Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume we own two stocks; asset A and B. We have invested GHC12000 in asset A and GHC 8000 in asset B. The return

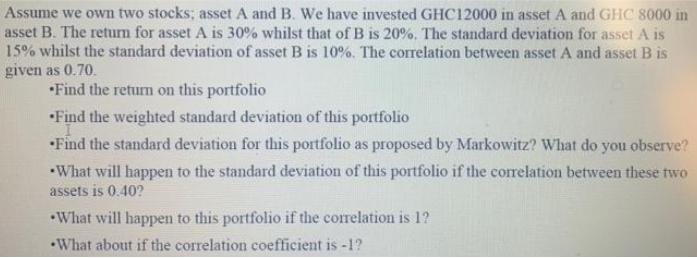

Assume we own two stocks; asset A and B. We have invested GHC12000 in asset A and GHC 8000 in asset B. The return for asset A is 30% whilst that of B is 20%. The standard deviation for asset A is 15% whilst the standard deviation of asset B is 10%. The correlation between asset A and asset B is given as 0.70. Find the return on this portfolio Find the weighted standard deviation of this portfolio Find the standard deviation for this portfolio as proposed by Markowitz? What do you observe? What will happen to the standard deviation of this portfolio if the correlation between these two assets is 0.40? What will happen to this portfolio if the correlation is 1? What about if the correlation coefficient is -1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Invest ER SD o Correlation r D StockA 12000 30 15 Return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d96495351d_177017.pdf

180 KBs PDF File

635d96495351d_177017.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started