Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which project or projects should be accepted if they are independent? Which project or projects should be accepted if they are mutually exclusive? Given a.

Which project or projects should be accepted if they are independent?

Which project or projects should be accepted if they are mutually exclusive?

Given

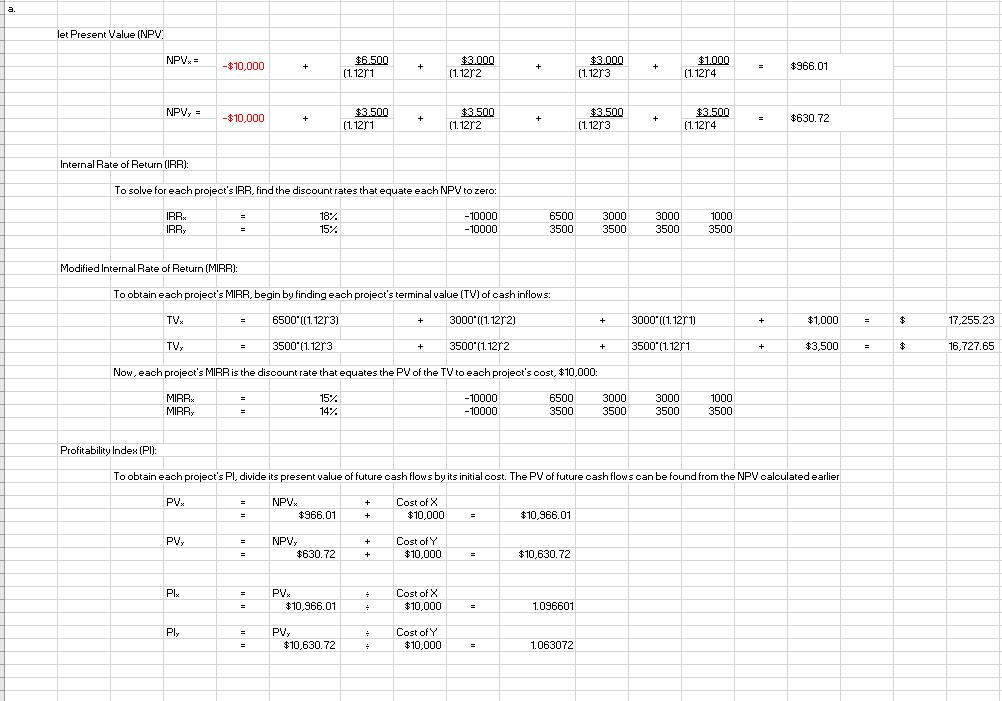

a. let Present Value (NPV NPV = $6.500 (1.12r1 $3.000 (1.12r2 $3.000 (1.12r3 $1.000 (1.12r4 -$10,000 + $966.01 + + NPV, = $3.500 (1.12r1 $3.500 (1.12r2 $3.500 (1.12r3 $3.500 (1.12r4 -$10,000 + + + + $630.72 Internal Rate of Return (IRR): To solve for each project's IRR, find the discount rates that equate each NPV to zero: IRR IRR, 18% -10000 6500 3000 3000 1000 3500 15% -10000 3500 3500 3500 Modified Internal Rate of Return (MIRR): To obtain each project's MIRR, begin by finding each project's terminal value (TV) of cash inflows: TVx 6500'((1. 12r3) 3000'((1.12r2) 3000'((1. 12r1) $1,000 $4 17,255.23 + + = TV, 3500 (1.12r3 3500'(1.12r2 3500'(1.12r1 $3,500 16,727.65 + + + Now, each project's MIRRIS the discount rate that equates the PV of the TV to each project's cost, $10,000: MIRR MIRRY 6500 3500 15% -10000 3000 3000 1000 14% -10000 3500 3500 3500 Profitability Index (PI): To obtain each project's Pl, divide its present value of future cash flows by its initial cost. The PV of future cash flows can be found from the NPV calculated earlier PVx NPV. + Cost of X $966.01 $10,000 $10,966.01 + %3D PV, NPV, $630.72 + Cost of Y $10,000 $10,630.72 PV $10.966.01 Plx Cost of X $10,000 1.096601 Ply PV, $10,630.72 Cost of Y = $10,000 1.063072

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Required solution QWhich project or projects should be accepted if they are independe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e2f3322585_182174.pdf

180 KBs PDF File

635e2f3322585_182174.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started