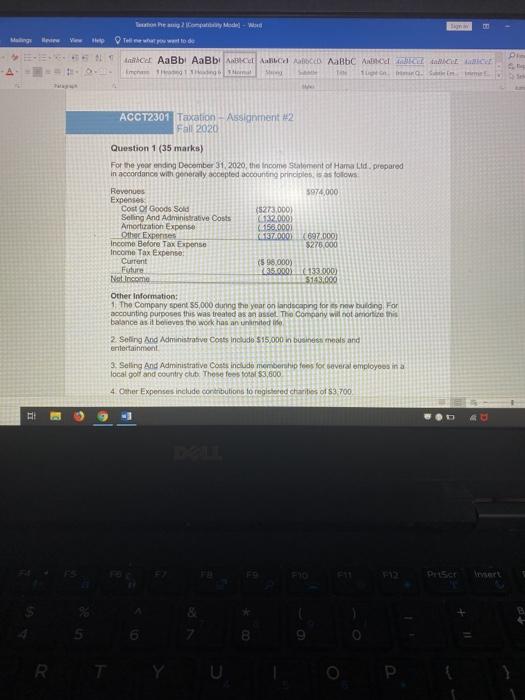

To hem Com Mode - Home Tell me what you want to de * AaBb AaBb ABIA ALA ABC Acce mm 1 Star Tom ACC T2301 Taxation Assignment 2 Fall 2020 Question 1 (35 marks) For the yoor ending Docomber 31 2020, the income Statement of Harald, prepared in accordance with generally accepted accounting principles, is as follows Revenues 5974,000 Expenses Cost Of Goods Sold (5273,000) Selling And Administrative Costs 12.000) Amortization Expense 150.0001 Other Expenses (87000 (697.000 Income Before Tax Expense $275.000 Income Tax Expense Current (598.000) Future 235.00036133.000) Natcome $143.000 Other Information: 1. The Company spent $5,000 duning the year on landscaping for new building For accounting purposes this was treated as an asset. The Company will not amortize it balance as it believes the work has an unlimited to 2. Selling and Administrative Conts include $15,000 in business meals and entertainment 3. Selling And Administrative Cons includo membership foes for several employons in a local gol and country clutThese fees tots $3,600 4 Other Expenses include contributions to registered charities of S3700 3 8 RT U P. To hem Com Mode - Home Tell me what you want to de * AaBb AaBb ABIA ALA ABC Acce mm 1 Star Tom ACC T2301 Taxation Assignment 2 Fall 2020 Question 1 (35 marks) For the yoor ending Docomber 31 2020, the income Statement of Harald, prepared in accordance with generally accepted accounting principles, is as follows Revenues 5974,000 Expenses Cost Of Goods Sold (5273,000) Selling And Administrative Costs 12.000) Amortization Expense 150.0001 Other Expenses (87000 (697.000 Income Before Tax Expense $275.000 Income Tax Expense Current (598.000) Future 235.00036133.000) Natcome $143.000 Other Information: 1. The Company spent $5,000 duning the year on landscaping for new building For accounting purposes this was treated as an asset. The Company will not amortize it balance as it believes the work has an unlimited to 2. Selling and Administrative Conts include $15,000 in business meals and entertainment 3. Selling And Administrative Cons includo membership foes for several employons in a local gol and country clutThese fees tots $3,600 4 Other Expenses include contributions to registered charities of S3700 3 8 RT U P