Answered step by step

Verified Expert Solution

Question

1 Approved Answer

to chapter, you learned how to use special journals to record transactions and how to post from these special journals to the ledger accounts.

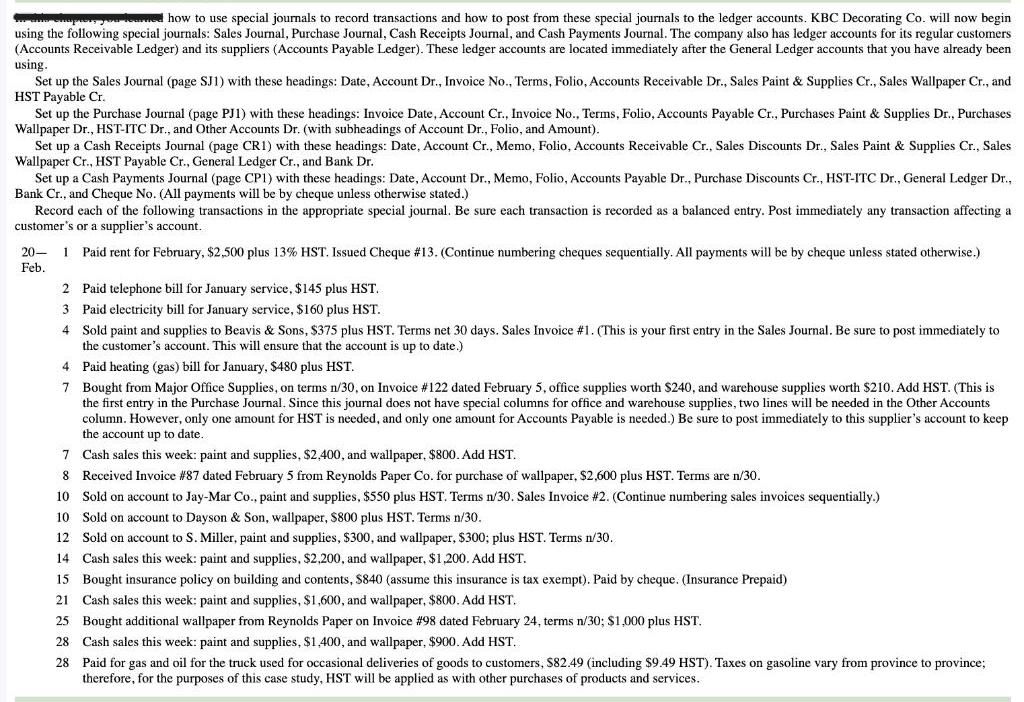

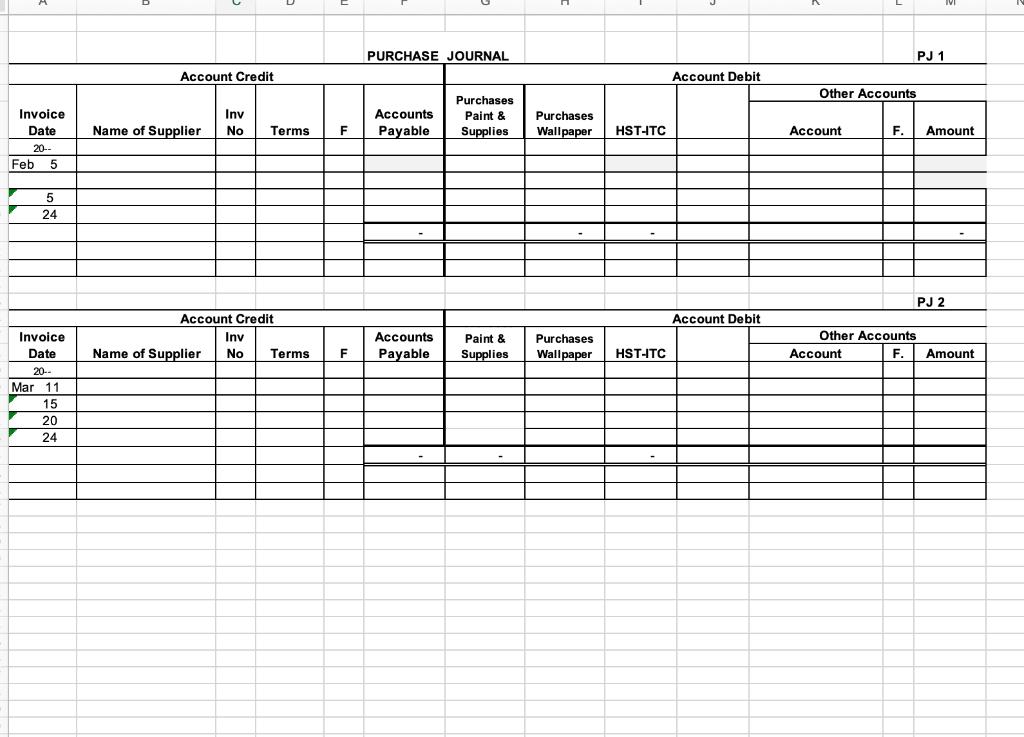

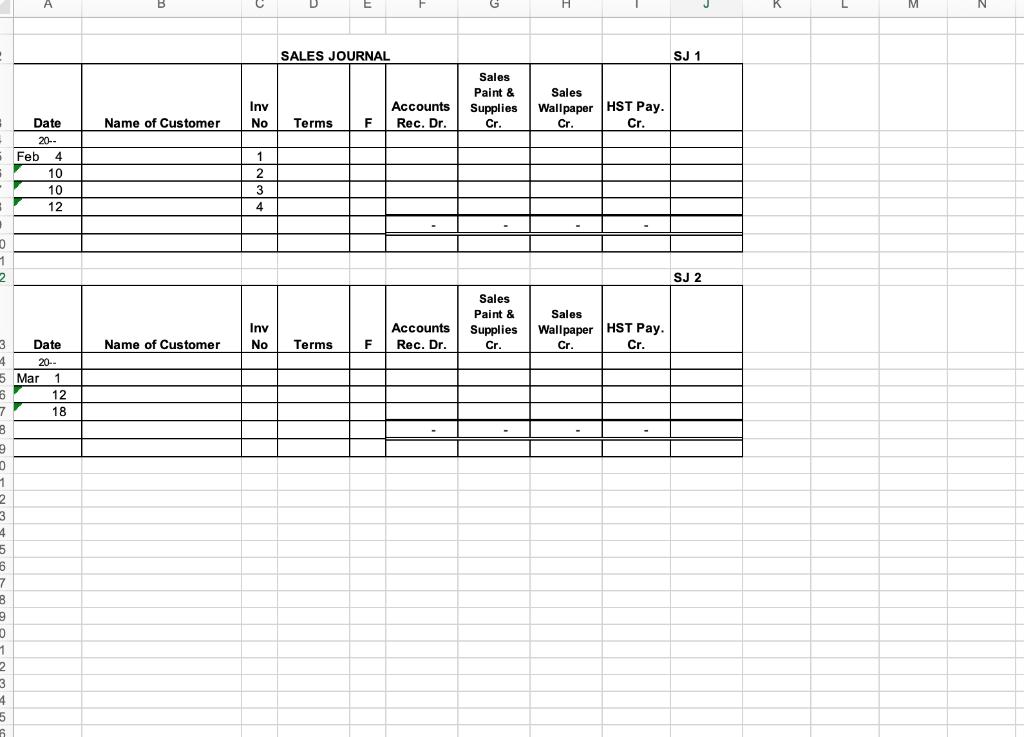

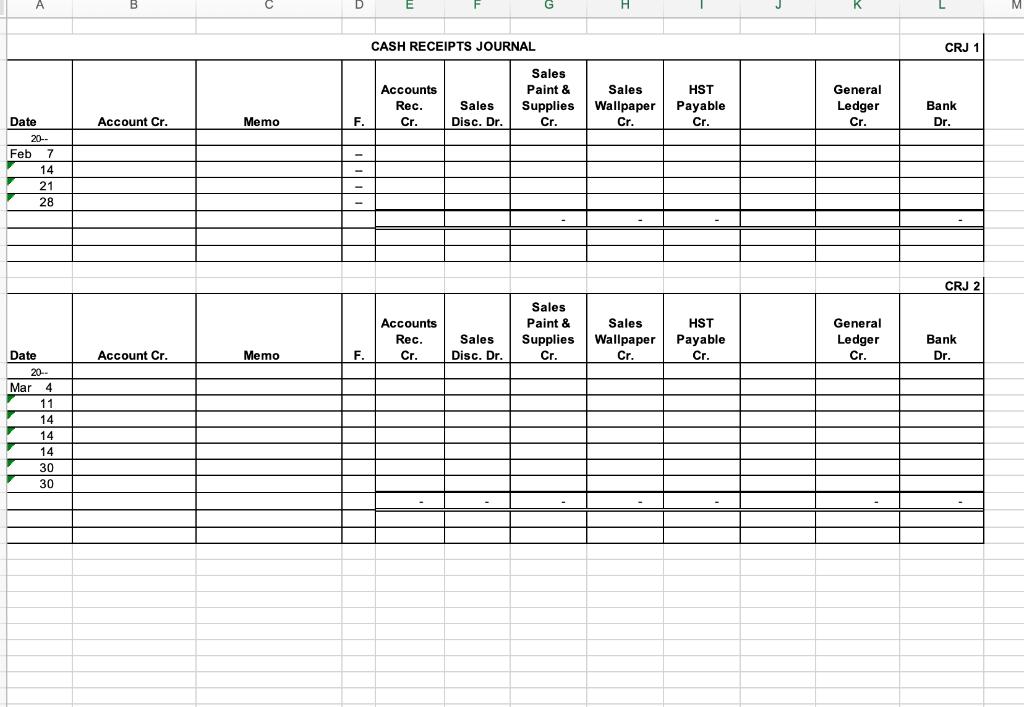

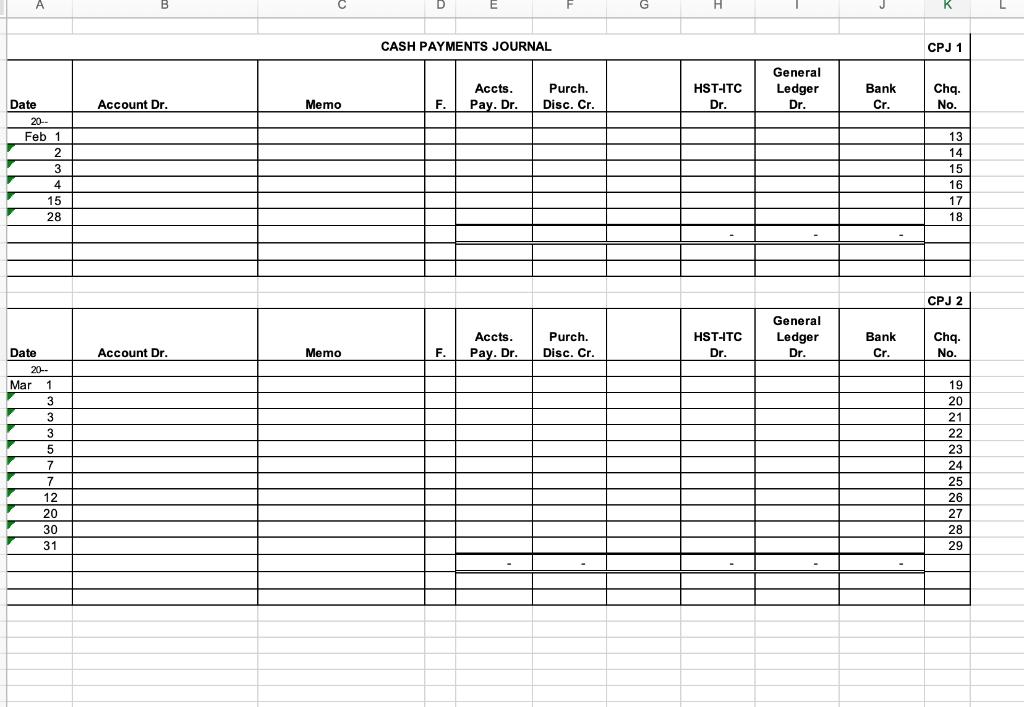

to chapter, you learned how to use special journals to record transactions and how to post from these special journals to the ledger accounts. KBC Decorating Co. will now begin using the following special journals: Sales Journal, Purchase Journal, Cash Receipts Journal, and Cash Payments Journal. The company also has ledger accounts for its regular customers (Accounts Receivable Ledger) and its suppliers (Accounts Payable Ledger). These ledger accounts are located immediately after the General Ledger accounts that you have already been using. Set up the Sales Journal (page SJ1) with these headings: Date, Account Dr., Invoice No., Terms, Folio, Accounts Receivable Dr., Sales Paint & Supplies Cr., Sales Wallpaper Cr., and HST Payable Cr. Set up the Purchase Journal (page PJ1) with these headings: Invoice Date, Account Cr., Invoice No., Terms, Folio, Accounts Payable Cr., Purchases Paint & Supplies Dr., Purchases Wallpaper Dr., HST-ITC Dr., and Other Accounts Dr. (with subheadings of Account Dr., Folio, and Amount). Set up a Cash Receipts Journal (page CR1) with these headings: Date, Account Cr., Memo, Folio, Accounts Receivable Cr., Sales Discounts Dr., Sales Paint & Supplies Cr., Sales Wallpaper Cr., HST Payable Cr., General Ledger Cr., and Bank Dr. Set up a Cash Payments Journal (page CP1) with these headings: Date, Account Dr., Memo, Folio, Accounts Payable Dr., Purchase Discounts Cr., HST-ITC Dr., General Ledger Dr., Bank Cr., and Cheque No. (All payments will be by cheque unless otherwise stated.) Record each of the following transactions in the appropriate special journal. Be sure each transaction is recorded as a balanced entry. Post immediately any transaction affecting a customer's or a supplier's account. 20- 1 Paid rent for February, $2,500 plus 13% HST. Issued Cheque # 13. (Continue numbering cheques sequentially. All payments will be by cheque unless stated otherwise.) Feb. 2 Paid telephone bill for January service, $145 plus HST. 3 Paid electricity bill for January service, $160 plus HST. 4 Sold paint and supplies to Beavis & Sons, $375 plus HST. Terms net 30 days. Sales Invoice #1. (This is your first entry in the Sales Journal. Be sure to post immediately to the customer's account. This will ensure that the account is up to date.) 4 Paid heating (gas) bill for January, $480 plus HST. 7 Bought from Major Office Supplies, on terms n/30, on Invoice # 122 dated February 5, office supplies worth $240, and warehouse supplies worth $210. Add HST. (This is the first entry in the Purchase Journal. Since this journal does not have special columns for office and warehouse supplies, two lines will be needed in the Other Accounts column. However, only one amount for HST is needed, and only one amount for Accounts Payable is needed.) Be sure to post immediately to this supplier's account to keep the account up to date. 7 Cash sales this week: paint and supplies, $2,400, and wallpaper, $800. Add HST. 8 Received Invoice #87 dated February 5 from Reynolds Paper Co. for purchase of wallpaper, $2,600 plus HST. Terms are n/30. 10 Sold on account to Jay-Mar Co., paint and supplies, $550 plus HST. Terms n/30. Sales Invoice #2. (Continue numbering sales invoices sequentially.) 10 Sold on account to Dayson & Son, wallpaper, $800 plus HST. Terms n/30. 12 Sold on account to S. Miller, paint and supplies, $300, and wallpaper, $300; plus HST. Terms n/30. 14 Cash sales this week: paint and supplies, $2,200, and wallpaper. $1,200. Add HST. 15 Bought insurance policy on building and contents, $840 (assume this insurance is tax exempt). Paid by cheque. (Insurance Prepaid) 21 Cash sales this week: paint and supplies, $1,600, and wallpaper, $800. Add HST. 25 Bought additional wallpaper from Reynolds Paper on Invoice # 98 dated February 24, terms n/30; $1,000 plus HST. 28 Cash sales this week: paint and supplies, $1,400, and wallpaper, $900. Add HST. 28 Paid for gas and oil for the truck used for occasional deliveries of goods to customers, $82.49 (including $9.49 HST). Taxes on gasoline vary from province to province; therefore, for the purposes of this case study, HST will be applied as with other purchases of products and services. Invoice Date 20-- Feb 5 5 24 Account Credit PURCHASE JOURNAL Purchases Inv Name of Supplier No Terms F Accounts Payable Paint & Purchases Supplies Wallpaper HST-TC Account Debit Other Accounts PJ 1 Account F. Amount PJ 2 Invoice Date 20-- Account Credit Inv Account Debit Name of Supplier No Terms F Accounts Payable Paint & Supplies Purchases Wallpaper HST-ITC Account Other Accounts F. Amount Mar 11 15 20 24 0 1 2 E SALES JOURNAL Sales Inv Date Name of Customer No Terms F Accounts Rec. Dr. Paint & Supplies Cr. Sales Wallpaper HST Pay. Cr. Cr. 20-- Feb 4 10 10 12 +234 Inv Accounts 3 Date Name of Customer No Terms F Rec. Dr. Sales Paint & Supplies Cr. Sales Cr. Wallpaper HST Pay. Cr. 4 20-- 5 Mar 1 6 12 7 18 8 9 0 1 2 3 4 5 6 7 B 9 0 1 2 3 4 5 6 SJ 1 SJ 2 A B D E CASH RECEIPTS JOURNAL CRJ 1 Accounts Rec. Date Account Cr. Memo F. Cr. Sales Disc. Dr. Sales Paint & Supplies Cr. Sales Wallpaper Cr. HST Payable Cr. General Ledger Cr. Bank Dr. 20-- Feb 7 - 14 21 28 CRJ 2 Accounts Rec. Sales Sales Paint & Supplies Date Account Cr. Memo F. Cr. Disc. Dr. Cr. Sales Wallpaper Cr. HST Payable General Ledger Bank Cr. Cr. Dr. 20-- Mar 4 11 14 14 14 30 30 A B Date 20- Feb 1 2 3 4 15 28 Date 20-- Mar 1 3 3 3 5 7 7 12 20 30 31 E F G H CASH PAYMENTS JOURNAL K CPJ 1 Account Dr. Memo F. Accts. Pay. Dr. Purch. Disc. Cr. HST-ITC General Ledger Bank Dr. Dr. Cr. Chq. No. 13 14 15 16 17 18 345698 CPJ 2 Accts. Purch. HST-ITC General Ledger Bank Chq. Account Dr. Memo F. Pay. Dr. Disc. Cr. Dr. Dr. Cr. No. 19 20 21 22 2222222

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started