Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To General Reserve (Transfer) 25,000 By Balance bid 3,00,000 To Goodwill(written off) 10,000 By Funds from Operations (Balancing figure) 26,000 To Provision for Depreciation 6.000

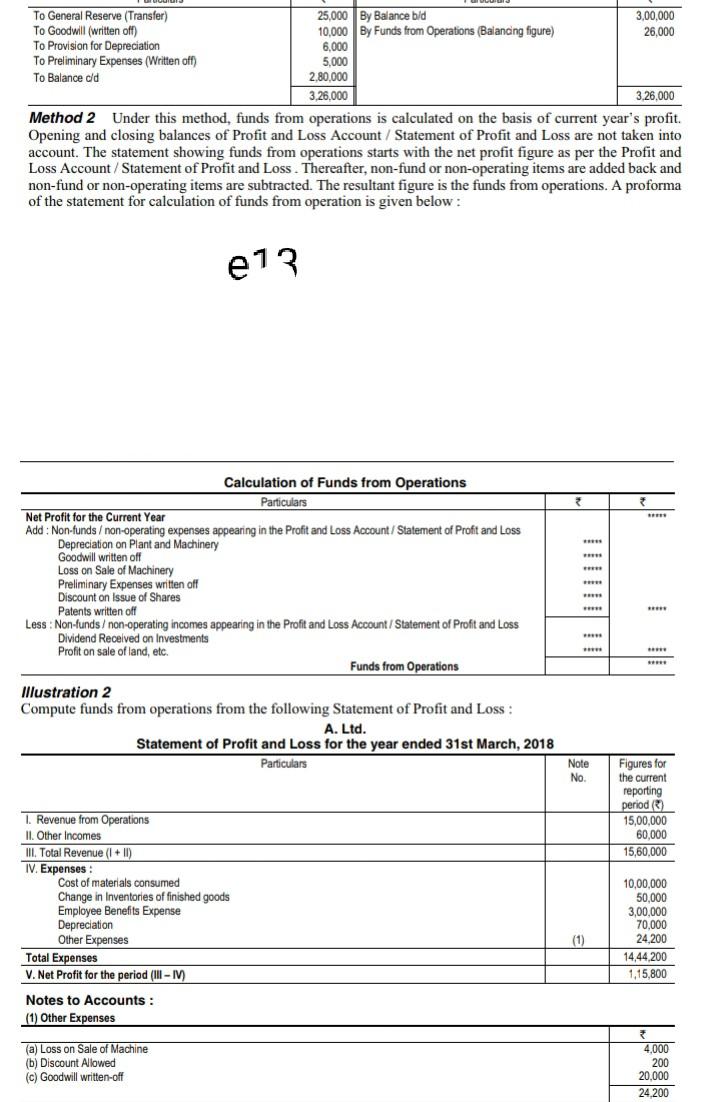

To General Reserve (Transfer) 25,000 By Balance bid 3,00,000 To Goodwill(written off) 10,000 By Funds from Operations (Balancing figure) 26,000 To Provision for Depreciation 6.000 To Preliminary Expenses (Written off) 5,000 To Balance old 2,80,000 3.26.000 3.26.000 Method 2 Under this method, funds from operations is calculated on the basis of current year's profit. Opening and closing balances of Profit and Loss Account/Statement of Profit and Loss are not taken into account. The statement showing funds from operations starts with the net profit figure as per the Profit and Loss Account/Statement of Profit and Loss. Thereafter, non-fund or non-operating items are added back and non-fund or non-operating items are subtracted. The resultant figure is the funds from operations. A proforma of the statement for calculation of funds from operation is given below: e13 we Calculation of Funds from Operations Particulars Net Profit for the Current Year Add: Non-funds / non-operating expenses appearing in the Profit and Loss Account/Statement of Profit and Loss Depreciation on Plant and Machinery Goodwill written off Loss on Sale of Machinery Preliminary Expenses written off Discount on issue of Shares Patents written off Less: Non-funds / non-operating incomes appearing in the Profit and Loss Account / Statement of Profit and Loss Dividend Received on Investments Profit on sale of land, etc. Funds from Operations Illustration 2 Compute funds from operations from the following Statement of Profit and Loss: A. Ltd. Statement of Profit and Loss for the year ended 31st March, 2018 Particulars wo see Note No Figures for the current reporting period 15,00,000 60,000 15,60,000 1. Revenue from Operations II. Other Incomes III. Total Revenue (I + II) IV. Expenses : Cost of materials consumed Change in Inventories of finished goods Employee Benefits Expense Depreciation Other Expenses Total Expenses V. Net Profit for the period (III-IV Notes to Accounts: (1) Other Expenses 10,00,000 50,000 3,00,000 70,000 24.200 14.44 200 1,15,800 (1) 4,000 (a) Loss on Sale of Machine (b) Discount Allowed (c) Goodwill written-off 200 20.000 24.200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started