Question

To open a new store, Perez Tire Company plans to invest $224,000 in equipment expected to have a four-year useful life and no salvage

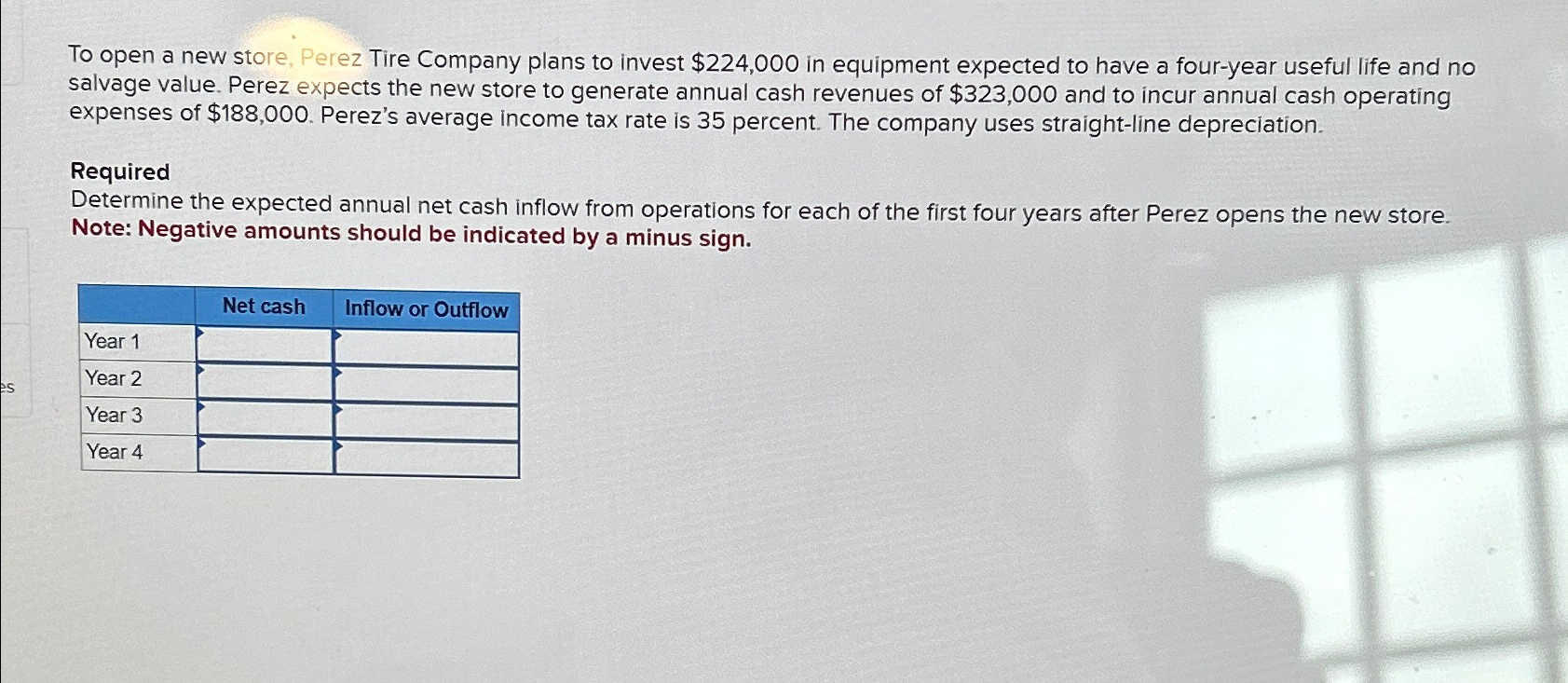

To open a new store, Perez Tire Company plans to invest $224,000 in equipment expected to have a four-year useful life and no salvage value. Perez expects the new store to generate annual cash revenues of $323,000 and to incur annual cash operating expenses of $188,000. Perez's average income tax rate is 35 percent. The company uses straight-line depreciation. Required Determine the expected annual net cash inflow from operations for each of the first four years after Perez opens the new store. Note: Negative amounts should be indicated by a minus sign. Year 1 Year 2 es Year 3 Year 4 Net cash Inflow or Outflow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the expected annual net cash inflow from operations for each of the first four years af...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey of Accounting

Authors: Edmonds, old, Mcnair, Tsay

2nd edition

9780077392659, 978-0-07-73417, 77392655, 0-07-734177-5, 73379557, 978-0073379555

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App