Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TLC Corporation has three departments which are painting, polishing and waxing departments. The company adopts the job order costing system to calculate the overhead

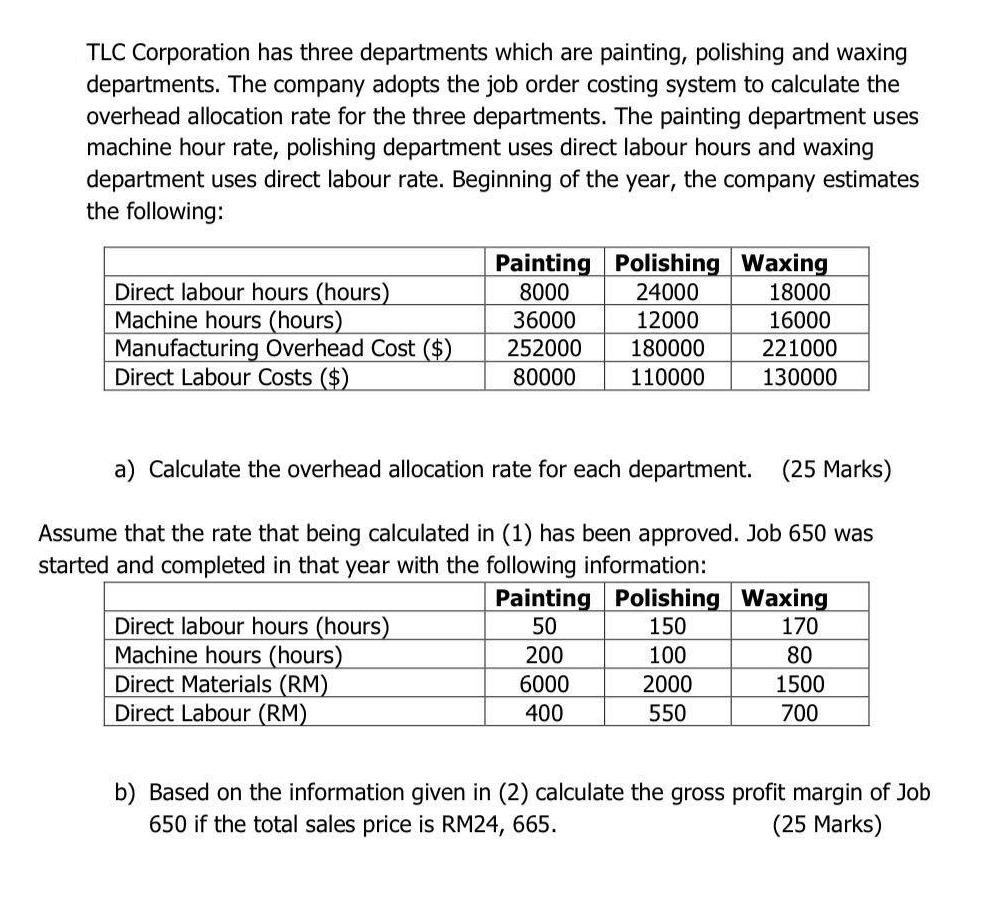

TLC Corporation has three departments which are painting, polishing and waxing departments. The company adopts the job order costing system to calculate the overhead allocation rate for the three departments. The painting department uses machine hour rate, polishing department uses direct labour hours and waxing department uses direct labour rate. Beginning of the year, the company estimates the following: Direct labour hours (hours) Machine hours (hours) Manufacturing Overhead Cost ($) Direct Labour Costs ($) Painting Polishing Waxing 8000 24000 18000 36000 16000 252000 221000 80000 130000 Direct labour hours (hours) Machine hours (hours) Direct Materials (RM) Direct Labour (RM) 12000 180000 110000 a) Calculate the overhead allocation rate for each department. (25 Marks) Assume that the rate that being calculated in (1) has been approved. Job 650 was started and completed in that year with the following information: Painting Polishing Waxing 50 150 170 200 100 80 6000 2000 1500 400 550 700 b) Based on the information given in (2) calculate the gross profit margin of Job 650 if the total sales price is RM24, 665. (25 Marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Lets start with part a Calculate the overhead allocation rate for each department 1 For the Painting department since it uses machine hours to allocat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started