Question

To live comfortably in retirement, you decide you will need to save $2 million by the time you are 65 (you are 30 years old

To live comfortably in retirement, you decide you will need to save $2 million by the time you are 65 (you are 30 years old today). You will start a new retirement savings account today and contribute the same amount of money on every birthday up to and including your 65th birthday. Using TVM principles, how much must you set aside each year to make sure that you hit your target goal if the interest rate is 5%? What flaws might exist in your calculations, and what variables could lead to different outcomes? What actions could you take ensure you reach your target goal?

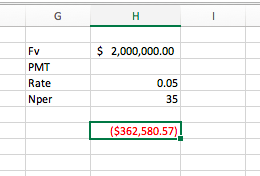

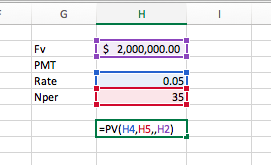

I am trying to calculate the answer using Excel and keep on getting $362,580.57. Can anyone help me determine what I am doing wrong?

Thank you!

G H $ 2,000,000.00 FV PMT Rate Nper 0.05 35 ($362,580.57) I $ 2,000,000.00 Fv PMT 0 Rate Nper .051 35 =PV(H4, H5,,H2)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started