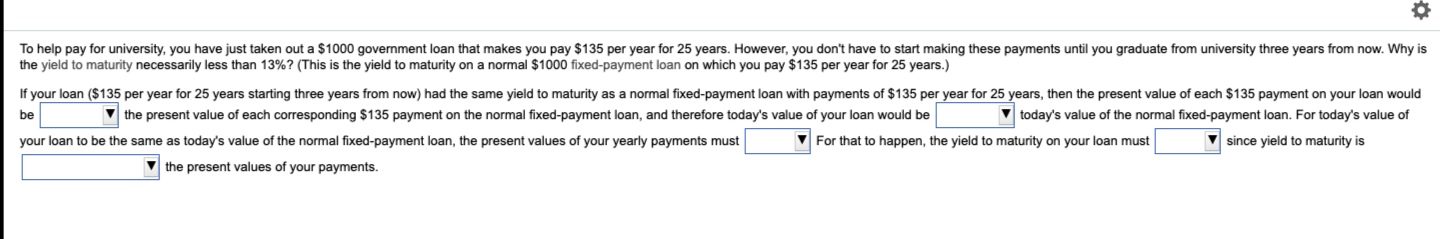

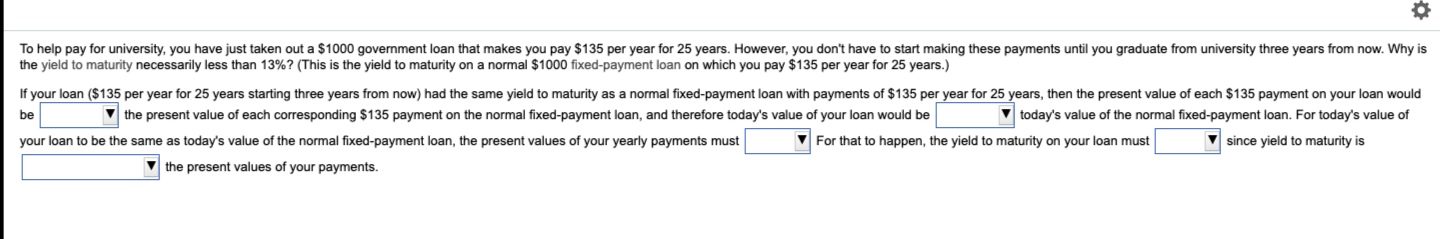

To help pay for university, you have just taken out a $1000 government loan that makes you pay $135 per year for 25 years. However, you don't have to start making these payments until you graduate from university three years from now. Why is the yield to maturity necessarily less than 13%? (This is the yield to maturity on a normal $1000 fixed-payment loan on which you pay $135 per year for 25 years.) If your loan ($135 per year for 25 years starting three years from now) had the same yield to maturity as a normal fixed-payment loan with payments of $135 per year for 25 years, then the present value of each $135 payment on your loan would the present value of each corresponding $135 payment on the normal fixed-payment loan, and therefore today's value of your loan would be v today's value of the normal fixed-payment loan. For today's value of your loan to be the same as today's value of the normal fixed-payment loan, the present values of your yearly payments must For that to happen, the yield to maturity on your loan must since yield to maturity is the present values of your payments. To help pay for university, you have just taken out a $1000 government loan that makes you pay $135 per year for 25 years. However, you don't have to start making these payments until you graduate from university three years from now. Why is the yield to maturity necessarily less than 13%? (This is the yield to maturity on a normal $1000 fixed-payment loan on which you pay $135 per year for 25 years.) If your loan ($135 per year for 25 years starting three years from now) had the same yield to maturity as a normal fixed-payment loan with payments of $135 per year for 25 years, then the present value of each $135 payment on your loan would the present value of each corresponding $135 payment on the normal fixed-payment loan, and therefore today's value of your loan would be v today's value of the normal fixed-payment loan. For today's value of your loan to be the same as today's value of the normal fixed-payment loan, the present values of your yearly payments must For that to happen, the yield to maturity on your loan must since yield to maturity is the present values of your payments