To help solve Requirement 3:

To help solve Requirement 3:

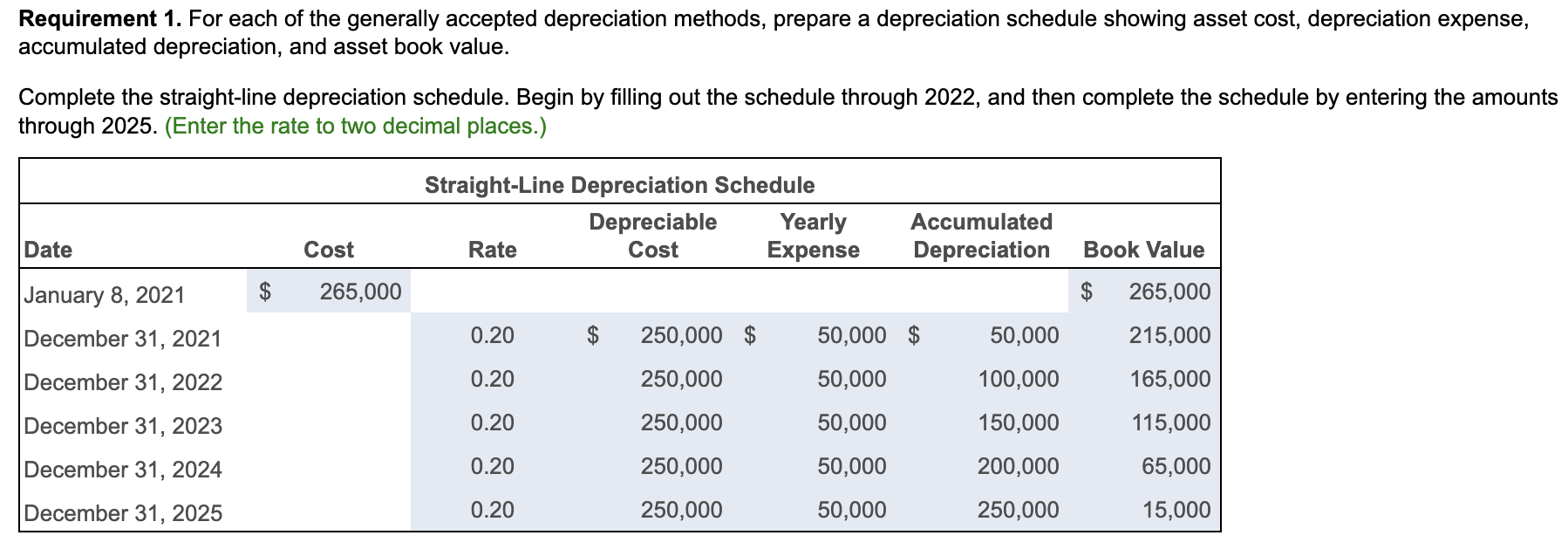

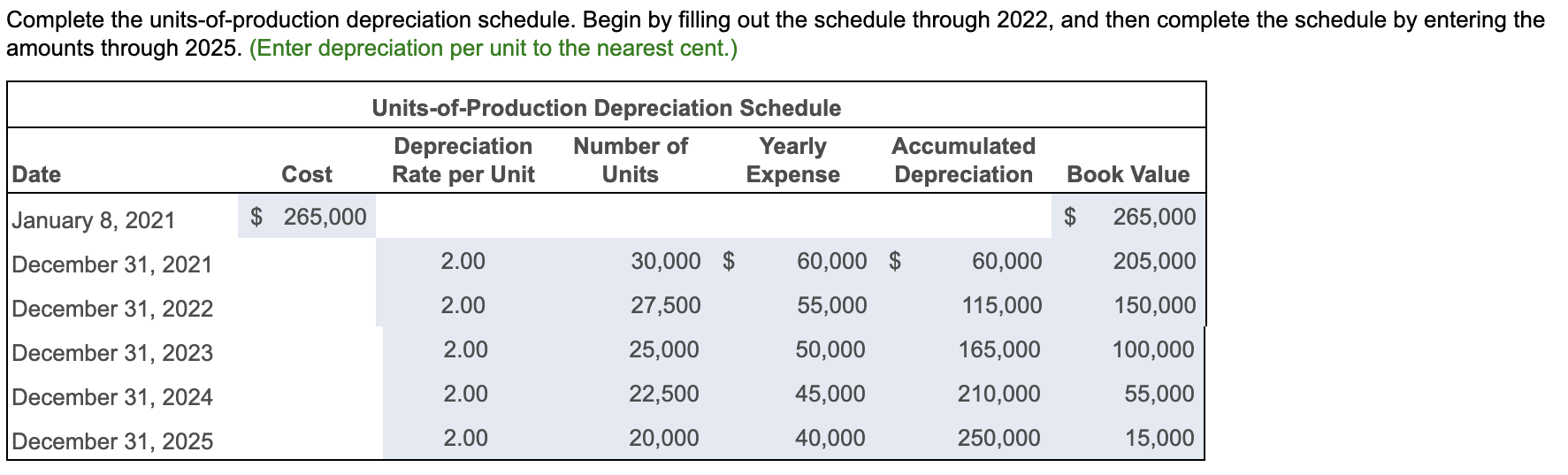

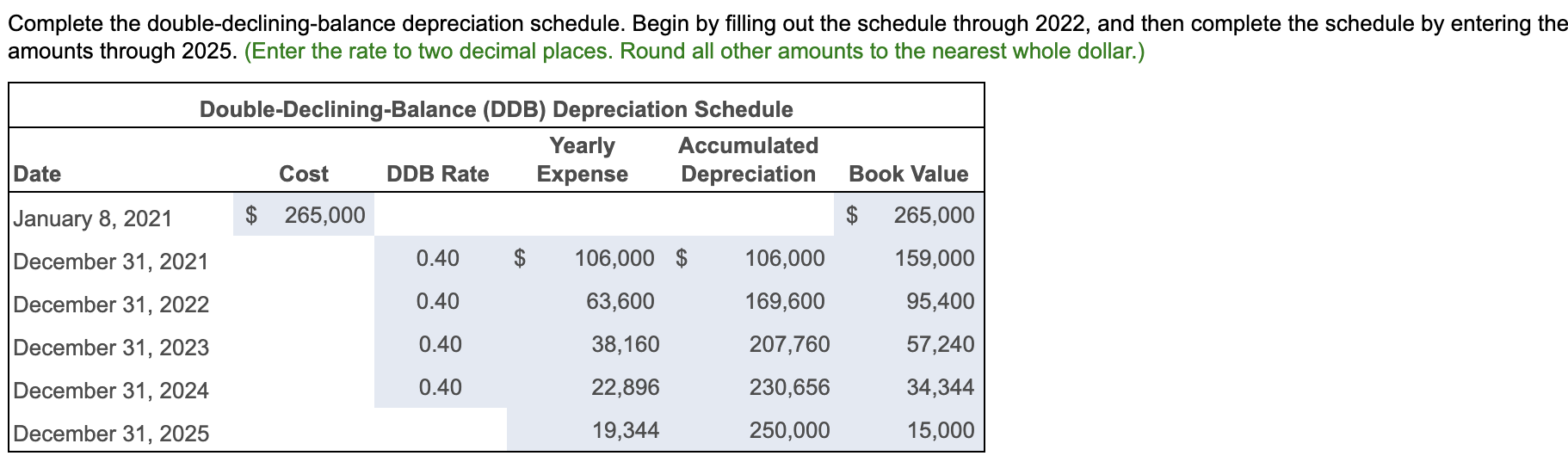

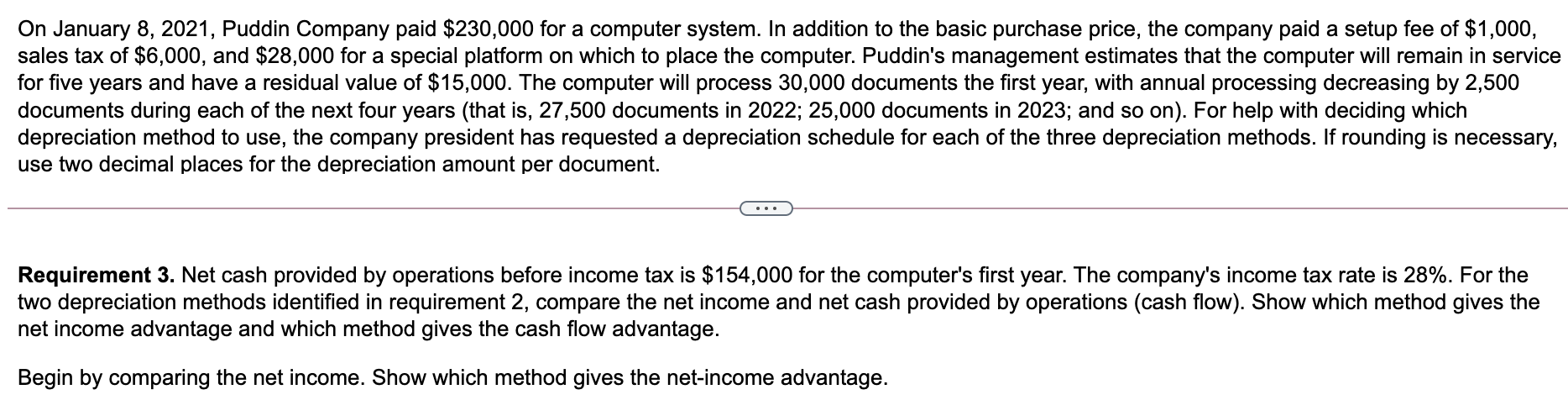

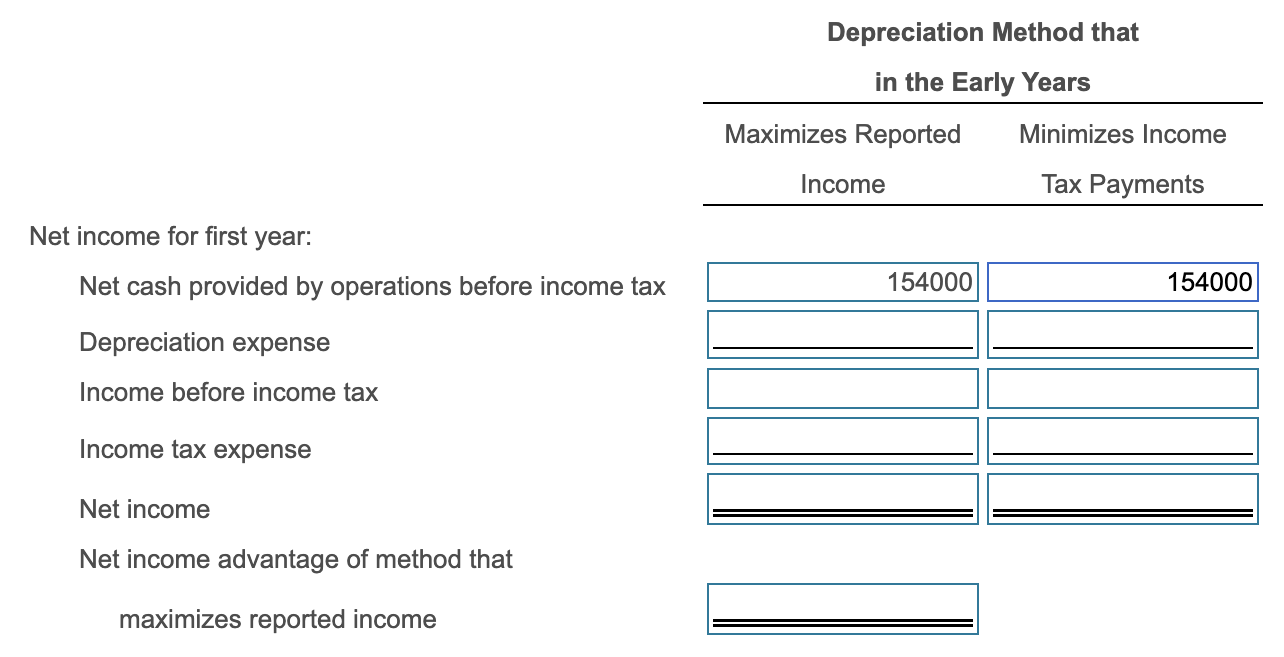

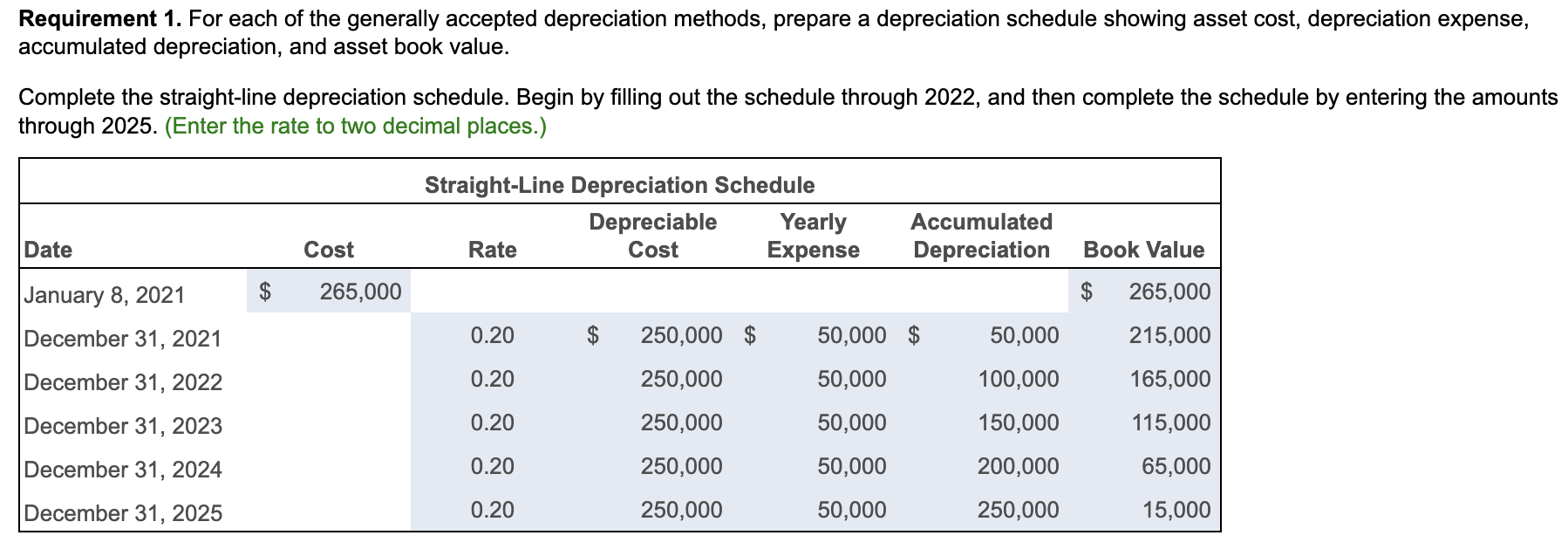

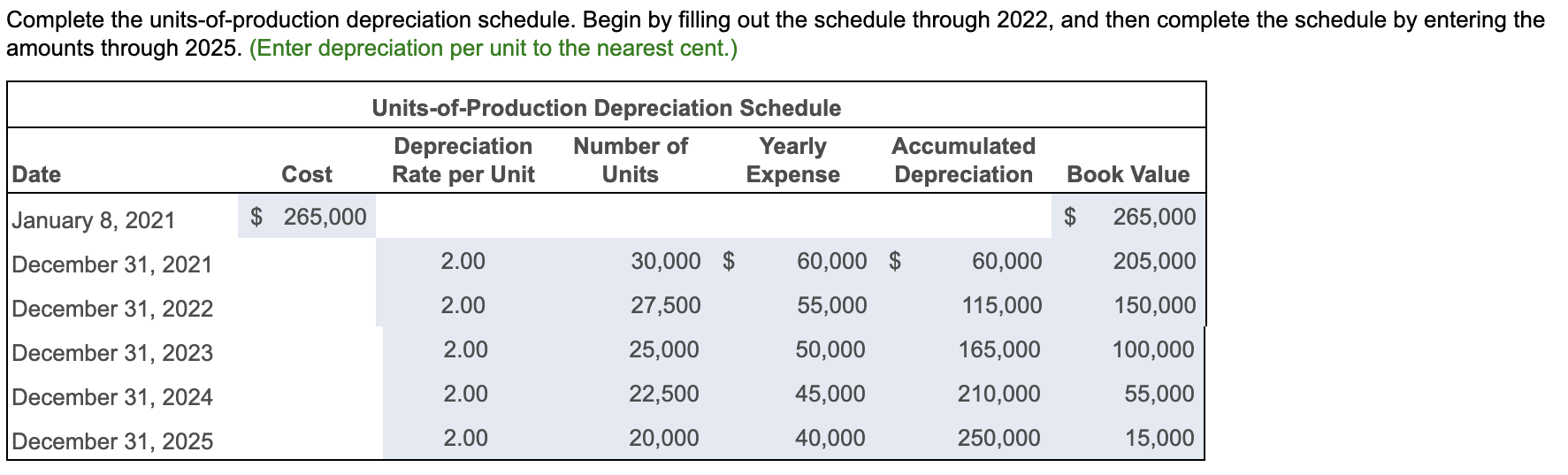

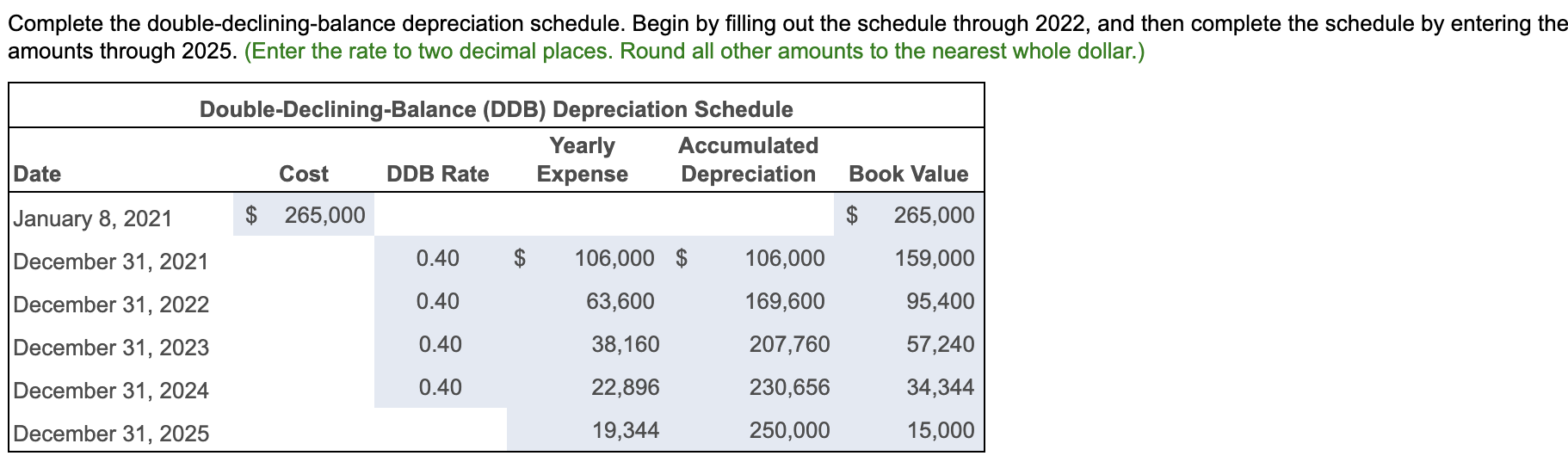

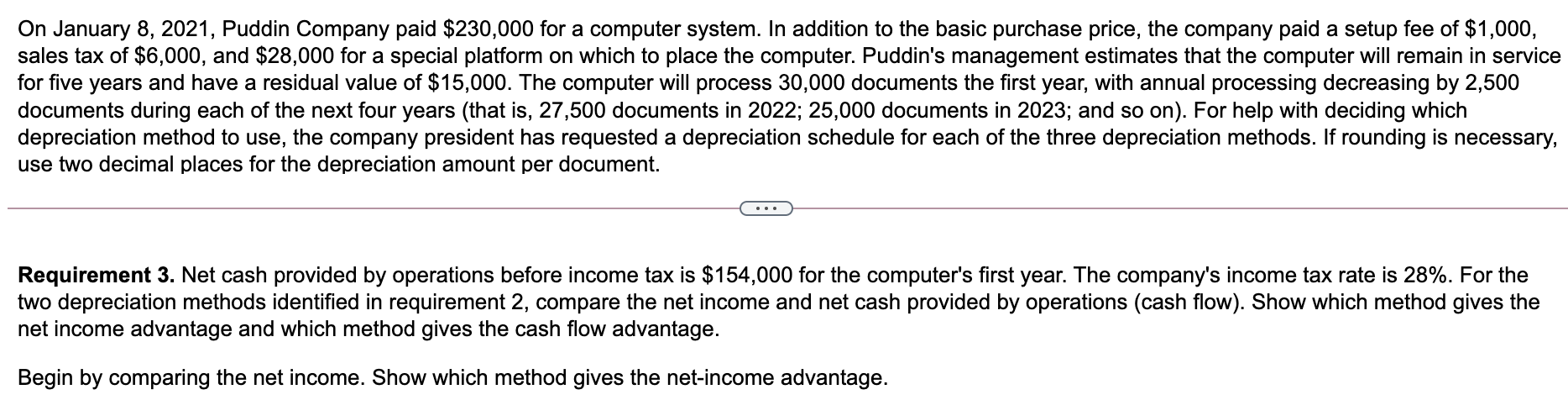

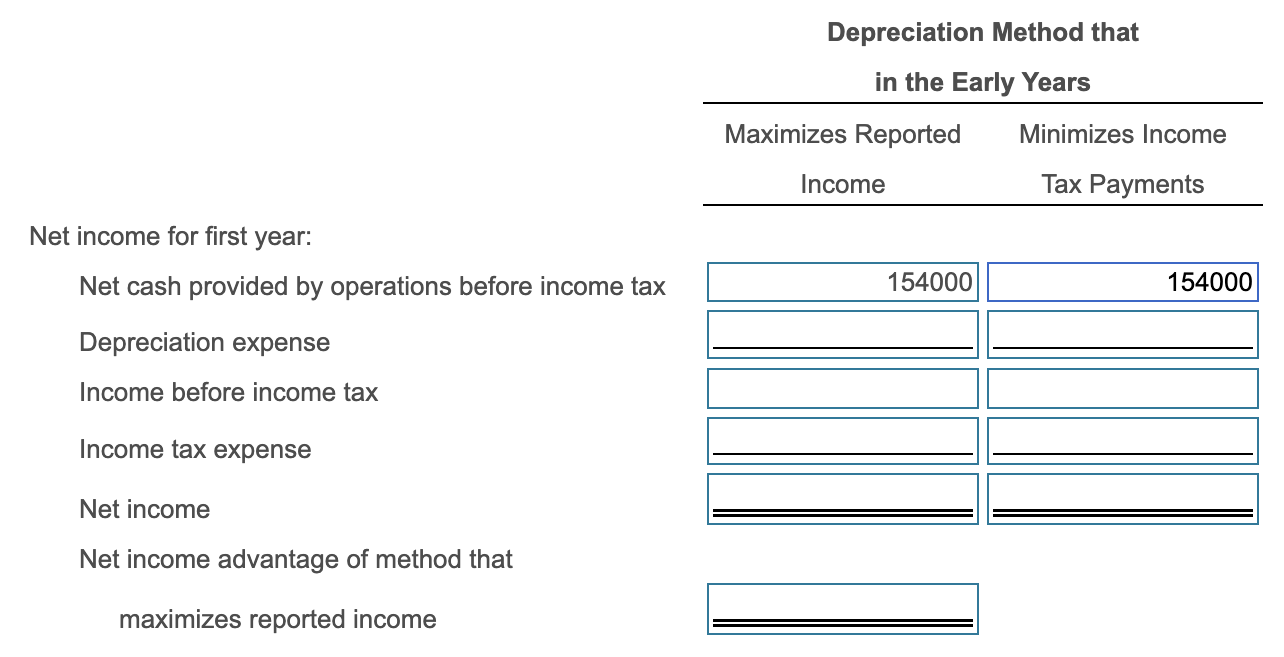

On January 8, 2021, Puddin Company paid $230,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,000, sales tax of $6,000, and $28,000 for a special platform on which to place the computer. Puddin's management estimates that the computer will remain in service for five years and have a residual value of $15,000. The computer will process 30,000 documents the first year, with annual processing decreasing by 2,500 documents during each of the next four years (that is, 27,500 documents in 2022; 25,000 documents in 2023; and so on). For help with deciding which depreciation method to use, the company president has requested a depreciation schedule for each of the three depreciation methods. If rounding is necessary, use two decimal places for the depreciation amount per document. Requirement 3. Net cash provided by operations before income tax is $154,000 for the computer's first year. The company's income tax rate is 28%. For the two depreciation methods identified in requirement 2, compare the net income and net cash provided by operations (cash flow). Show which method gives the net income advantage and which method gives the cash flow advantage. Begin by comparing the net income. Show which method gives the net-income advantage. Depreciation Method that in the Early Years Maximizes Reported Minimizes Income Income Tax Payments Net income for first year: Net cash provided by operations before income tax 154000 154000 Depreciation expense Income before income tax Income tax expense Net income Net income advantage of method that maximizes reported income Requirement 1. For each of the generally accepted depreciation methods, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated depreciation, and asset book value. Complete the straight-line depreciation schedule. Begin by filling out the schedule through 2022, and then complete the schedule by entering the amounts through 2025. (Enter the rate to two decimal places.) Straight-Line Depreciation Schedule Depreciable Yearly Rate Cost Expense Date Cost Accumulated Depreciation Book Value January 8, 2021 $ 265,000 $ 265,000 December 31, 2021 0.20 250,000 $ 50,000 $ 50,000 December 31, 2022 0.20 50,000 100,000 250,000 250,000 215,000 165,000 115,000 December 31, 2023 0.20 50,000 150,000 December 31, 2024 0.20 250,000 50,000 200,000 65,000 December 31, 2025 0.20 250,000 50,000 250,000 15,000 Complete the units-of-production depreciation schedule. Begin by filling out the schedule through 2022, and then complete the schedule by entering the amounts through 2025. (Enter depreciation per unit to the nearest cent.) Units-of-Production Depreciation Schedule Depreciation Number of Yearly Rate per Unit Units Expense Accumulated Depreciation Date Cost Book Value January 8, 2021 $ 265,000 $ December 31, 2021 2.00 30,000 $ 60,000 $ 60,000 265,000 205,000 150,000 100,000 December 31, 2022 2.00 27,500 55,000 115,000 December 31, 2023 2.00 25,000 50,000 165,000 December 31, 2024 2.00 22,500 45,000 210,000 55,000 December 31, 2025 2.00 20,000 40,000 250,000 15,000 Complete the double-declining-balance depreciation schedule. Begin by filling out the schedule through 2022, and then complete the schedule by entering the amounts through 2025. (Enter the rate to two decimal places. Round all other amounts to the nearest whole dollar.) Double-Declining-Balance (DDB) Depreciation Schedule Yearly Accumulated Cost DDB Rate Expense Depreciation Date Book Value January 8, 2021 $ 265,000 265,000 December 31, 2021 0.40 $ 106,000 $ 106,000 159,000 December 31, 2022 0.40 63,600 95,400 169,600 207,760 December 31, 2023 0.40 38,160 57,240 December 31, 2024 0.40 22,896 230,656 34,344 December 31, 2025 19,344 250,000 15,000

To help solve Requirement 3:

To help solve Requirement 3: