Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tistal & very TT VI ASUL One of the goals of economic policy is to stabilize the economy. This means promoting full employment and

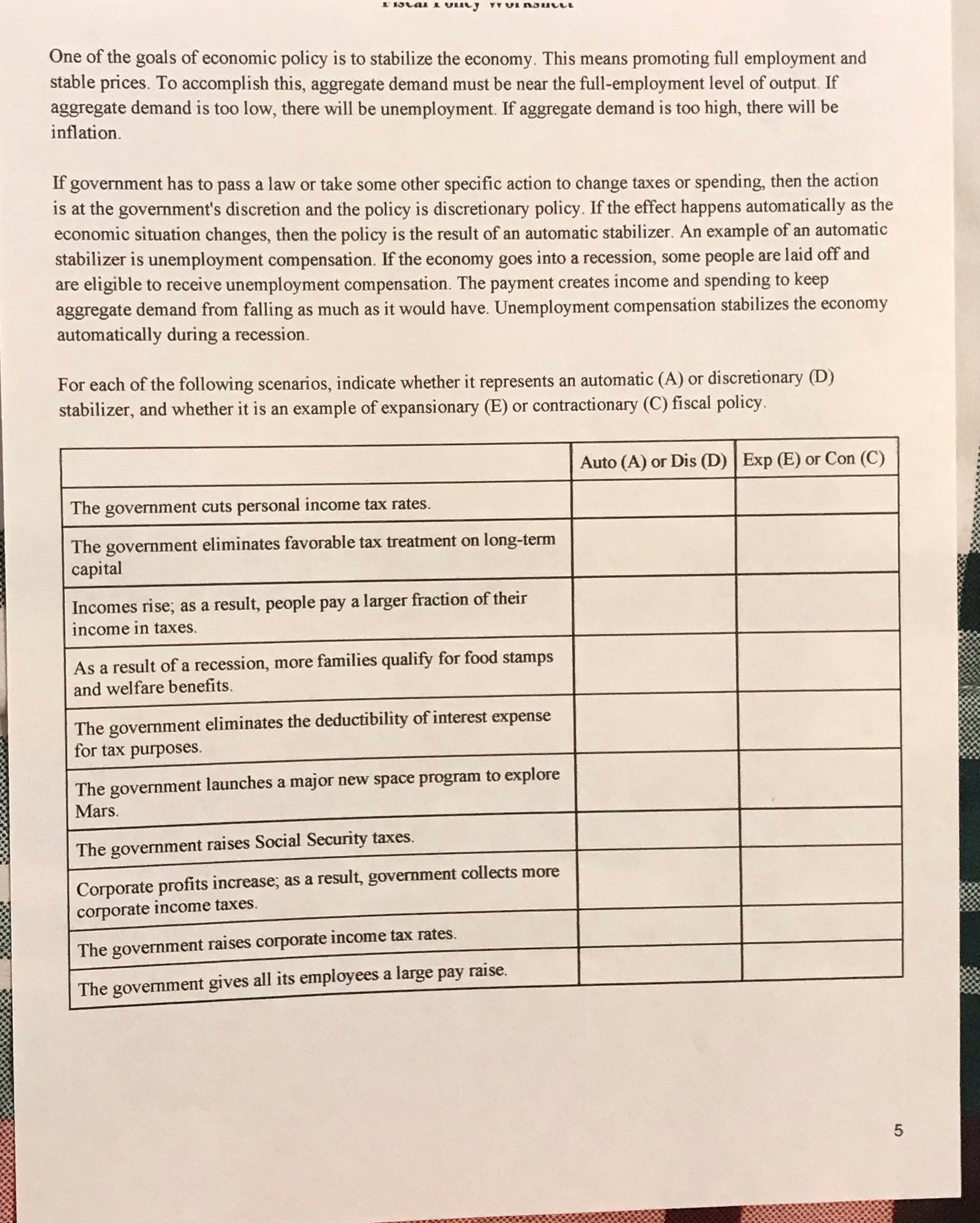

Tistal & very TT VI ASUL One of the goals of economic policy is to stabilize the economy. This means promoting full employment and stable prices. To accomplish this, aggregate demand must be near the full-employment level of output. If aggregate demand is too low, there will be unemployment. If aggregate demand is too high, there will be inflation. If government has to pass a law or take some other specific action to change taxes or spending, then the action is at the government's discretion and the policy is discretionary policy. If the effect happens automatically as the economic situation changes, then the policy is the result of an automatic stabilizer. An example of an automatic stabilizer is unemployment compensation. If the economy goes into a recession, some people are laid off and are eligible to receive unemployment compensation. The payment creates income and spending to keep aggregate demand from falling as much as it would have. Unemployment compensation stabilizes the economy automatically during a recession. For each of the following scenarios, indicate whether it represents an automatic (A) or discretionary (D) stabilizer, and whether it is an example of expansionary (E) or contractionary (C) fiscal policy. The government cuts personal income tax rates. The government eliminates favorable tax treatment on long-term capital Incomes rise; as a result, people pay a larger fraction of their income in taxes. As a result of a recession, more families qualify for food stamps and welfare benefits. The government eliminates the deductibility of interest expense for tax purposes. The government launches a major new space program to explore Mars. The government raises Social Security taxes. Corporate profits increase; as a result, government collects more corporate income taxes. The government raises corporate income tax rates. The government gives all its employees a large pay raise. Auto (A) or Dis (D) Exp (E) or Con (C) 01

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started