Answered step by step

Verified Expert Solution

Question

1 Approved Answer

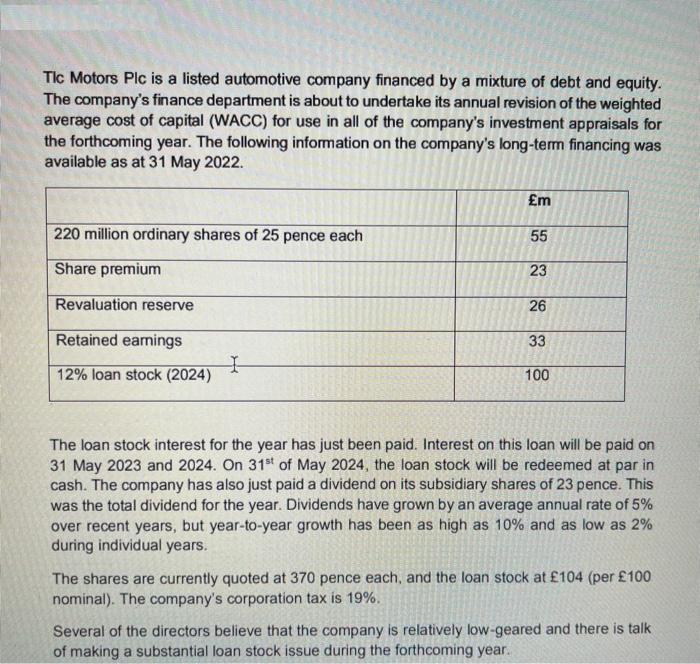

Tlc Motors Plc is a listed automotive company financed by a mixture of debt and equity. The company's finance department is about to undertake

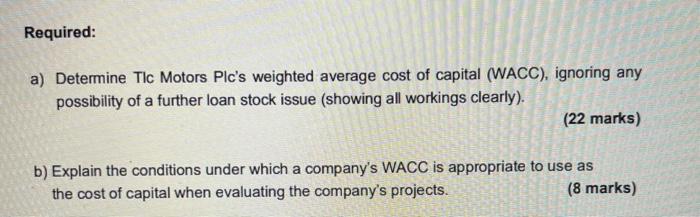

Tlc Motors Plc is a listed automotive company financed by a mixture of debt and equity. The company's finance department is about to undertake its annual revision of the weighted average cost of capital (WACC) for use in all of the company's investment appraisals for the forthcoming year. The following information on the company's long-term financing was available as at 31 May 2022. 220 million ordinary shares of 25 pence each Share premium Revaluation reserve Retained earnings 12% loan stock (2024) I m 55 23 26 33 100 The loan stock interest for the year has just been paid. Interest on this loan will be paid on 31 May 2023 and 2024. On 31st of May 2024, the loan stock will be redeemed at par in cash. The company has also just paid a dividend on its subsidiary shares of 23 pence. This was the total dividend for the year. Dividends have grown by an average annual rate of 5% over recent years, but year-to-year growth has been as high as 10% and as low as 2% during individual years. The shares are currently quoted at 370 pence each, and the loan stock at 104 (per 100 nominal). The company's corporation tax is 19%. Several of the directors believe that the company is relatively low-geared and there is talk of making a substantial loan stock issue during the forthcoming year. Required: a) Determine Tlc Motors Plc's weighted average cost of capital (WACC), ignoring any possibility of a further loan stock issue (showing all workings clearly). (22 marks) b) Explain the conditions under which a company's WACC is appropriate to use as the cost of capital when evaluating the company's projects. (8 marks)

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Tic Motors Pics Weighted Average Cost of Capital WACC Equity Market Value of Equity 220 million x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started