Answered step by step

Verified Expert Solution

Question

1 Approved Answer

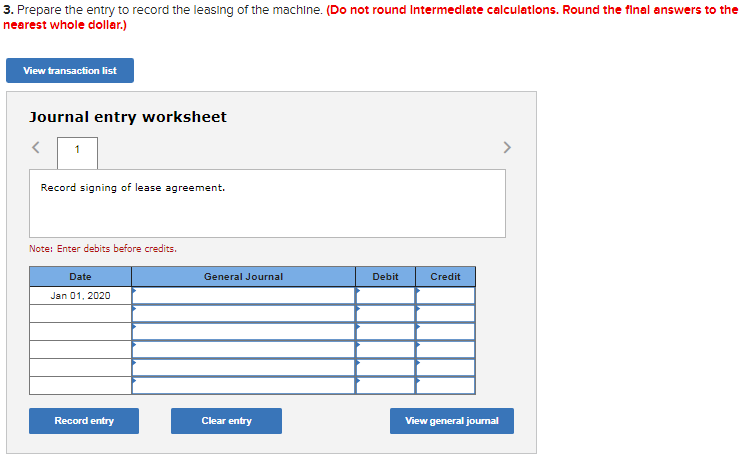

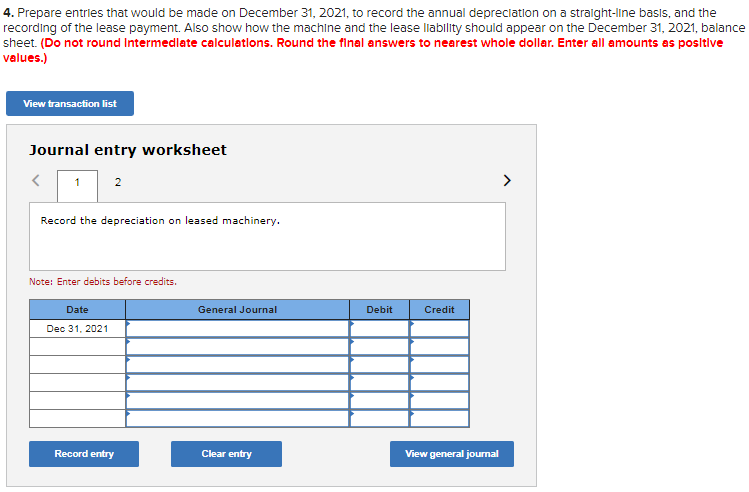

Title of account for Journal entry worksheet: 1. Accumulated depreciation, machinery 2. Cash 3. Depreciation expense, machinery 4. Interest expense 5. Interest payable 6. Lease

Title of account for Journal entry worksheet:

1. Accumulated depreciation, machinery

2. Cash

3. Depreciation expense, machinery

4. Interest expense

5. Interest payable

6. Lease liability

7. Leased machinery

8. Notes payable

9. Property, plant and equipment

Title of account for Laporte engineering company partial balance sheet:

1. Lease liability, current portion

2. Lease liability, less current portion

3. Machinery

4. Add: accumulated depreciation

5. Less: accumulated depreciation

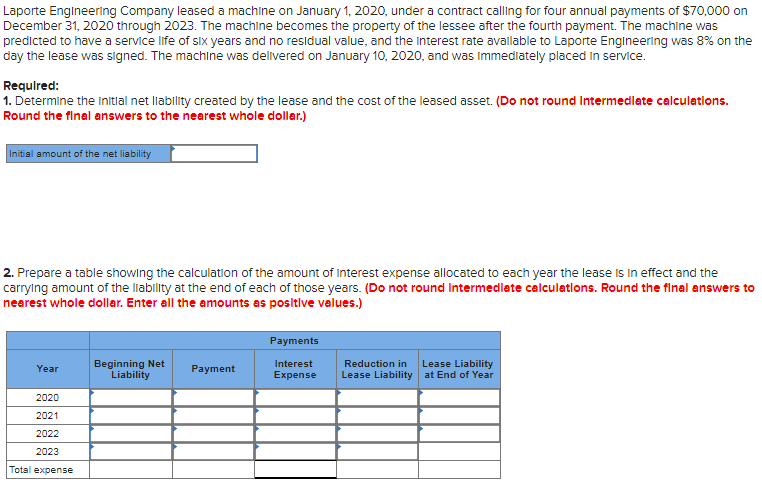

Laporte Engineering Company leased a machine on January 1, 2020, under a contract calling for four annual payments of $70,000 on December 31, 2020 through 2023. The machine becomes the property of the lessee after the fourth payment. The machine was predicted to have a service life of six years and no residual value, and the Interest rate available to Laporte Engineering was 8% on the day the lease was signed. The machine was delivered on January 10, 2020, and was immediately placed in service. Required: 1. Determine the initial net liability created by the lease and the cost of the leased asset. (Do not round Intermediate calculations. Round the final answers to the nearest whole dollar.) Initial amount of the net liability 2. Prepare a table showing the calculation of the amount of Interest expense allocated to each year the lease is in effect and the carrying amount of the liability at the end of each of those years. (Do not round Intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amounts as positive values.) Payments Year Beginning Net Liability Payment Interest Expense Reduction in Lease Liability Lease Liability at End of Year 2020 2021 2022 2023 Total expense 3. Prepare the entry to record the leasing of the machine. (Do not round Intermediate calculations. Round the final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record signing of lease agreement. Note: Enter debits before credits Date General Journal Debit Credit Jan 01, 2020 Record entry Clear entry View general journal 4. Prepare entries that would be made on December 31, 2021, to record the annual depreciation on a straight-line basis, and the recording of the lease payment. Also show how the machine and the lease liability should appear on the December 31, 2021, balance sheet. (Do not round Intermediate calculations. Round the final answers to nearest whole dollar. Enter all amounts as positive values.) View transaction list Journal entry worksheet Record the depreciation on leased machinery. Note: Enter debits before credits Date General Journal Debit Credit Dec 31, 2021 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started