To answer Q3 only

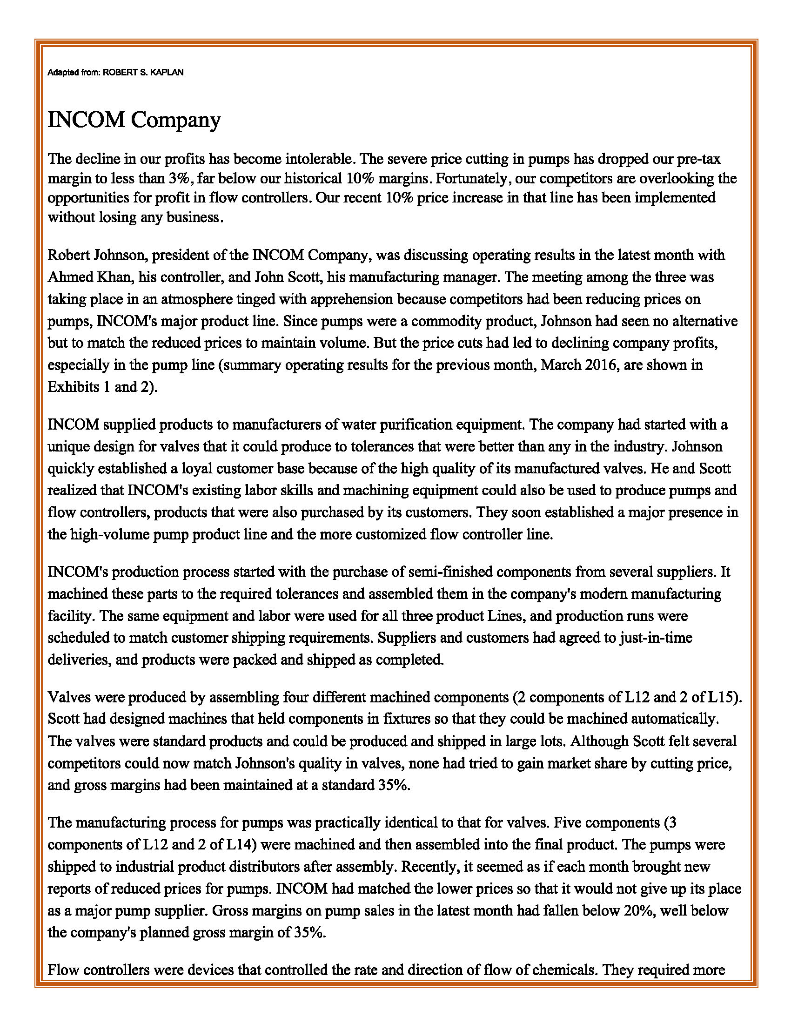

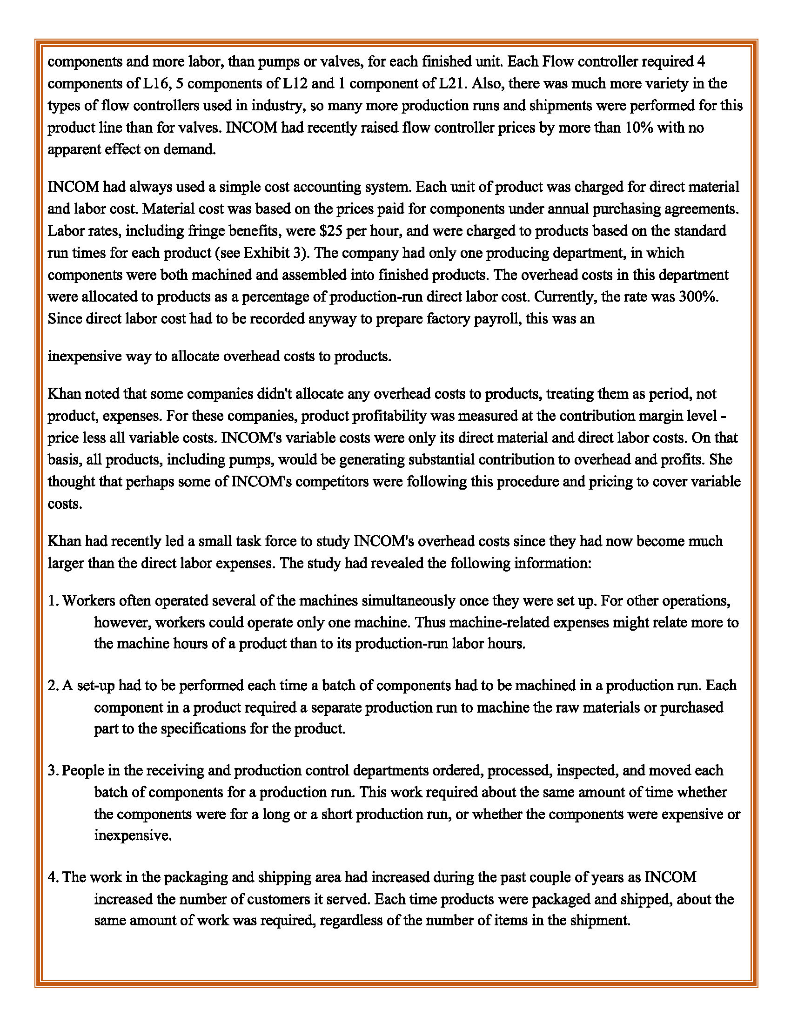

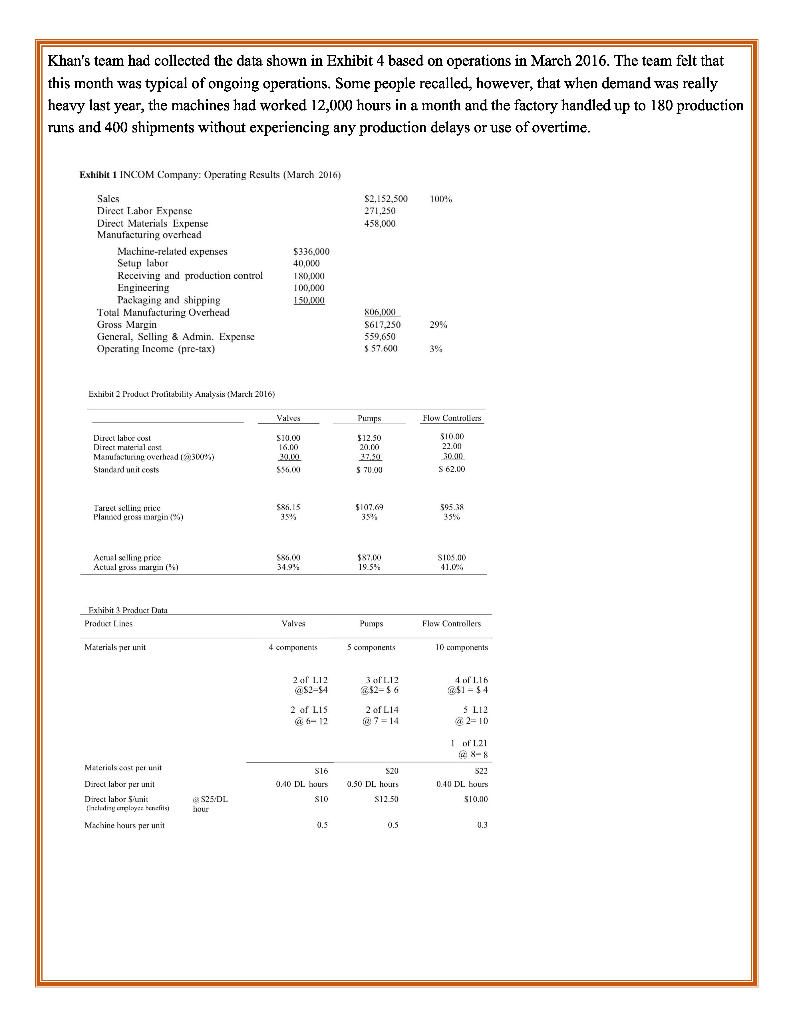

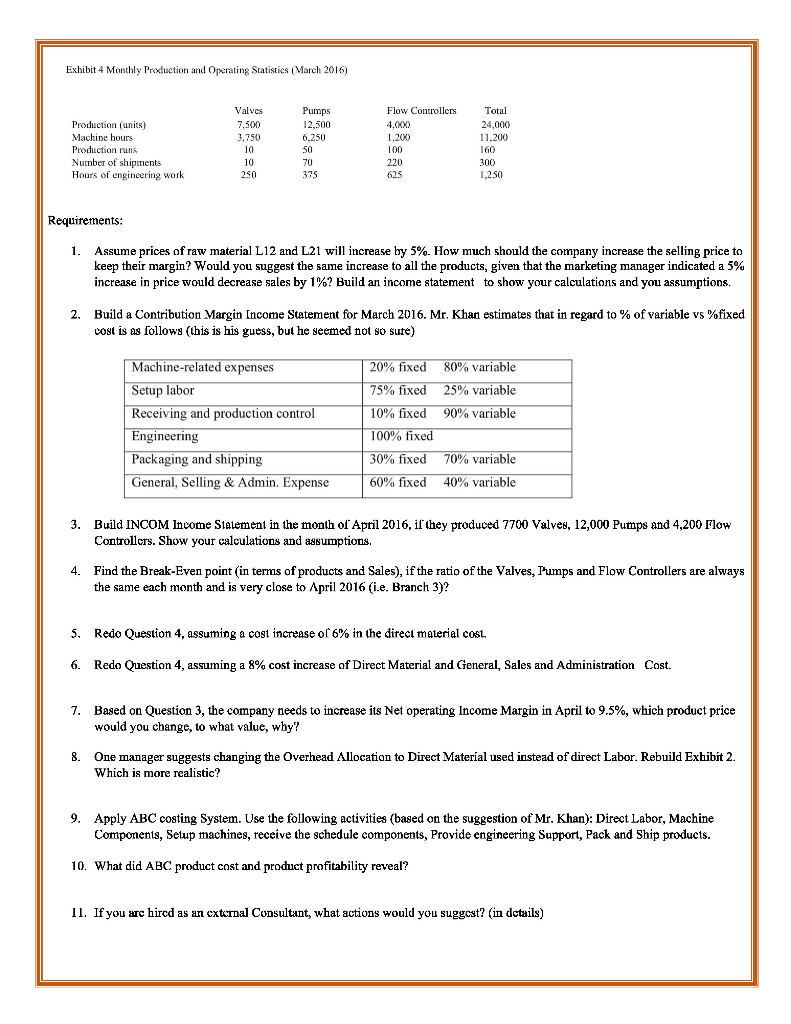

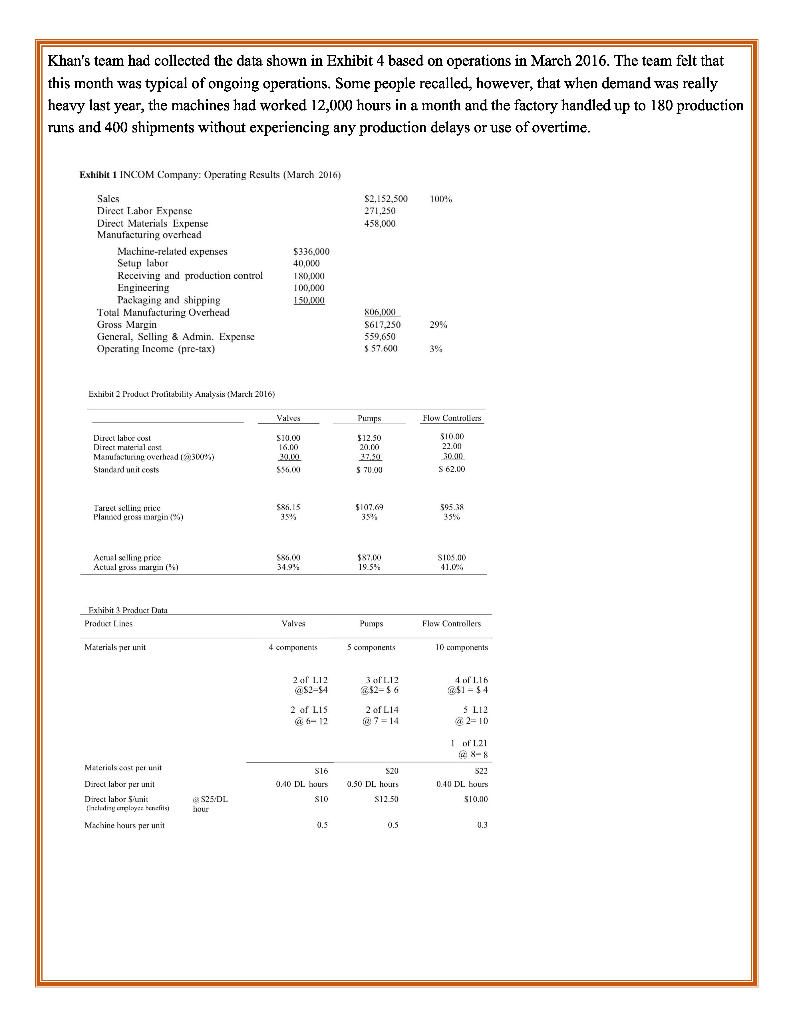

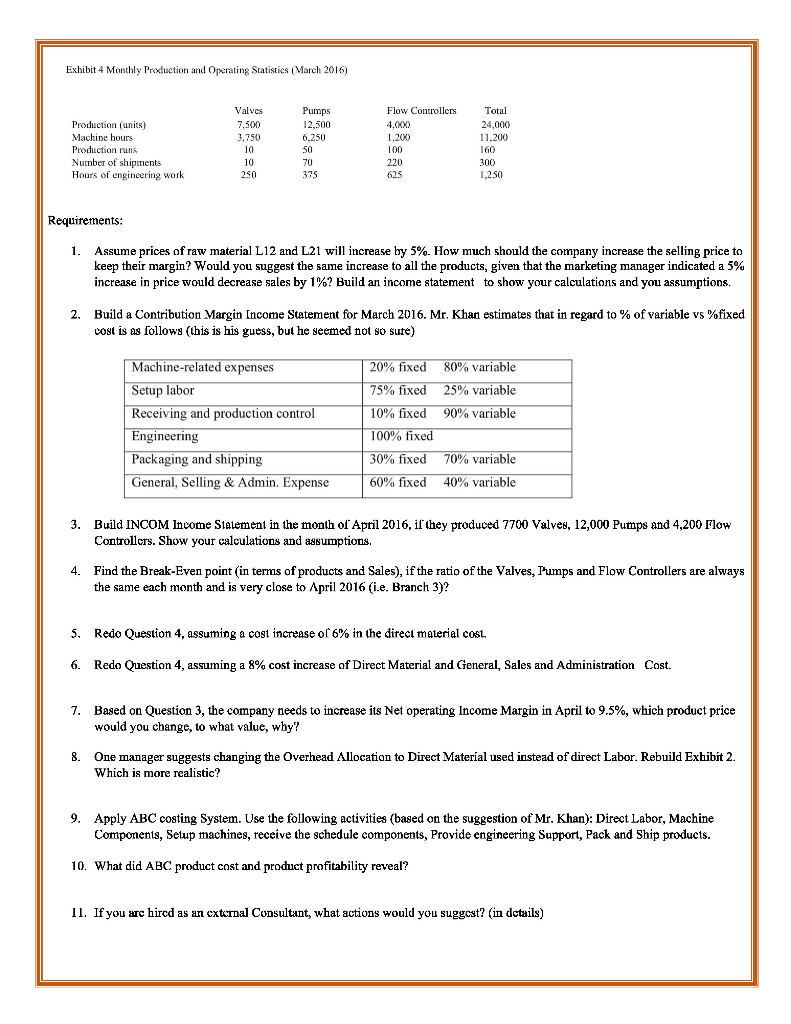

Adapted from: ROBERT S. KAPLAN INCOM Company The decline in our profits has become intolerable. The severe price cutting in pumps has dropped our pre-tax margin to less than 3%, far below our historical 10% margins. Fortunately, our competitors are overlooking the opportunities for profit in flow controllers. Our recent 10% price increase in that line has been implemented without losing any business. Robert Johnson, president of the INCOM Company, was discussing operating results in the latest month with Ahmed Khan, his controller, and John Scott, his manufacturing manager. The meeting among the three was taking place in an atmosphere tinged with apprehension because competitors had been reducing prices on pumps, INCOM's major product line. Since pumps were a commodity product, Johnson had seen no alternative but to match the reduced prices to maintain volume. But the price cuts had led to declining company profits, especially in the pump line (summary operating results for the previous month, March 2016, are shown in Exhibits 1 and 2). INCOM supplied products to manufacturers of water purification equipment. The company had started with a unique design for valves that it could produce to tolerances that were better than any in the industry. Johnson quickly established a loyal customer base because of the high quality of its manufactured valves. He and Scott realized that INCOM's existing labor skills and machining equipment could also be used to produce pumps and flow controllers, products that were also purchased by its customers. They soon established a major presence in the high-volume pump product line and the more customized flow controller line. INCOM's production process started with the purchase of semi-finished components from several suppliers. It machined these parts to the required tolerances and assembled them in the company's modern manufacturing facility. The same equipment and labor were used for all three product Lines, and production runs were scheduled to match customer shipping requirements. Suppliers and customers had agreed to just-in-time deliveries, and products were packed and shipped as completed. Valves were produced by assembling four different machined components (2 components of L12 and 2 of L15). Scott had designed machines that held components in fixtures so that they could be machined automatically. The valves were standard products and could be produced and shipped in large lots. Although Scott felt several competitors could now match Johnson's quality in valves, none had tried to gain market share by cutting price, and gross margins had been maintained at a standard 35%. The manufacturing process for pumps was practically identical to that for valves. Five components (3 components of L12 and 2 of L14) were machined and then assembled into the final product. The pumps were shipped to industrial product distributors after assembly. Recently, it seemed as if each month brought new reports of reduced prices for pumps. INCOM had matched the lower prices so that it would not give up its place as a major pump supplier. Gross margins on pump sales in the latest month had fallen below 20%, well below the company's planned gross margin of 35%. Flow controllers were devices that controlled the rate and direction of flow of chemicals. They required more components and more labor, than pumps or valves, for each finished unit. Each Flow controller required 4 components of L16,5 components of L12 and 1 component of L21. Also, there was much more variety in the types of flow controllers used in industry, so many more production runs and shipments were performed for this product line than for valves. INCOM had recently raised flow controller prices by more than 10% with no apparent effect on demand. INCOM had always used a simple cost accounting system. Each unit of product was charged for direct material and labor cost. Material cost was based on the prices paid for components under annual purchasing agreements. Labor rates, including fringe benefits, were $25 per hour, and were charged to products based on the standard run times for each product (see Exhibit 3). The company had only one producing department, in which components were both machined and assembled into finished products. The overhead costs in this department were allocated to products as a percentage of production-run direct labor cost. Currently, the rate was 300%. Since direct labor cost had to be recorded anyway to prepare factory payroll, this was an inexpensive way to allocate overhead costs to products. Khan noted that some companies didn't allocate any overhead costs to products, treating them as period, not product, expenses. For these companies, product profitability was measured at the contribution margin level - price less all variable costs. INCOM's variable costs were only its direct material and direct labor costs. On that basis, all products, including pumps, would be generating substantial contribution to overhead and profits. She thought that perhaps some of INCOM's competitors were following this procedure and pricing to cover variable costs. Khan had recently led a small task force to study INCOM's overhead costs since they had now become much larger than the direct labor expenses. The study had revealed the following information: 1. Workers often operated several of the machines simultaneously once they were set up. For other operations, however, workers could operate only one machine. Thus machine-related expenses might relate more to the machine hours of a product than to its production-run labor hours. 2. A set-up had to be performed each time a batch of components had to be machined in a production run. Each component in a product required a separate production run to machine the raw materials or purchased part to the specifications for the product. 3. People in the receiving and production control departments ordered, processed, inspected, and moved each batch of components for a production run. This work required about the same amount of time whether the components were for a long or a short production run, or whether the components were expensive or inexpensive 4. The work in the packaging and shipping area had increased during the past couple of years as INCOM increased the number of customers it served. Each time products were packaged and shipped, about the same amount of work was required, regardless of the number of items in the shipment. Khan's team had collected the data shown in Exhibit 4 based on operations in March 2016. The team felt that this month was typical of ongoing operations. Some people recalled, however, that when demand was really heavy last year, the machines had worked 12,000 hours in a month and the factory handled up to 180 production runs and 400 shipments without experiencing any production delays or use of overtime. Exhibit 1 INCOM Company: Operating Results (March 2016) 100% S2.152.500 271,250 458,000 Sales Direct Labor Expense Direct Materials Expense Manufacturing overhead Machine-related expenses Setup labor Receiving and production control Engineering Packaging and shipping Total Manufacturing Overhead Gross Margin Gencral, Selling & Admin. Expense Operating Income (pre-tax) $336,000 40,00%) 18D,IXI 100,XIO 150).XII 206,XXI S617,250 559,650 $57. 29% 3% Exhibit 2 Product Prolitability Analysis (March 2016) Valves Pumps $10.00 16.00 Flow Controllers $10.00 22.00 Direct labor cost Direct material enst Manufacturing overholdt300%) Standard unit costs $12.50 20.00 37.50 $ 70.00 $56, S 62.00 5R15 Taree selling me Pland gross chargin(%) $107.69 35% 395.38 35% Actual selling price Actual gross mat) $86,00 34.9 % $87.00 19.5% SI05.00 11.0% Exhibit 3 Product Data Product Lines Valves Pumps Flow Controllers Materials per unit 4 cominents 5 components 10 cm penents 3 of L12 4 of LIG $-$4 2 af L2 a 52-54 2 of LIS a 6-12 2 of L14 5 L12 02-10 1 of 1.21 522 SI 0.40 DL xurs Materials exist per unit Direct labor per unit Direct labor Sumit Ingen var nefisi Machine lours per unit S2U 0.50 DL hours S12.50 0.40 DL hours SIO S25 DL bour S10.00 0.5 O.S 0.3 Exhibit 4 Monthly Production and Operating Statistics ( March 2016) Total 24,000 Valves 7.500 3,750 10 10 250 Production (units) Machine hours Production runs Number of shipments Hours of engineering work Pumps 12,500 6.250 50 70 375 Flow Controllers 4.CXX) 1,200 100 220 625 11.200 160 300) 1.250 Requirements: 1. Assume prices of raw material L12 and L21 will increase by 5%. How much should the company increase the selling price to keep their margin? Would you suggest the same increase to all the products, given that the marketing manager indicated a 5% increase in price would decrease sales by 1%? Build an income statement to show your calculations and you assumptions. 2. Build a Contribution Margin Income Statement for March 2016. Mr. Khan estimates that in regard to % of variable vs %fixed cost is as follows (this is his guess, but he seemed not so sute) Machine-related expenses Setup labor Receiving and production control Engineering Packaging and shipping General, Selling & Admin. Expense 20% fixed 80% variable 75% fixed 25% variable 10% fixed 90% variable 100% fixed 30% fixed 70% variable 60% fixed 40% variable 3. Build INCOM Income Statement in the month of April 2016, if they produced 7700 Valves, 12,000 Pumps and 4,200 Flow Controllers. Show your calculations and assumptions. 4. Find the Break-Even point in terms of products and Sales), if the ratio of the Valves, Pumps and Flow Controllers are always the same each month and is very close to April 2016 (i.e. Branch 3)? 5. Redo Question 4, assuming a cost increase of 6% in the direct material cost. 6. Redo Question 4, assuming a 8% cost increase of Direct Material and General, Sales and Administration Cost. 7. Based on Question 3, the company needs to increase its Net operating Income Margin in April to 9.5%, which product price would you change, to what value, why? 8. One manager suggests changing the Overhead Allocation to Direct Material used instead of direct Labor. Rebuild Exhibit 2. Which is more realistic? 9. Apply ABC costing System. Use the following activities (based on the suggestion of Mr. Khan): Direct Labor, Machine Components, Setup machines, receive the schedule components, Provide engineering Support, Pack and Ship products. 10. What did ABC product cost and product profitability reveal? 11. If you are hired as an external Consultant, what actions would you suggest? (in details)