Answered step by step

Verified Expert Solution

Question

1 Approved Answer

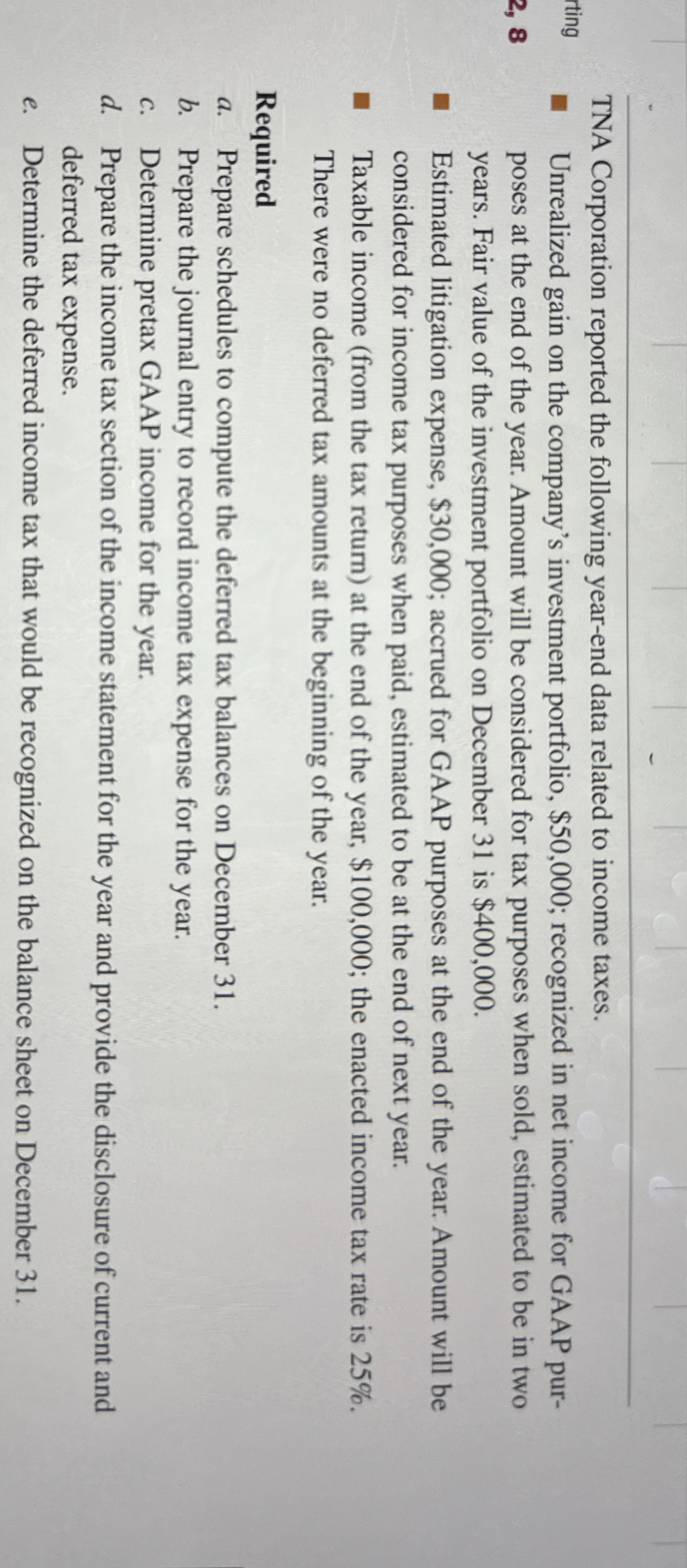

TNA Corporation reported the following year - end data related to income taxes. Unrealized gain on the company's investment portfolio, $ 5 0 , 0

TNA Corporation reported the following yearend data related to income taxes.

Unrealized gain on the company's investment portfolio, $; recognized in net income for GAAP pur

poses at the end of the year. Amount will be considered for tax purposes when sold, estimated to be in two

years. Fair value of the investment portfolio on December is $

Estimated litigation expense, $; accrued for GAAP purposes at the end of the year. Amount will be

considered for income tax purposes when paid, estimated to be at the end of next year.

Taxable income from the tax return at the end of the year, $; the enacted income tax rate is

There were no deferred tax amounts at the beginning of the year.

Required

a Prepare schedules to compute the deferred tax balances on December

b Prepare the journal entry to record income tax expense for the year.

c Determine pretax GAAP income for the year.

d Prepare the income tax section of the income statement for the year and provide the disclosure of current and

deferred tax expense.

e Determine the deferred income tax that would be recognized on the balance sheet on December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started