Answered step by step

Verified Expert Solution

Question

1 Approved Answer

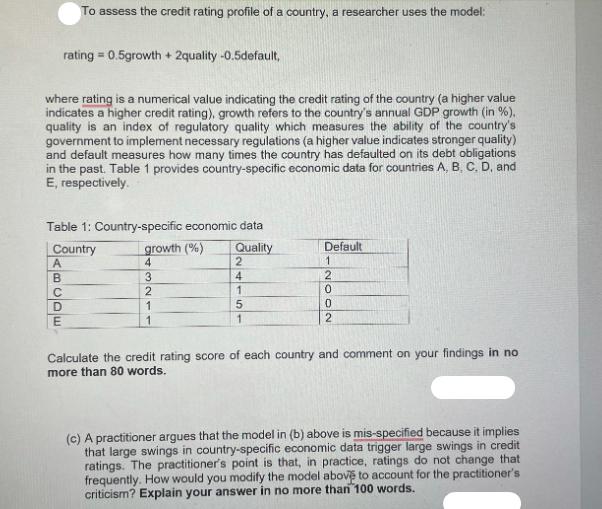

To assess the credit rating profile of a country, a researcher uses the model: rating = 0.5growth + 2quality -0.5default, where rating is a

To assess the credit rating profile of a country, a researcher uses the model: rating = 0.5growth + 2quality -0.5default, where rating is a numerical value indicating the credit rating of the country (a higher value indicates a higher credit rating), growth refers to the country's annual GDP growth (in %). quality is an index of regulatory quality which measures the ability of the country's government to implement necessary regulations (a higher value indicates stronger quality) and default measures how many times the country has defaulted on its debt obligations in the past. Table 1 provides country-specific economic data for countries A, B, C, D, and E, respectively. Table 1: Country-specific economic data growth (%) Quality 4 3 2 1 Country A BUDE 2 4 1 5 1 Default 1 2 NOON Calculate the credit rating score of each country and comment on your findings in no more than 80 words. (c) A practitioner argues that the model in (b) above is mis-specified because it implies that large swings in country-specific economic data trigger large swings in credit ratings. The practitioner's point is that, in practice, ratings do not change that frequently. How would you modify the model above to account for the practitioner's criticism? Explain your answer in no more than 100 words.

Step by Step Solution

★★★★★

3.22 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for the credit rating scores of each country For country ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started