Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tiple Select Question ct all that apply th of the following statements are correct? A current year insurance reimbursement of prior year medical expenses is

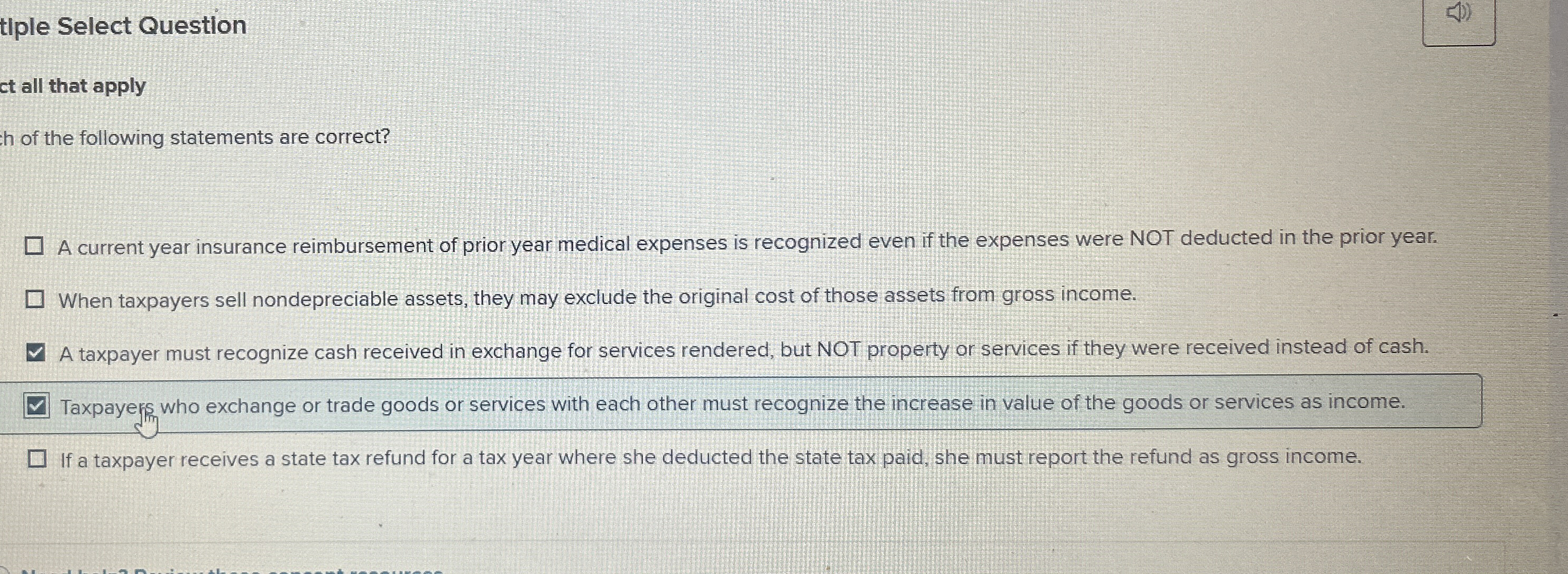

tiple Select Question

ct all that apply

th of the following statements are correct?

A current year insurance reimbursement of prior year medical expenses is recognized even if the expenses were NOT deducted in the prior year.

When taxpayers sell nondepreciable assets, they may exclude the original cost of those assets from gross income.

A taxpayer must recognize cash received in exchange for services rendered, but NOT property or services if they were received instead of cash.

Taxpayers who exchange or trade goods or services with each other must recognize the increase in value of the goods or services as income.

If a taxpayer receives a state tax refund for a tax year where she deducted the state tax paid, she must report the refund as gross income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started