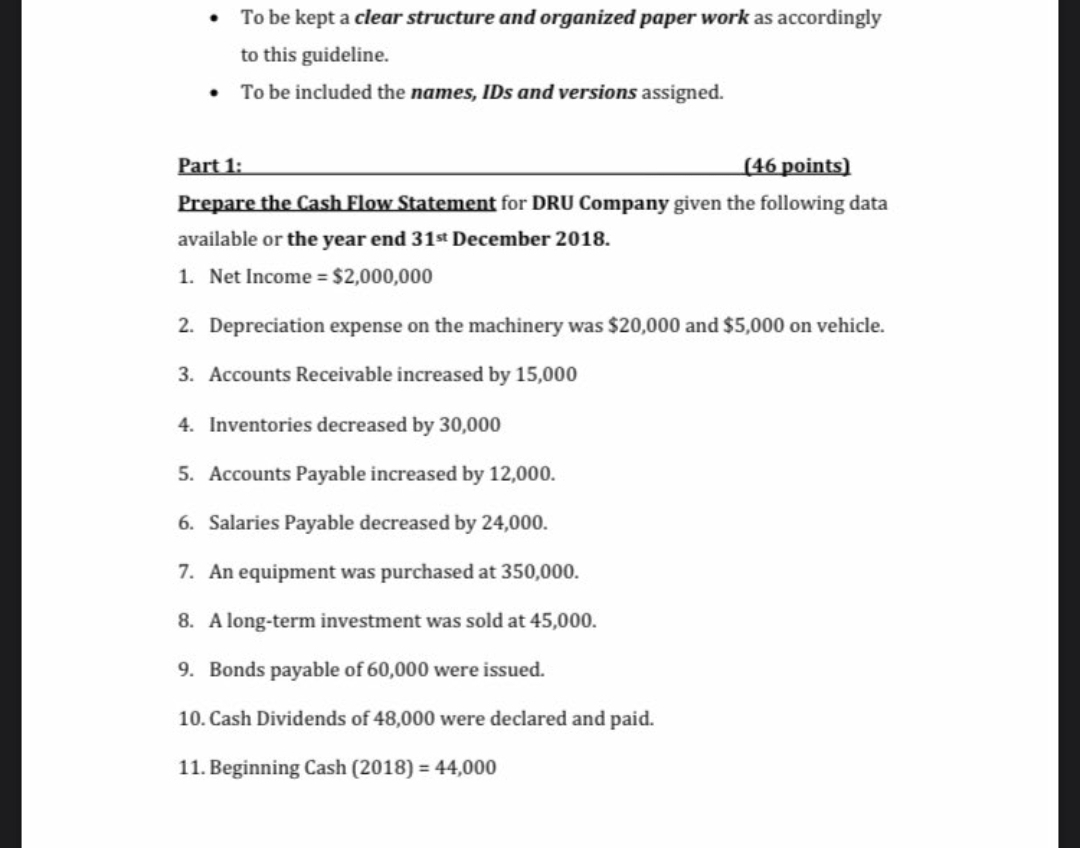

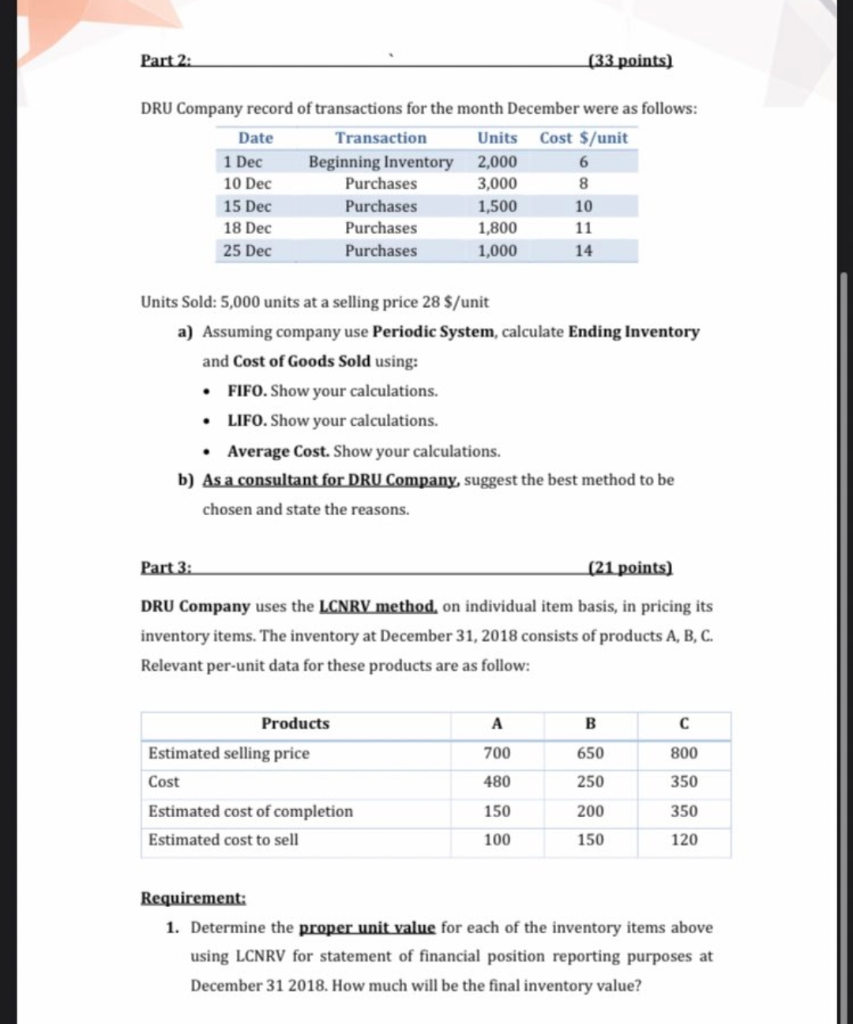

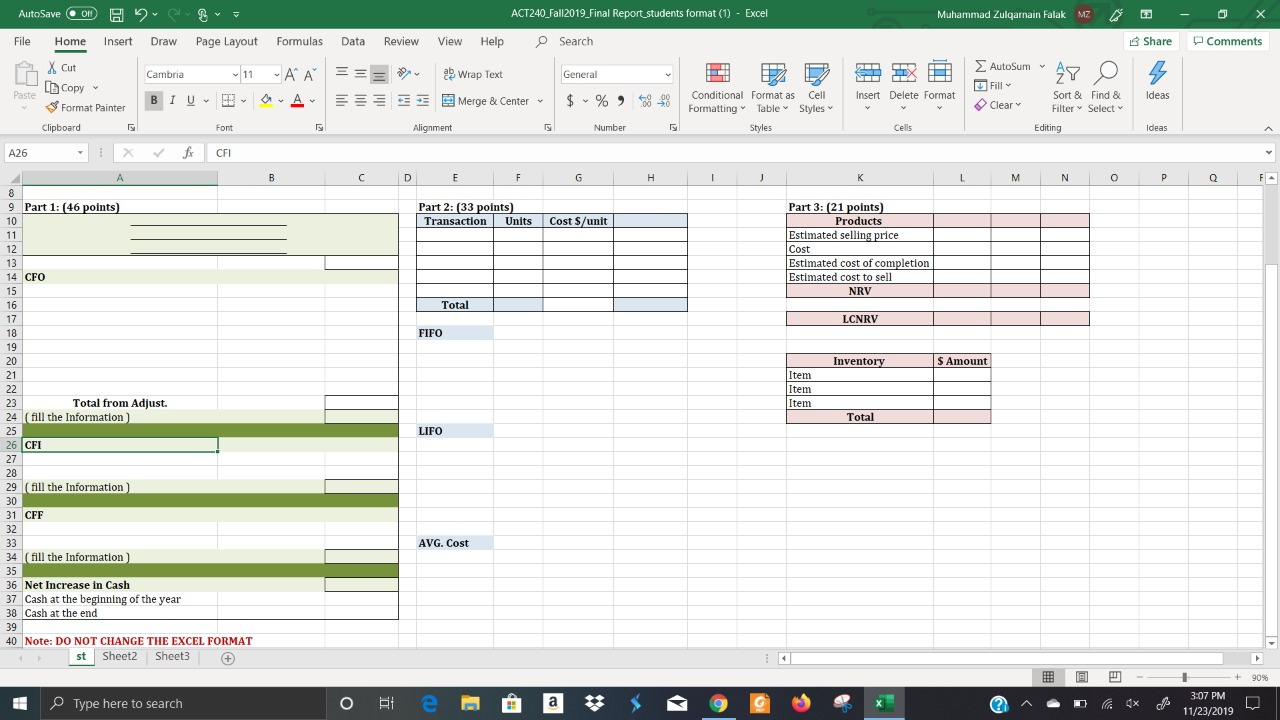

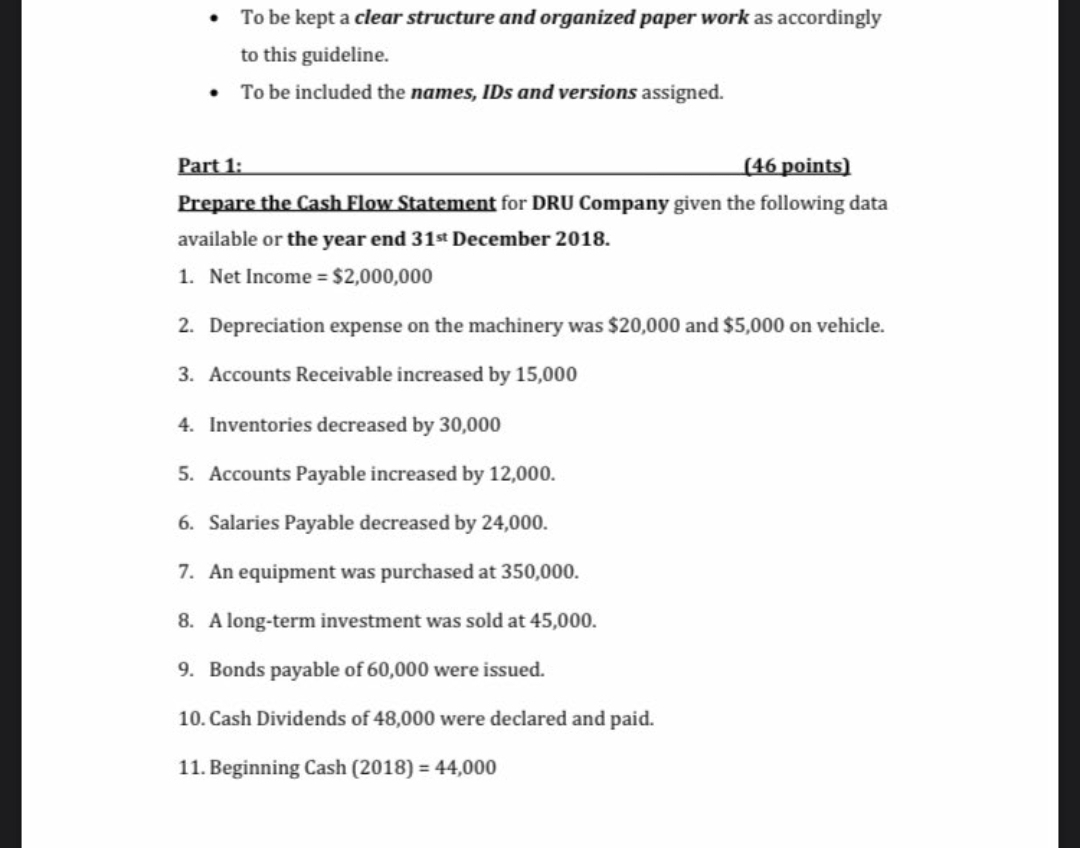

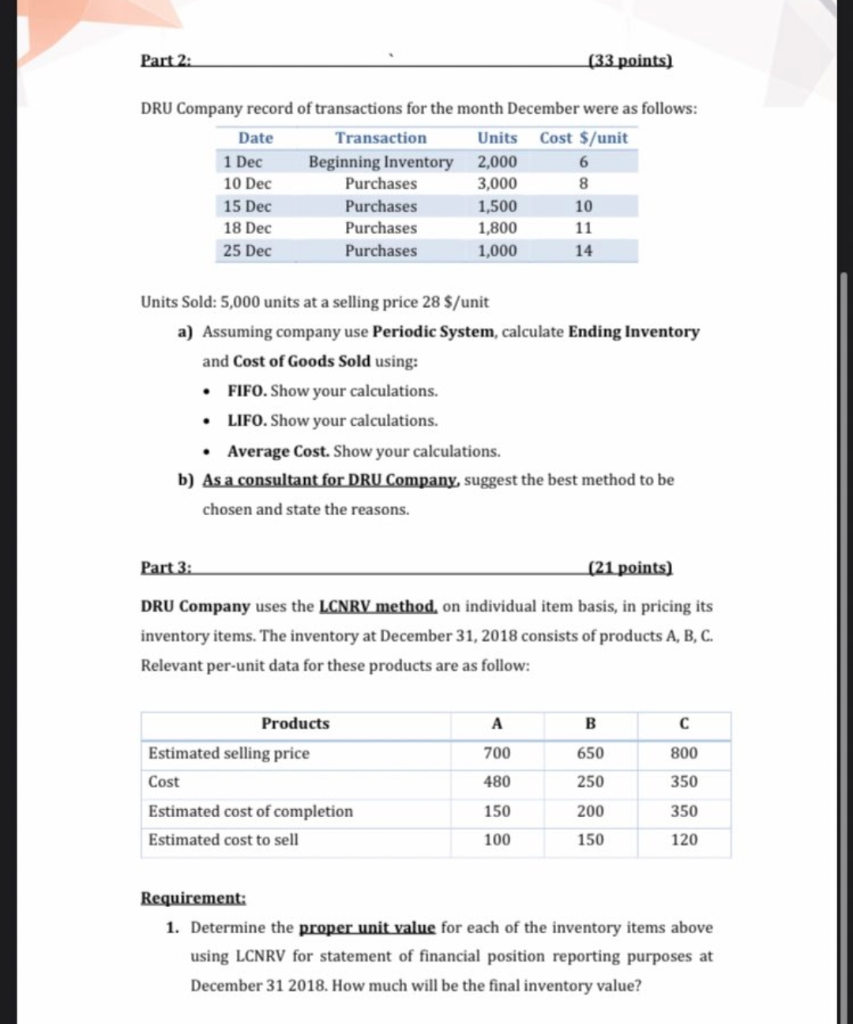

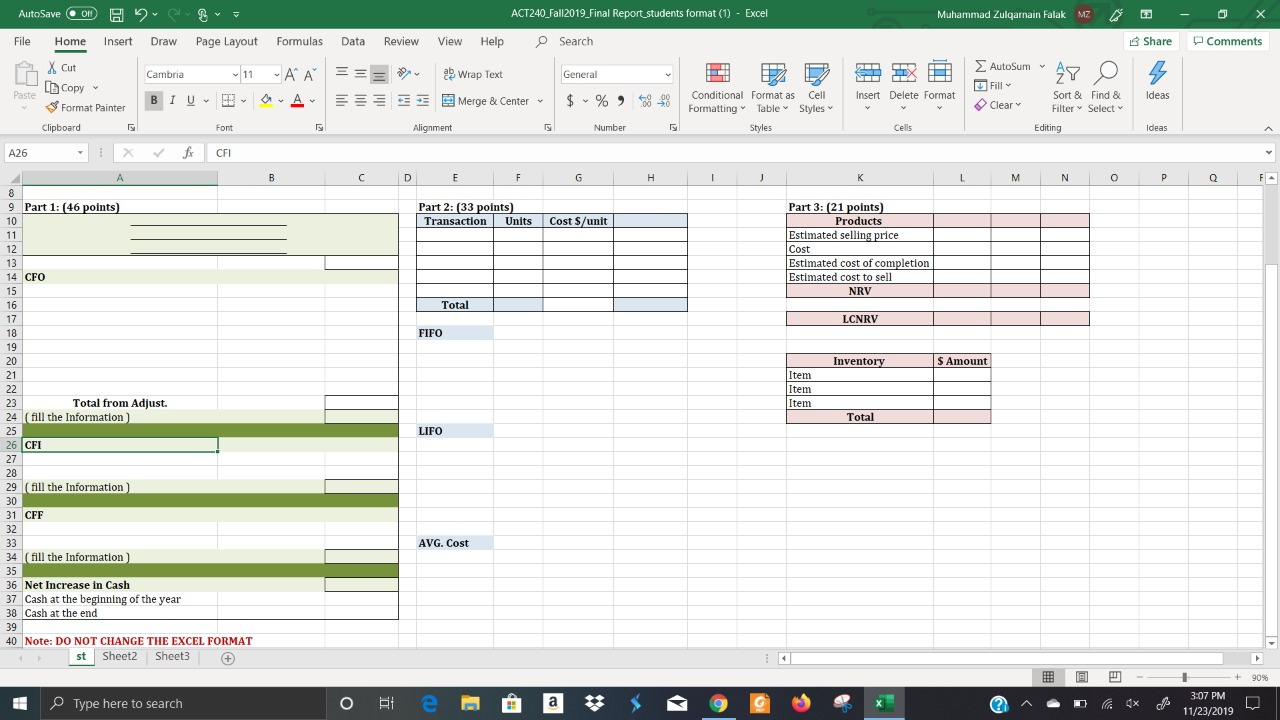

To be kept a clear structure and organized paper work as accordingly to this guideline. To be included the names, IDs and versions assigned (46 points) Part 1: Prepare the Cash Elow Statement for DRU Company given the following data available or the year end 31st December 2018. 1. Net Income = $2,000,000 Depreciation expense on the machinery was $20,000 and $5,000 on vehicle. 2. 3. Accounts Receivable increased by 15,000 4. Inventories decreased by 30,000 5. Accounts Payable increased by 12,000 6. Salaries Payable decreased by 24,000 7. An equipment was purchased at 350,000. A long-term investment was sold at 45,000. 8. 9. Bonds payable of 60,000 were issued. 10. Cash Dividends of 48,000 were declared and paid. 11. Beginning Cash (2018) 44,000 Part 2: (33 points) DRU Company record of transactions for the month December were as follows Cost $/unit Date Transaction Units 1 Dec Beginning Inventory Purchases 2,000 6 10 Dec 3,000 8 1,500 1,800 Purchases 15 Dec 10 Purchases 18 Dec 11 25 Dec Purchases 1,000 14 Units Sold: 5,000 units at a selling price 28 $/unit a) Assuming company use Periodic System, calculate Ending Inventory and Cost of Goods Sold using: FIFO. Show your calculations. LIFO.Show your calculations. Average Cost. Show your calculations b) As a consultant for DRU Company, suggest the best method to be chosen and state the reasons. Part 3: (21 points) DRU Company uses the LCNRV method, on individual item basis, in pricing its inventory items. The inventory at December 31, 2018 consists of products A, B, C Relevant per-unit data for these products are as follow: Products A Estimated selling price 700 650 800 Cost 250 350 480 Estimated cost of completion 150 200 350 Estimated cost to sell 150 100 120 Requirement 1. Determine the proper unit value for each of the inventory items above using LCNRV for statement of financial position reporting purposes at December 31 2018. How much will be the final inventory value? ACT240 Fall2019 Final Report students format (1) AutoSave Off Excel Muhammad Zulqarnain Falak MZ Insert Draw Review Share PComments File Home Page Layout Formulas Data View Help Search AutoSum XCut 11 Wrap Text General A A Cambria Copy Paste Fill Conditional Format as Cell Insert Delete Format Sort & Find & Ideas Merge & Center BIU E EE $% A v Clear Format Painter Formatting Table Styles Filter Select Clipboard Font Alignment Number Styles Cells Editing Ideas fr X A26 CFI A B C D E F G H K M N o P Q FA 8 9 Part 1: (46 points) Part 2: (33 points) Part 3: (21 points) Cost S/unit Products 10 Transaction Units Estimated selling price 11 12 Cost Estimated cost of completion Estimated cost to sell 13 14 CFO 15 NRV 16 Total 17 LCNRV 18 FIFO 19 20 Inventory S Amount Item Item 21 22 Total from Adjust. 23 Item 24 fill the Information) Total 25 LIFO 26 CFI 27 28 29 (fill the Information) 30 31 CFF 32 33 AVG. Cost 34 fill the Information 35 36 Net Increase in Cash 37 Cash at the beginning of the year 38 Cash at the end 39 40 Note: DO NOT CHANGE THE EXCEL FORMAT st Sheet2 Sheet3 E 90 % 3:07 PM e O Type here to search a 4x 11/23/2019