Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company P prepares consolidated financial statements that include its 70% owned subsidiary, Company S. This year's consolidated income statement shows net income of $423,900,

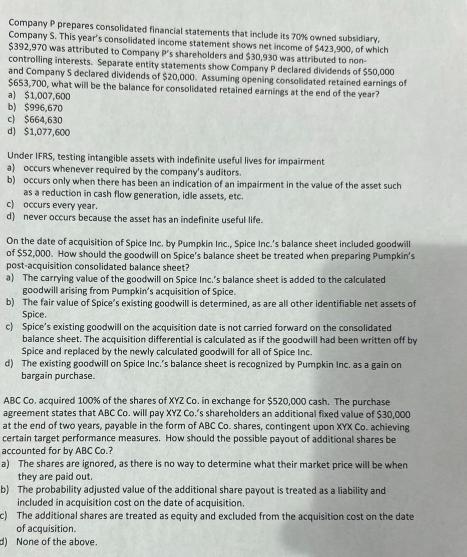

Company P prepares consolidated financial statements that include its 70% owned subsidiary, Company S. This year's consolidated income statement shows net income of $423,900, of which $392,970 was attributed to Company P's shareholders and $30,930 was attributed to non- controlling interests. Separate entity statements show Company P declared dividends of $50,000 and Company S declared dividends of $20,000. Assuming opening consolidated retained earnings of $653,700, what will be the balance for consolidated retained earnings at the end of the year? a) $1,007,600 b) $996,670 c) $664,630 d) $1,077,600 Under IFRS, testing intangible assets with indefinite useful lives for impairment a) occurs whenever required by the company's auditors. b) occurs only when there has been an indication of an impairment in the value of the asset such as a reduction in cash flow generation, idle assets, etc. c) occurs every year.. d) never occurs because the asset has an indefinite useful life. On the date of acquisition of Spice Inc. by Pumpkin Inc., Spice Inc.'s balance sheet included goodwill of $52,000. How should the goodwill on Spice's balance sheet be treated when preparing Pumpkin's post-acquisition consolidated balance sheet? a) The carrying value of the goodwill on Spice Inc.'s balance sheet is added to the calculated goodwill arising from Pumpkin's acquisition of Spice. b) The fair value of Spice's existing goodwill is determined, as are all other identifiable net assets of Spice. c) Spice's existing goodwill on the acquisition date is not carried forward on the consolidated balance sheet. The acquisition differential is calculated as if the goodwill had been written off by Spice and replaced by the newly calculated goodwill for all of Spice Inc. d) The existing goodwill on Spice Inc.'s balance sheet is recognized by Pumpkin Inc. as a gain on bargain purchase. ABC Co. acquired 100% of the shares of XYZ Co. in exchange for $520,000 cash. The purchase agreement states that ABC Co. will pay XYZ Co.'s shareholders an additional fixed value of $30,000 at the end of two years, payable in the form of ABC Co. shares, contingent upon XYX Co. achieving certain target performance measures. How should the possible payout of additional shares be accounted for by ABC Co.? a) The shares are ignored, as there is no way to determine what their market price will be when they are paid out. b) The probability adjusted value of the additional share payout is treated as a liability and included in acquisition cost on the date of acquisition. c) The additional shares are treated as equity and excluded from the acquisition cost on the date of acquisition. d) None of the above.

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 6 Answer c 664630 Consolidated Retained ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started