QUESTION: Tools Paradise is a local hardware store. In 2022, they issuod 1044 stock options to EACH of their 317 employees. The stock options have a 2 -year vesting period. The tair value of each opton was $2.76 on the grant date and $3.65 on the vesting date. At the end of 2022, the accounting department was informed that 19 employees departod during the year (2022) and it was estimated that 73 more employees would leave before the 2 -year vesting period olapsed. At the end of 2023, the company chocks with HR again and lound out that 31 omployees actually departed during 2023. Calculate the compensation expense that the company wil rocognize at the end of 2023 related to these cotions. Do not round intermediary answers. Round your thal answer to the nearost dollar. Do not use $ signs or decimal places in your

tion Completion Status: - Do not use $ signs or commas in your final answer. - Round your final answer to the nearest dollar. Do not round intermediary answers. QUESTION 4 3 points (E) BONUS QUESTION: Tools Paradise is a local hardware store. In 2022, they issuod 1044 stock options to EACH of their 317 employees. The stock options have a 2 -year vesting period. The tair value of each opton was $2.76 on the grant date and $3.65 on the vesting date. At the end of 2022, the accounting department was informed that 19 employees departod during the year (2022) and it was estimated that 73 more employees would leave before the 2 -year vesting period olapsed. At the end of 2023, the company chocks with HR again and lound out that 31 omployees actually departed during 2023. Calculate the compensation expense that the company wil rocognize at the end of 2023 related to these cotions. Do not round intermediary answers. Round your thal answer to the nearost dollar. Do not use $ signs or decimal places in your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started