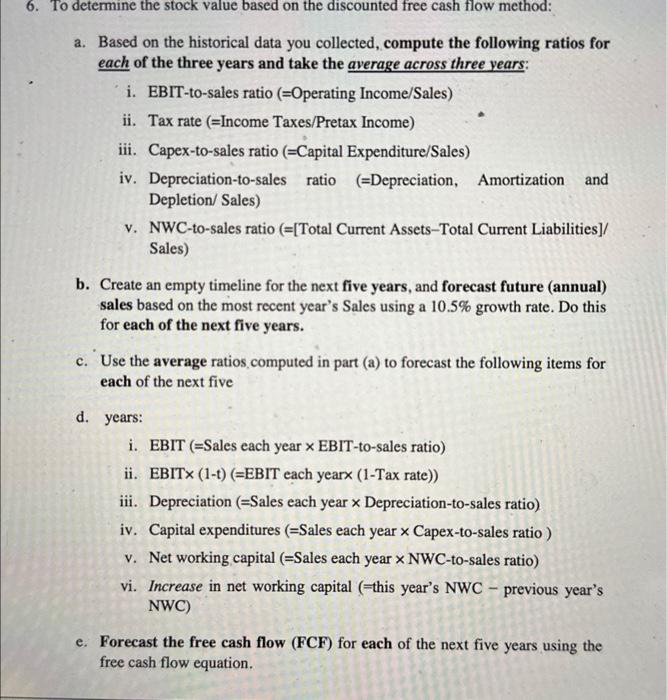

To determine the stock value based on the discounted free cash flow method: a. Based on the historical data you collected, compute the following ratios for each of the three years and take the average across three years: i. EBIT-to-sales ratio (=Operating Income/Sales) ii. Tax rate (=Income Taxes/Pretax Income) iii. Capex-to-sales ratio (=Capital Expenditure/Sales) iv. Depreciation-to-sales ratio (=Depreciation, Amortization and Depletion/ Sales) v. NWC-to-sales ratio (=[ Total Current Assets-Total Current Liabilities ]/ Sales) b. Create an empty timeline for the next five years, and forecast future (annual) sales based on the most recent year's Sales using a 10.5% growth rate. Do this for each of the next five years. c. Use the average ratios,computed in part (a) to forecast the following items for each of the next five d. years: i. EBIT (=Sales each year EBIT-to-sales ratio) ii. EBIT (1t)(= EBIT each yearx (1-Tax rate)) iii. Depreciation (=Sales each year Depreciation-to-sales ratio) iv. Capital expenditures (=Sales each year Capex-to-sales ratio ) v. Net working capital (=Sales each year NWC-to-sales ratio) vi. Increase in net working capital (=this year's NWC - previous year's NWC) e. Forecast the free cash flow (FCF) for each of the next five years using the free cash flow equation. Your role: new junior analysts for a large brokerage firm. Your assignment: analyze Starbucks (SBUX) stock. Your boss recommends determining prices based on both the discounted free cash flow valuation method and the comparable P/E ratio method. To determine the stock value based on the discounted free cash flow method: a. Based on the historical data you collected, compute the following ratios for each of the three years and take the average across three years: i. EBIT-to-sales ratio (=Operating Income/Sales) ii. Tax rate (=Income Taxes/Pretax Income) iii. Capex-to-sales ratio (=Capital Expenditure/Sales) iv. Depreciation-to-sales ratio (=Depreciation, Amortization and Depletion/ Sales) v. NWC-to-sales ratio (=[ Total Current Assets-Total Current Liabilities ]/ Sales) b. Create an empty timeline for the next five years, and forecast future (annual) sales based on the most recent year's Sales using a 10.5% growth rate. Do this for each of the next five years. c. Use the average ratios,computed in part (a) to forecast the following items for each of the next five d. years: i. EBIT (=Sales each year EBIT-to-sales ratio) ii. EBIT (1t)(= EBIT each yearx (1-Tax rate)) iii. Depreciation (=Sales each year Depreciation-to-sales ratio) iv. Capital expenditures (=Sales each year Capex-to-sales ratio ) v. Net working capital (=Sales each year NWC-to-sales ratio) vi. Increase in net working capital (=this year's NWC - previous year's NWC) e. Forecast the free cash flow (FCF) for each of the next five years using the free cash flow equation. Your role: new junior analysts for a large brokerage firm. Your assignment: analyze Starbucks (SBUX) stock. Your boss recommends determining prices based on both the discounted free cash flow valuation method and the comparable P/E ratio method