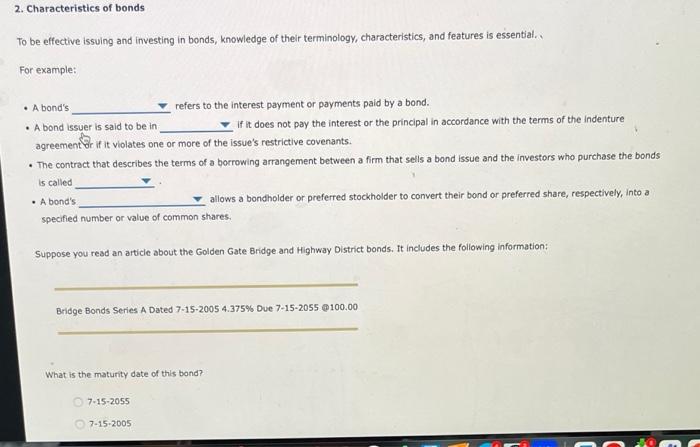

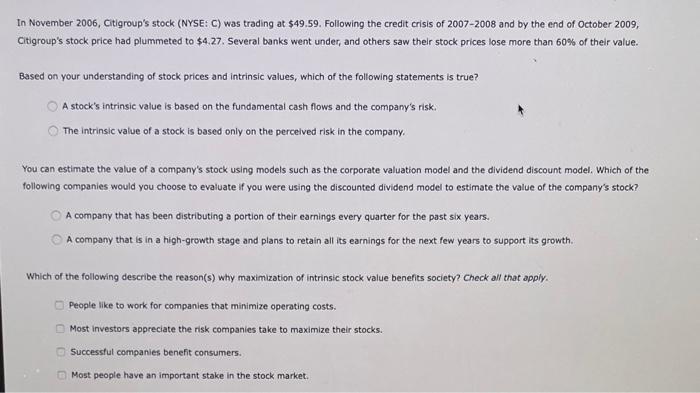

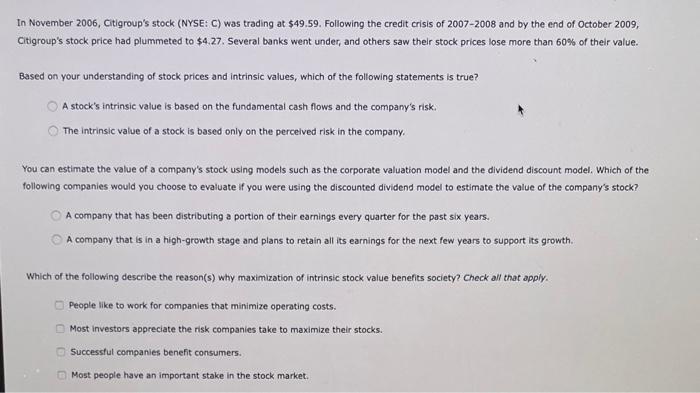

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: - A bond's refers to the interest payment or payments paid by a bond. - A bond issuer is said to be in If it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. - The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called - A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375\% Due 7-15-2055 100.00 What is the maturity date of this bond? 71520557152005 In November 2006, Citigroup's stock (NYSE: C) was trading at \$49.59. Following the credit crisis of 2007-2008 and by the end of October 2009, Citigroup's stock price had plummeted to $4.27. Several banks went under, and others saw their stock prices lose more than 60% of their value. Based on your understanding of stock prices and intrinsic values, which of the following statements is true? A stock's intrinsic value is based on the fundamental cash flows and the compary's risk. The intrinsic value of a stock is based only on the percelved risk in the company. You can estimate the value of a company's stock using models such as the corporate valuation model and the dividend discount model. Which of the following companies would you choose to evaluate if you were using the discounted dividend model to estimate the value of the company's stock? A company that has been distributing a portion of their earnings every quarter for the past six years. A company that is in a high-growth stage and plans to retain all its earnings for the next few years to support its growth. Which of the following describe the reason(s) why maximization of intrinsic stock value benefits society? Check all that apply. People like to work for companies that minimize operating costs. Most investors appreciate the risk companies take to maximize their stocks. Successtul companies benefit consumers. Most people have an important stake in the stock market