Answered step by step

Verified Expert Solution

Question

1 Approved Answer

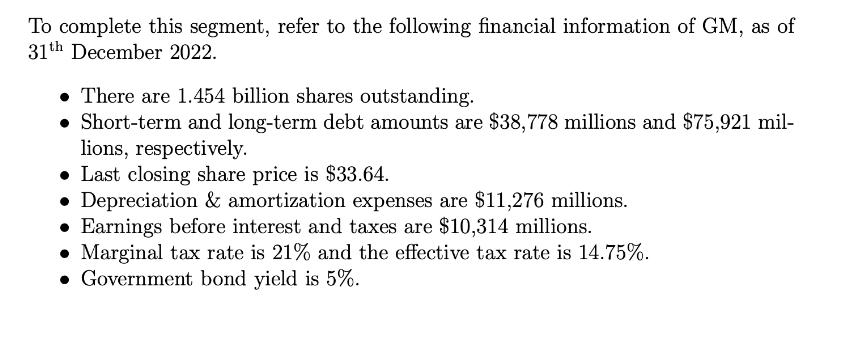

To complete this segment, refer to the following financial information of GM, as of 31th December 2022. There are 1.454 billion shares outstanding. Short-term

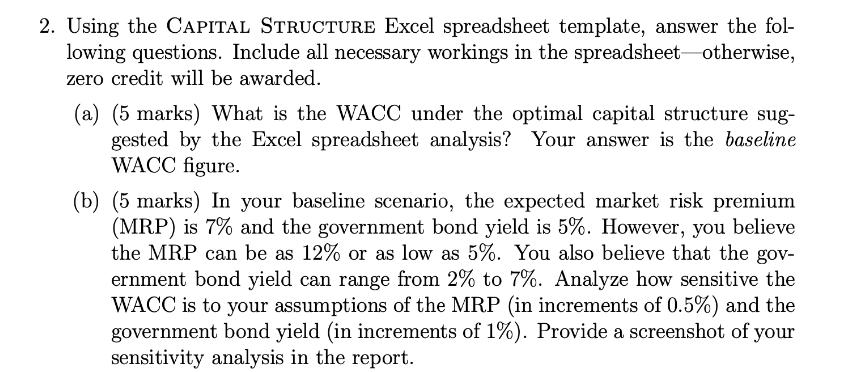

To complete this segment, refer to the following financial information of GM, as of 31th December 2022. There are 1.454 billion shares outstanding. Short-term and long-term debt amounts are $38,778 millions and $75,921 mil- lions, respectively. Last closing share price is $33.64. Depreciation & amortization expenses are $11,276 millions. Earnings before interest and taxes are $10,314 millions. Marginal tax rate is 21% and the effective tax rate is 14.75%. . Government bond yield is 5%. 2. Using the CAPITAL STRUCTURE Excel spreadsheet template, answer the fol- lowing questions. Include all necessary workings in the spreadsheet otherwise, zero credit will be awarded. (a) (5 marks) What is the WACC under the optimal capital structure sug- gested by the Excel spreadsheet analysis? Your answer is the baseline WACC figure. (b) (5 marks) In your baseline scenario, the expected market risk premium (MRP) is 7% and the government bond yield is 5%. However, you believe the MRP can be as 12% or as low as 5%. You also believe that the gov- ernment bond yield can range from 2% to 7%. Analyze how sensitive the WACC is to your assumptions of the MRP (in increments of 0.5%) and the government bond yield (in increments of 1%). Provide a screenshot of your sensitivity analysis in the report.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem I will use the CAPITAL STRUCTURE Excel spreadsheet template provided Given inf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started