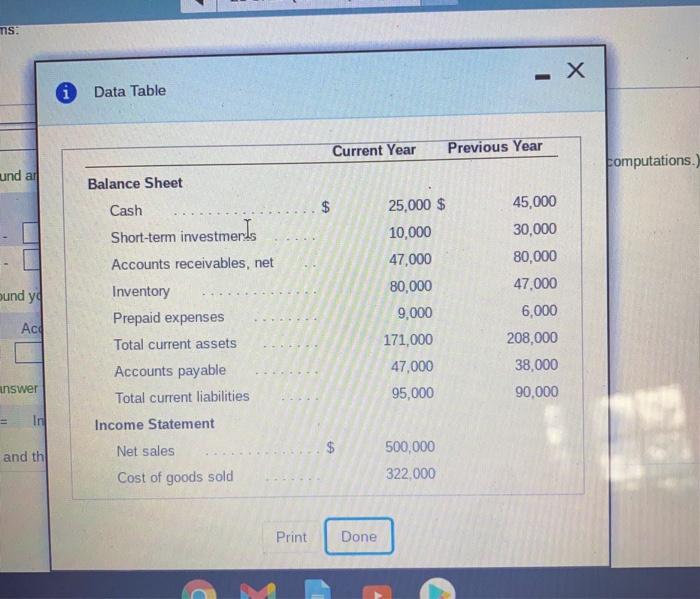

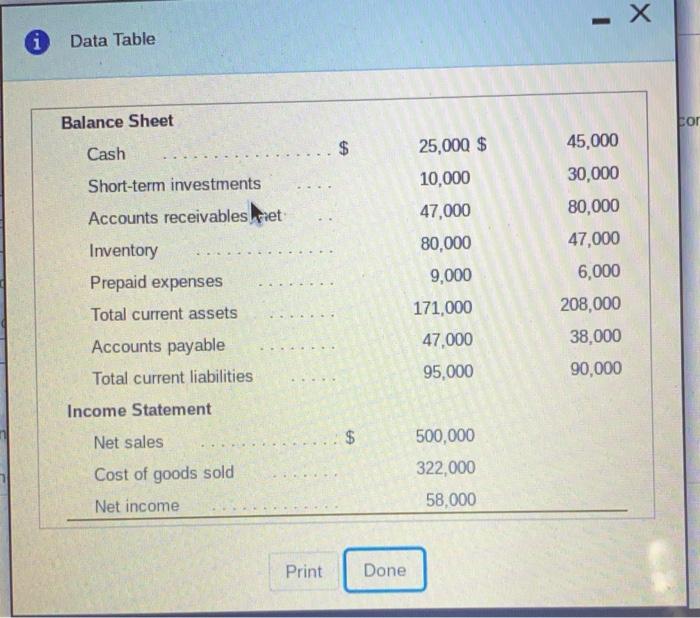

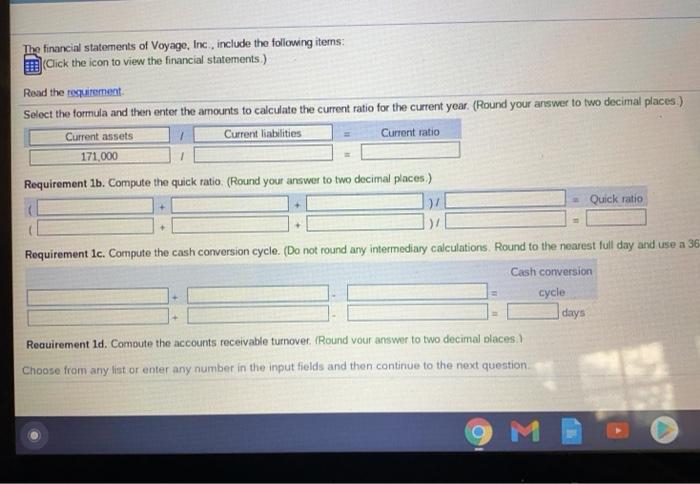

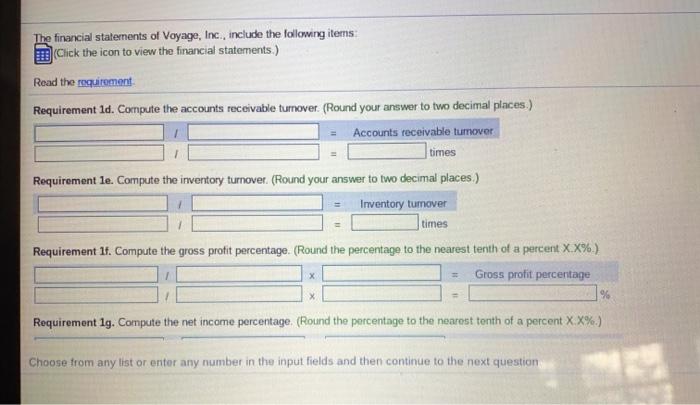

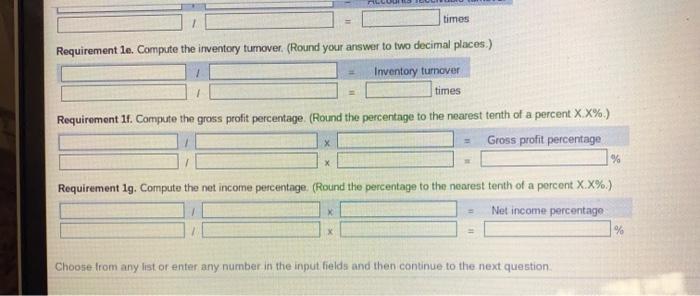

TIS: Data Table Current Year Previous Year Computations.) und all Balance Sheet Cash $ 45,000 30,000 stmer Is und ya Short-term investme Accounts receivables, net Inventory Prepaid expenses Total current assets Accounts payable Total current liabilities 25,000 $ 10,000 47,000 80,000 9,000 171,000 47,000 95,000 Aca 80,000 47,000 6,000 208,000 38,000 90,000 inswer In Income Statement Net sales $ and the 500,000 322,000 Cost of goods sold Print Done i Data Table Balance Sheet cor Cash $ 25,000 $ 10,000 47,000 80,000 Short-term investments Accounts receivables Fiet Inventory Prepaid expenses Total current assets Accounts payable Total current liabilities 45,000 30,000 80,000 47,000 6,000 208,000 38,000 90,000 9,000 171,000 47,000 95,000 Income Statement Net sales $ Cost of goods sold Net income 500,000 322,000 58,000 Print Done The financial statements of Voyage, Inc., include the following items: Click the icon to view the financial statements) Read the requirement Select the formula and then enter the amounts to calculate the current ratio for the current year. (Round your answer to two decimal places) Current assets Current liabilities Current ratio 171.000 Requirement lb. Compute the quick ratio (Round your answer to two decimal places) 07 Quick ratio Requirement lc. Compute the cash conversion cycle. (Do not round any intermediary calculations. Round to the nearest full day and use a 36 Cash conversion cycle days Requirement id. Compute the accounts receivable turnover (Round your answer to two decimal places) Choose from any list or enter any number in the input fields and then continue to the next question M The financial statements of Voyage, Inc., include the following items Click the icon to view the financial statements) Read the requirement Requirement id. Compute the accounts receivable turnover. (Round your answer to two decimal places) Accounts receivable tumover times Requirement le. Compute the inventory turnover (Round your answer to two decimal places) Inventory tumover times Requirement 1f. Compute the gross protit percentage. (Round the percentage to the nearest tenth of a percent X.X%.) = Gross profit percentage % X Requirement 1g. Compute the net income percentage (Round the percentage to the nearest tenth of a percent X.X%) Choose from any list or enter any number in the input fields and then continue to the next question times Requirement le Compute the inventory tumover. (Round your answer to two decimal places.) Inventory turnover times Requirement 11. Compute the gross profit percentage (Round the percentage to the nearest tenth of a percent XX%) Gross profit percentage % X Requirement lg. Compute the net income percentage. (Round the percentage to the nearest tenth of a percent X.X%) Net income percentage % X Choose from any list or enter any number in the input fields and then continue to the next