Question

Tiwari & Company Ltd have issued 180,000 7% redeemable preference shares of $1 each and 690,000 ordinary shares of $0.58 each. All the shares are

Tiwari & Company Ltd have issued 180,000 7% redeemable preference shares of $1 each and 690,000 ordinary shares of $0.58 each. All the shares are fully paid.

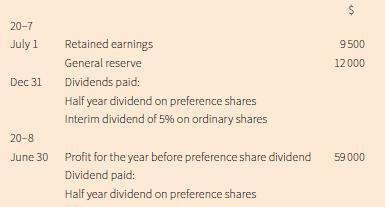

Tiwari and Company Ltd provided the following information relating to the year ended 30 June 20–8:

On 30 June 20–8 it was decided to transfer $10,000 to the general reserve and to pay a final dividend of 10% on the ordinary shares.

a. Calculate the profit for the year ended 30 June 20–8 after the preference share dividend. Show your workings.

b. Prepare the statement of changes in equity of Tiwari & Company Ltd for the year ended 30 June 20–8.

c. Prepare a relevant extract from the statement of financial position of Tiwari & Company Ltd at 30 June 2008 showing the equity and reserves section.

d. Explain which dividends (if any) would appear in the statement of financial position of Tiwari and Company Ltd at 30 June 20–8. Give reasons for your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started