Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tipple Inc plans to acquire Ennea and sell it after 4 years. The financial manager forecasted that Ennea will generate $5 million in operating

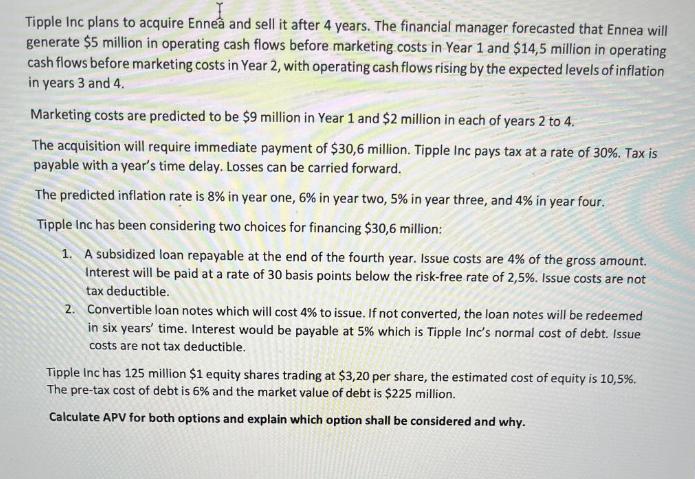

Tipple Inc plans to acquire Ennea and sell it after 4 years. The financial manager forecasted that Ennea will generate $5 million in operating cash flows before marketing costs in Year 1 and $14,5 million in operating cash flows before marketing costs in Year 2, with operating cash flows rising by the expected levels of inflation in years 3 and 4. Marketing costs are predicted to be $9 million in Year 1 and $2 million in each of years 2 to 4. The acquisition will require immediate payment of $30,6 million. Tipple Inc pays tax at a rate of 30%. Tax is payable with a year's time delay. Losses can be carried forward. The predicted inflation rate is 8% in year one, 6% in year two, 5% in year three, and 4% in year four. Tipple Inc has been considering two choices for financing $30,6 million: 1. A subsidized loan repayable at the end of the fourth year. Issue costs are 4% of the gross amount. Interest will be paid at a rate of 30 basis points below the risk-free rate of 2,5%. Issue costs are not tax deductible. 2. Convertible loan notes which will cost 4% to issue. If not converted, the loan notes will be redeemed in six years' time. Interest would be payable at 5% which is Tipple Inc's normal cost of debt. Issue costs are not tax deductible. Tipple Inc has 125 million $1 equity shares trading at $3,20 per share, the estimated cost of equity is 10,5%. The pre-tax cost of debt is 6% and the market value of debt is $225 million. Calculate APV for both options and explain which option shall be considered and why.

Step by Step Solution

★★★★★

3.55 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the Adjusted Present Value APV for both financing options we need to discount the cash flows associated with each option to the present value taking into consideration the time v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started