Answered step by step

Verified Expert Solution

Question

1 Approved Answer

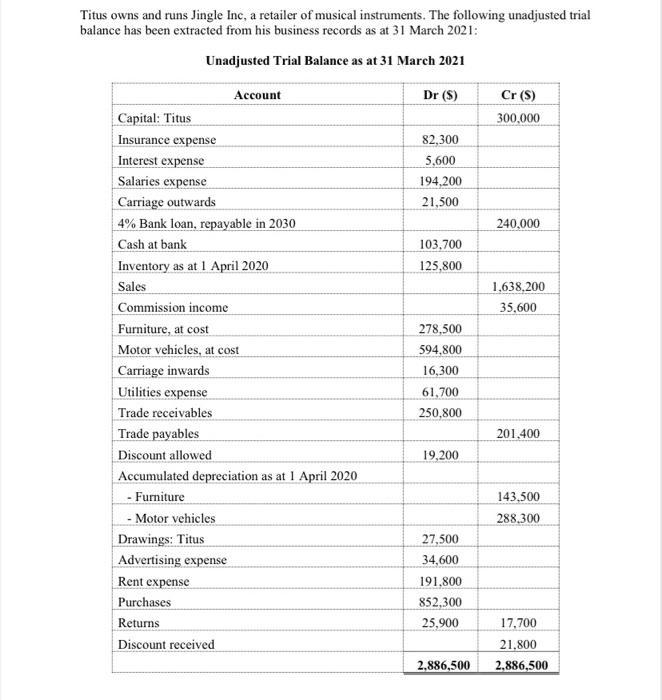

Titus owns and runs Jingle Inc, a retailer of musical instruments. The following unadjusted trial balance has been extracted from his business records as

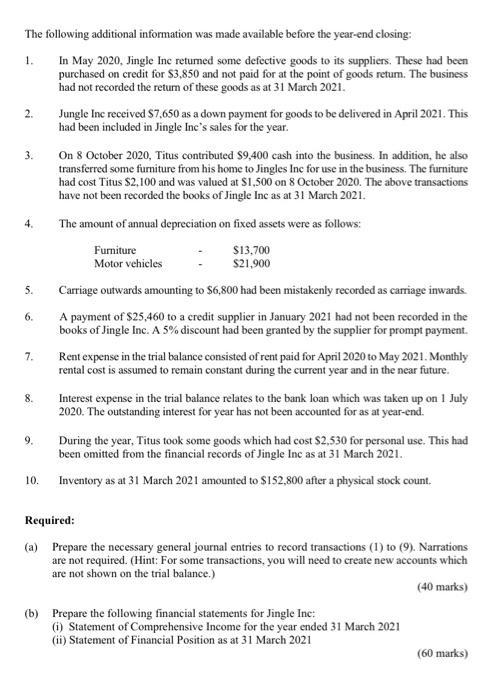

Titus owns and runs Jingle Inc, a retailer of musical instruments. The following unadjusted trial balance has been extracted from his business records as at 31 March 2021: Unadjusted Trial Balance as at 31 March 2021 Dr (S) Cr (S) Account Capital: Titus 300.000 Insurance expense 82,300 Interest expense Salaries expense Carriage outwards 4% Bank loan, repayable in 2030 5,600 194,200 21,500 240,000 Cash at bank 103,700 Inventory as at 1 April 2020 Sales Commission income Furniture, at cost Motor vehicles, at cost Carriage inwards Utilities expense Trade receivables Trade payables Discount allowed 125,800 1,638.200 35,600 278,500 594,800 16.300 61,700 250,800 201.400 19,200 Accumulated depreciation as at I April 2020 - Furniture - Motor vehicles Drawings: Titus Advertising expense Rent expense Purchases 143,500 288.300 27,500 34,600 191,800 852,300 Returns 25,900 17,700 Discount received 21,800 2,886,500 2,886,500 The following additional information was made available before the year-end closing: 1. In May 2020, Jingle Inc retumed some defective goods to its suppliers. These had been purchased on credit for $3,850 and not paid for at the point of goods retum. The business had not recorded the retum of these goods as at 31 March 2021. Jungle Inc received S7,650 as a down payment for goods to be delivered in April 2021. This had been included in Jingle Inc's sales for the year. 2. On 8 October 2020, Titus contributed S9,400 cash into the business. In addition, he also transferred some furniture from his home to Jingles Inc for use in the business. The furniture had cost Titus $2,100 and was valued at S1,500 on 8 October 2020. The above transactions have not been recorded the books of Jingle Inc as at 31 March 2021. 3. 4. The amount of annual depreciation on fixed assets were as follows: Furniture S13,700 $21,900 Motor vehicles 5. Carriage outwards amounting to S6,800 had been mistakenly recorded as carriage inwards. 6. A payment of $25,460 to a credit supplier in January 2021 had not been recorded in the books of Jingle Inc. A 5% discount had been granted by the supplier for prompt payment. 7. Rent expense in the trial balance consisted of rent paid for April 2020 to May 2021. Monthly rental cost is assumed to remain constant during the current year and in the near future. 8. Interest expense in the trial balance relates to the bank loan which was taken up on 1 July 2020. The outstanding interest for year has not been accounted for as at year-end. 9. During the year, Titus took some goods which had cost $2,530 for personal use. This had been omitted from the financial records of Jingle Inc as at 31 March 2021. 10. Inventory as at 31 March 2021 amounted to $152,800 after a physical stock count. Required: (a) Prepare the necessary general journal entries to record transactions (1) to (9). Narrations are not required. (Hint: For some transactions, you will need to create new accounts which are not shown on the trial balance.) (40 marks) (b) Prepare the following financial statements for Jingle Inc: (i) Statement of Comprehensive Income for the year ended 31 March 2021 (ii) Statement of Financial Position as at 31 March 2021 (60 marks)

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Requirement a General Journal Entries SNo Accounts Title Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started