Question

To help financing its green projects, a UK based company is issuing a number of new bonds. These bonds have a face value of

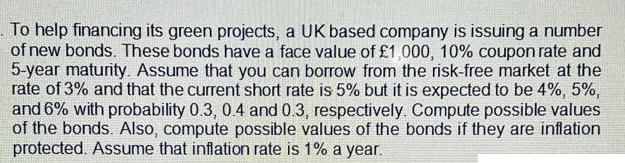

To help financing its green projects, a UK based company is issuing a number of new bonds. These bonds have a face value of 1,000, 10% coupon rate and 5-year maturity. Assume that you can borrow from the risk-free market at the rate of 3% and that the current short rate is 5% but it is expected to be 4%, 5%, and 6% with probability 0.3, 0.4 and 0.3, respectively. Compute possible values of the bonds. Also, compute possible values of the bonds if they are inflation protected. Assume that inflation rate is 1% a year.

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Possible values of the bonds PV 1000 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Physics

Authors: Jearl Walker, Halliday Resnick

10th Extended edition

978-1118230718, 111823071X, 978-1118230725

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App