Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TIP: The AMT adjustment for personal property is the difference between the depreciation taken under MACRS and the amount determined by using 150% declining balance

TIP: The AMT adjustment for personal property is the difference between | |||||

the depreciation taken under MACRS and the amount determined by using 150% | |||||

declining balance (DB) method under ADS. The AMT adjustment for real property is | |||||

the difference between the depreciation taken under MACRS and the amount | |||||

determined by using the strait line (SL) method under ADS. please include formulas/work for each column | |||||

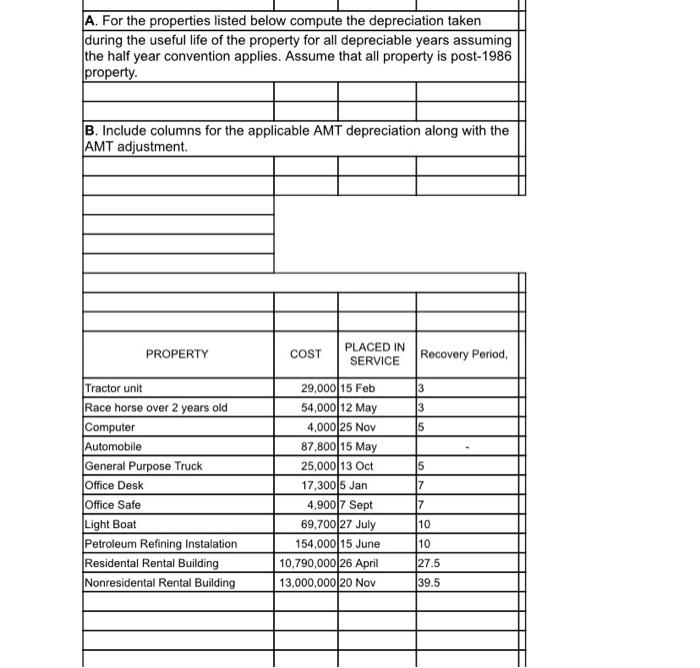

A. For the properties listed below compute the depreciation taken during the useful life of the property for all depreciable years assuming the half year convention applies. Assume that all property is post-1986 property. B. Include columns for the applicable AMT depreciation along with the AMT adjustment. PLACED IN SERVICE PROPERTY COST Recovery Period, Tractor unit Race horse over 2 years old Computer Automobile General Purpose Truck Office Desk Office Safe Light Boat Petroleum Refining Instalation Residental Rental Building 29,000 15 Feb 54,000 12 May 3 3 4,000 25 Nov 87,800 15 May 25,000 13 Oct 17,300 5 Jan 4,900 7 Sept 69,700 27 July 154,000 15 June 10,790,000 26 April 5 7 10 10 27.5 Nonresidental Rental Building 13,000,000 20 Nov 39.5

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

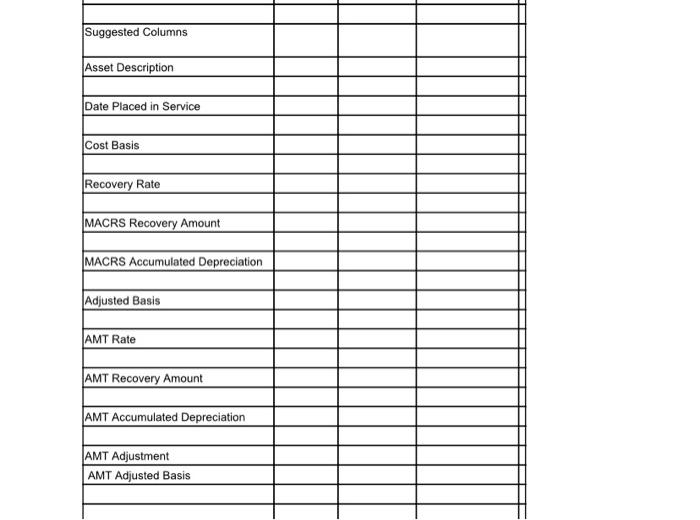

Asset Date Cost basis Recovery rate ACRS ACRS Depreciation Adjust...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started