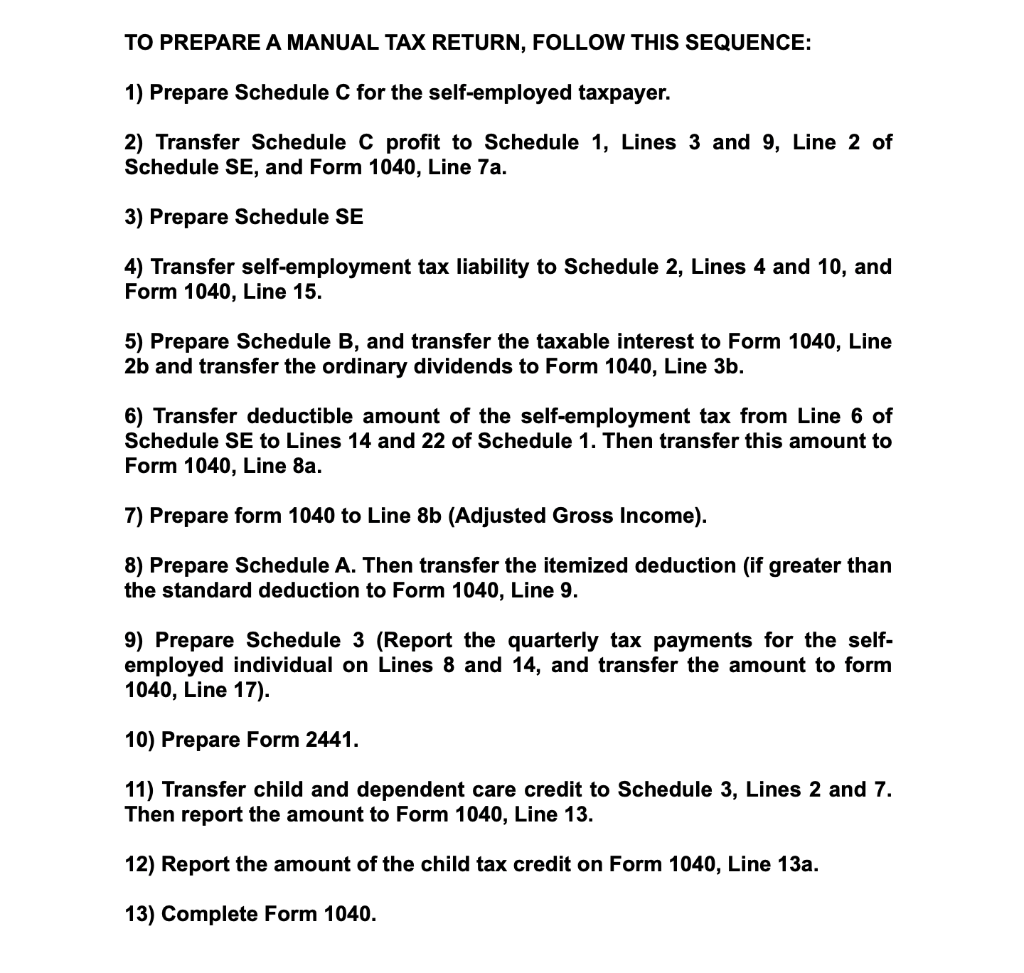

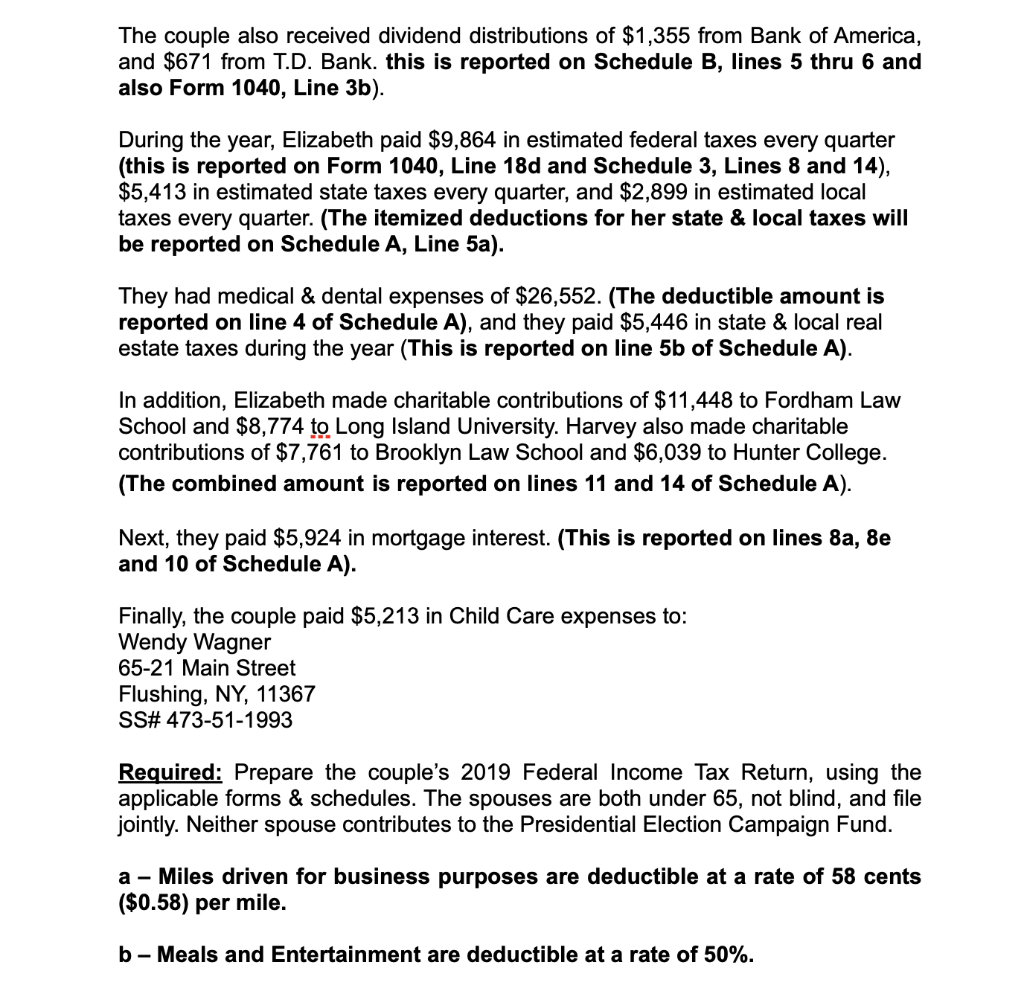

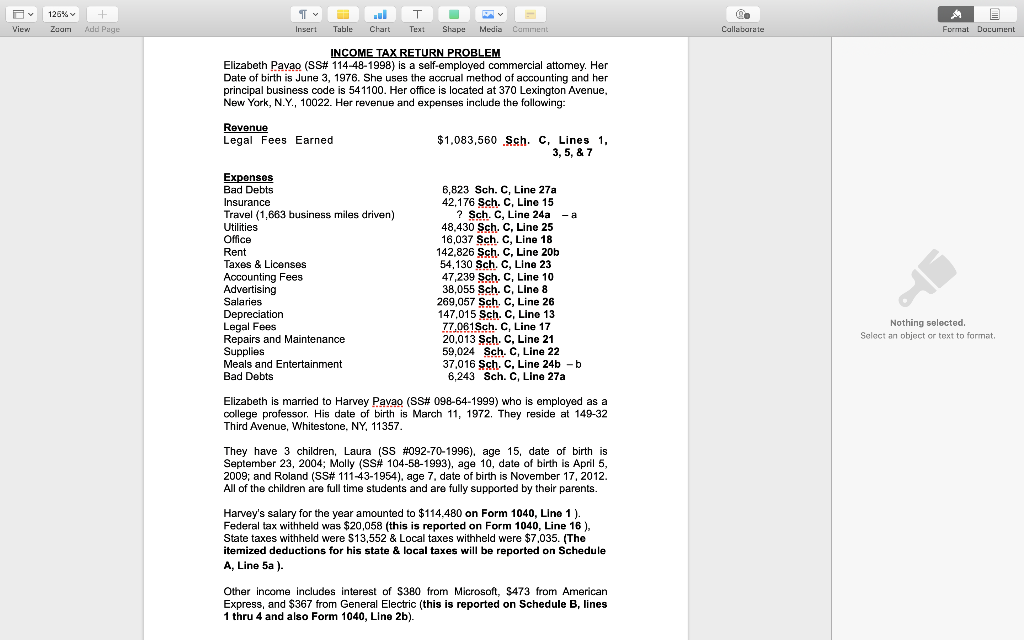

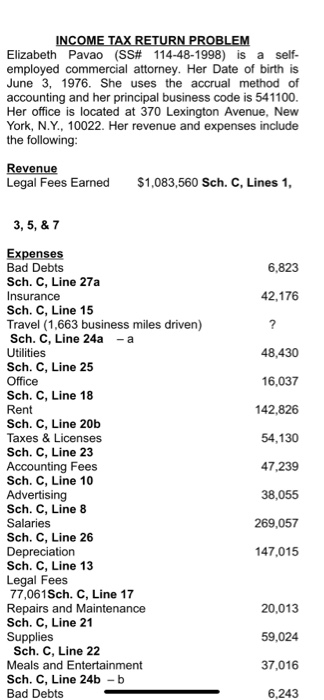

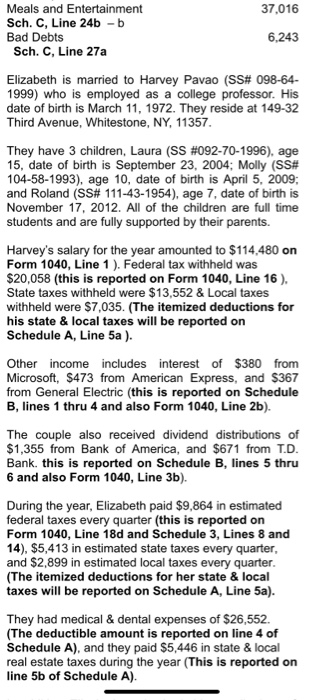

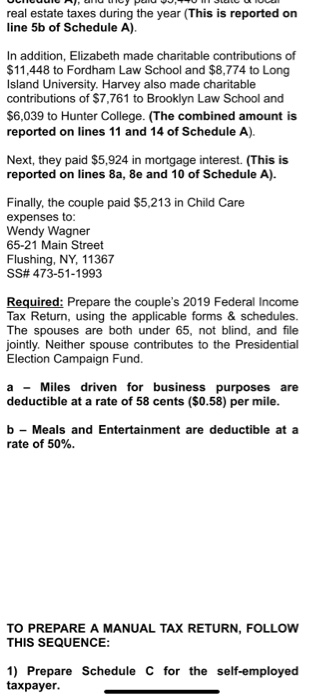

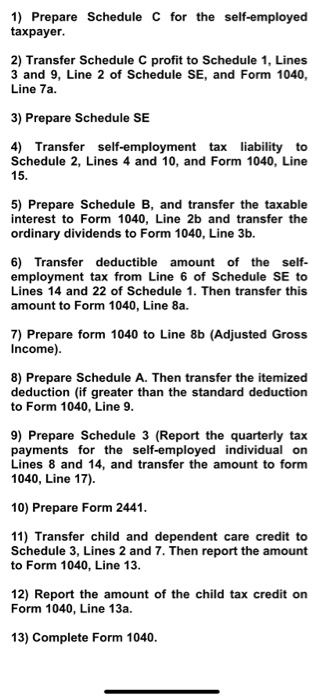

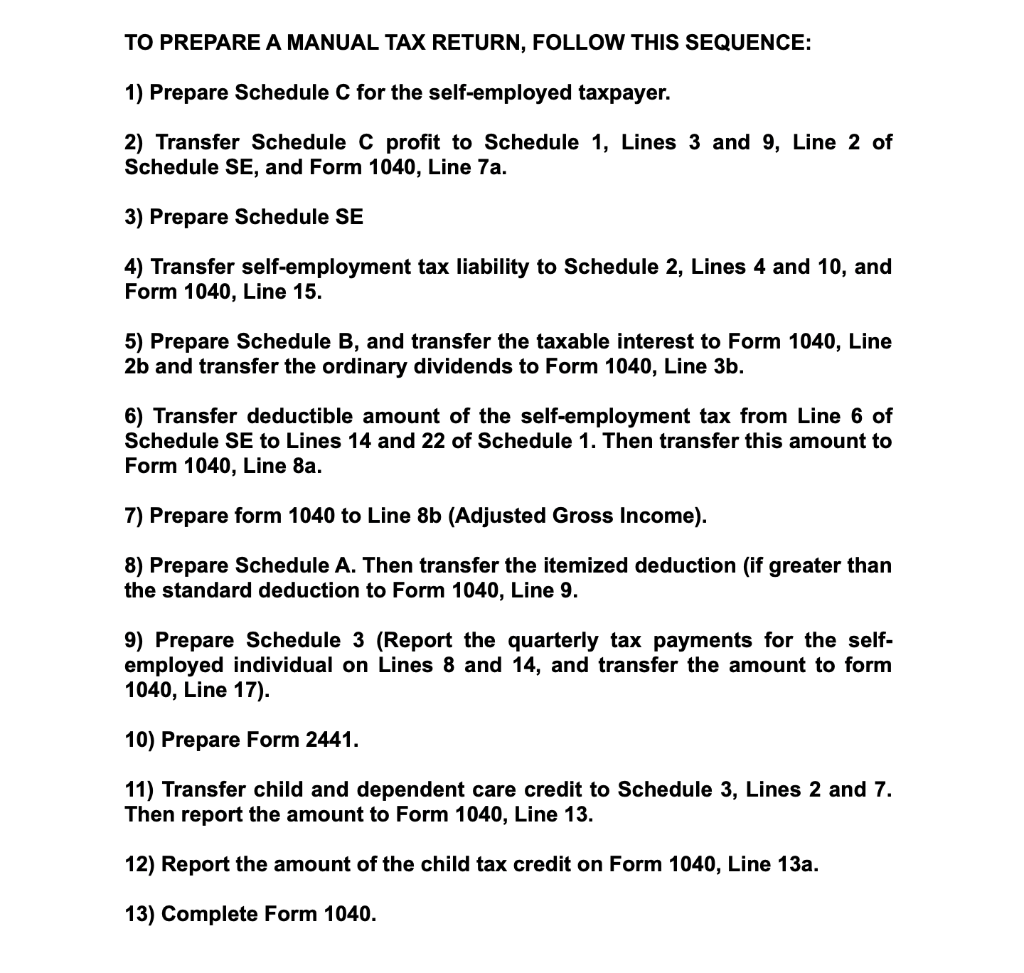

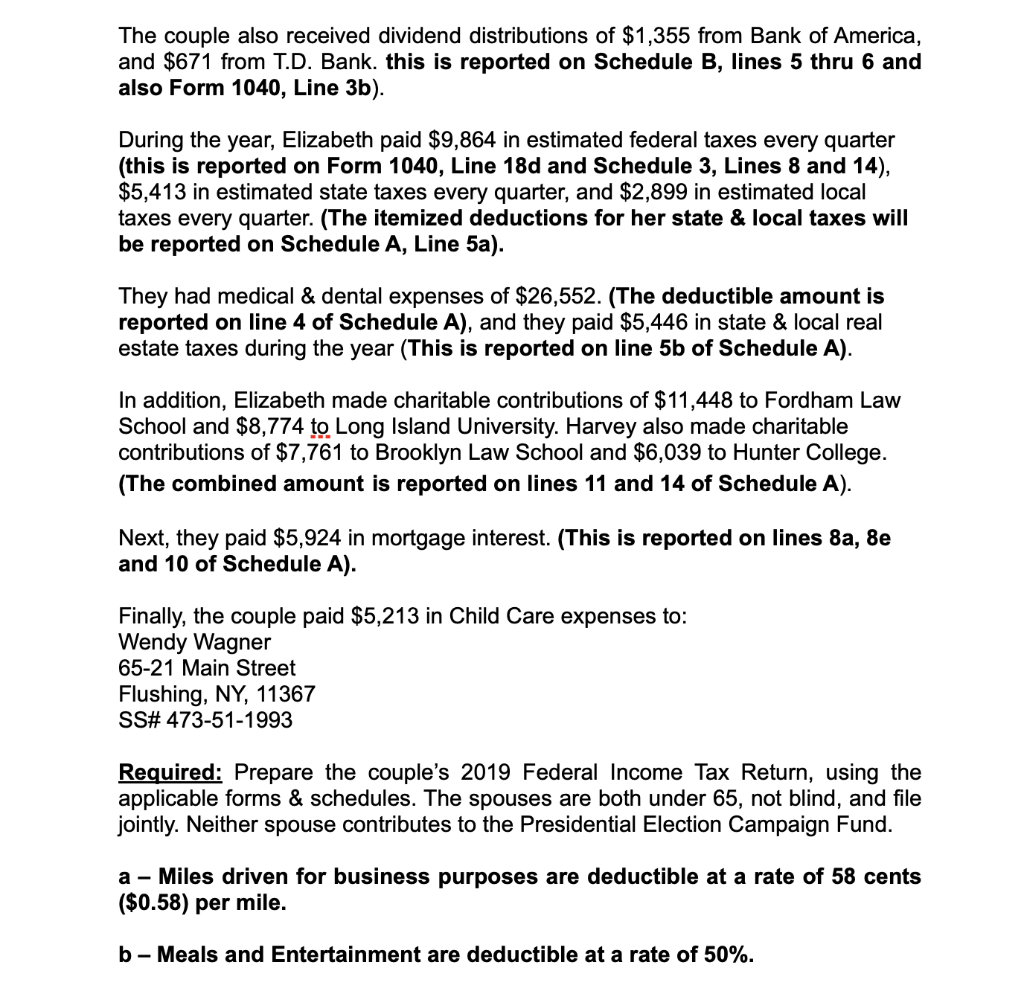

TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self-employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self- employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. 13) Complete Form 1040. The couple also received dividend distributions of $1,355 from Bank of America, and $671 from T.D. Bank. this is reported on Schedule B, lines 5 thru 6 and also Form 1040, Line 3b). During the year, Elizabeth paid $9,864 in estimated federal taxes every quarter (this is reported on Form 1040, Line 18d and Schedule 3, Lines 8 and 14), $5,413 in estimated state taxes every quarter, and $2,899 in estimated local taxes every quarter. (The itemized deductions for her state & local taxes will be reported on Schedule A, Line 5a). They had medical & dental expenses of $26,552. (The deductible amount is reported on line 4 of Schedule A), and they paid $5,446 in state & local real estate taxes during the year (This is reported on line 5b of Schedule A). In addition, Elizabeth made charitable contributions of $11,448 to Fordham Law School and $8,774 to Long Island University. Harvey also made charitable contributions of $7,761 to Brooklyn Law School and $6,039 to Hunter College. (The combined amount is reported on lines 11 and 14 of Schedule A). Next, they paid $5,924 in mortgage interest. (This is reported on lines 8a, 8e and 10 of Schedule A). Finally, the couple paid $5,213 in Child Care expenses to: Wendy Wagner 65-21 Main Street Flushing, NY, 11367 SS# 473-51-1993 Required: Prepare the couple's 2019 Federal Income Tax Return, using the applicable forms & schedules. The spouses are both under 65, not blind, and file jointly. Neither spouse contributes to the Presidential Election Campaign Fund. a - Miles driven for business purposes are deductible at a rate of 58 cents ($0.58) per mile. b - Meals and Entertainment are deductible at a rate of 50%. 126% Zaam + Add Page Tv Insert ul Chart T Text View Table Shape Media Comment Collaborate Format Document INCOME TAX RETURN PROBLEM Elizabeth Pavao (SS# 114-48-1998) is a self-employed commercial attomey. Her Date of birth is June 3, 1976. She uses the accrual method of accounting and her principal business code is 541100. Her office is located at 370 Lexington Avenue, New York, N.Y., 10022. Her revenue and expenses include the following: Revenue Legal Fees Earned $1,083,560 Sch. C, Lines 1, 3, 5, & 7 Expenses Bad Debts Insurance Travel (1,663 business miles driven) Utilities Office Rent Taxes & Licenses Accounting Fees Advertising Salaries Depreciation Legal Fees Repairs and Maintenance Supplies Meals and Entertainment Bad Debts 6,823 Sch. C, Line 27a 42,176 Sch. C, Line 15 ? Sch. C, Line 24a -a 48.430 Sch. C, Line 25 16,037 Sch. C, Line 18 142,826 Sch. C, Line 20b 54,130 Sch. C, Line 23 47,239 Sch. C, Line 10 38,055 Sch. C, Line 8 269,057 Sch. C, Line 26 147,015 Sch. C, Line 13 77,081Sch. C, Line 17 20,013 Sch. C, Line 21 59,024 Sch. C, Line 22 37,016 Sch. C, Line 24b-b 6,243 Sch. C, Line 27a Nothing selected. Select an object or text to format Elizabeth is married to Harvey Pavao (SS# 098-64-1999) who is employed as a college professor. His date of birth is March 11, 1972. They reside at 149-32 Third Avenue, Whitestone, NY, 11357. They have 3 children, Laura (SS #092-70-1996), age 15, date of birth is September 23, 2004; Molly (SS# 104-58-1993), age 10, date of birth is April 5, 2009; and Roland (SS# 111-43-1954), age 7, date of birth is November 17, 2012. All of the children are full time students and are fully supported by their parents. Harvey's salary for the year amounted to $114.480 on Form 1040, Line 1). Federal tax withheld was $20,058 (this is reported on Form 1040, Line 16), State taxes withheld were $13,552 & Local taxes withheld were $7,035. (The itemized deductions for his state & local taxes will be reported on Schedule A, Line 5a). Other income includes interest of $380 from Microsoft, $473 from American Express, and $367 from General Electric (this is reported on Schedule B, lines 1 thru 4 and also Form 1040, Line 2b). INCOME TAX RETURN PROBLEM Elizabeth Pavao (SS# 114-48-1998) is a self- employed commercial attorney. Her Date of birth is June 3, 1976. She uses the accrual method of accounting and her principal business code is 541100. Her office is located at 370 Lexington Avenue, New York, N.Y., 10022. Her revenue and expenses include the following: Revenue Legal Fees Earned $1,083,560 Sch. C, Lines 1, 3, 5, & 7 6,823 42,176 48,430 16,037 142,826 54,130 47,239 Expenses Bad Debts Sch. C, Line 27a Insurance Sch. C, Line 15 Travel (1,663 business miles driven) Sch. C, Line 24a -a Utilities Sch. C, Line 25 Office Sch. C, Line 18 Rent Sch. C, Line 20b Taxes & Licenses Sch. C, Line 23 Accounting Fees Sch. C, Line 10 Advertising Sch. C, Line 8 Salaries Sch. C, Line 26 Depreciation Sch. C, Line 13 Legal Fees 77,061 Sch. C, Line 17 Repairs and Maintenance Sch. C, Line 21 Supplies Sch. C, Line 22 Meals and Entertainment Sch. C, Line 24b-b Bad Debts 38,055 269,057 147,015 20,013 59,024 37,016 6,243 37,016 Meals and Entertainment Sch. C, Line 24b-b Bad Debts Sch. C, Line 27a 6,243 Elizabeth is married to Harvey Pavao (SS# 098-64- 1999) who is employed as a college professor. His date of birth is March 11, 1972. They reside at 149-32 Third Avenue, Whitestone, NY, 11357. They have 3 children, Laura (SS #092-70-1996). age 15, date of birth is September 23, 2004; Molly (SS# 104-58-1993), age 10, date of birth is April 5, 2009; and Roland (SS# 111-43-1954), age 7, date of birth is November 17, 2012. All of the children are full time students and are fully supported by their parents. Harvey's salary for the year amounted to $114,480 on Form 1040, Line 1 ). Federal tax withheld was $20,058 (this is reported on Form 1040, Line 16 ). State taxes withheld were $13,552 & Local taxes withheld were $7,035. (The itemized deductions for his state & local taxes will be reported on Schedule A, Line 5a). Other income includes interest of $380 from Microsoft, $473 from American Express, and $367 from General Electric (this is reported on Schedule B, lines 1 thru 4 and also Form 1040, Line 2b). The couple also received dividend distributions of $1,355 from Bank of America, and $671 from T.D. Bank this is reported on Schedule B, lines 5 thru 6 and also Form 1040, Line 3b). During the year, Elizabeth paid $9,864 in estimated federal taxes every quarter (this is reported on Form 1040, Line 18d and Schedule 3, Lines 8 and 14), $5,413 in estimated state taxes every quarter, and $2,899 in estimated local taxes every quarter. (The itemized deductions for her state & local taxes will be reported on Schedule A, Line 5a). They had medical & dental expenses of $26,552. (The deductible amount is reported on line 4 of Schedule A), and they paid $5,446 in state & local real estate taxes during the year (This is reported on line 5b of Schedule A). ULTUUR LICY Peru UUTUH JLCC real estate taxes during the year (This is reported on line 5b of Schedule A). In addition, Elizabeth made charitable contributions of $11,448 to Fordham Law School and $8,774 to Long Island University. Harvey also made charitable contributions of $7,761 to Brooklyn Law School and $6,039 to Hunter College. (The combined amount is reported on lines 11 and 14 of Schedule A). Next, they paid $5,924 in mortgage interest. (This is reported on lines 8a, 8e and 10 of Schedule A). Finally, the couple paid $5,213 in Child Care expenses to: Wendy Wagner 65-21 Main Street Flushing, NY, 11367 SS# 473-51-1993 Required: Prepare the couple's 2019 Federal Income Tax Return, using the applicable forms & schedules The spouses are both under 65, not blind, and file jointly. Neither spouse contributes to the Presidential Election Campaign Fund. a - Miles driven for business purposes are deductible at a rate of 58 cents ($0.58) per mile. b - Meals and Entertainment are deductible at a rate of 50% TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: for the self-employed 1) Prepare Schedule taxpayer. TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self- employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self-employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self- employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self-employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self- employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self-employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. 13) Complete Form 1040. TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self-employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self- employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. 13) Complete Form 1040. The couple also received dividend distributions of $1,355 from Bank of America, and $671 from T.D. Bank. this is reported on Schedule B, lines 5 thru 6 and also Form 1040, Line 3b). During the year, Elizabeth paid $9,864 in estimated federal taxes every quarter (this is reported on Form 1040, Line 18d and Schedule 3, Lines 8 and 14), $5,413 in estimated state taxes every quarter, and $2,899 in estimated local taxes every quarter. (The itemized deductions for her state & local taxes will be reported on Schedule A, Line 5a). They had medical & dental expenses of $26,552. (The deductible amount is reported on line 4 of Schedule A), and they paid $5,446 in state & local real estate taxes during the year (This is reported on line 5b of Schedule A). In addition, Elizabeth made charitable contributions of $11,448 to Fordham Law School and $8,774 to Long Island University. Harvey also made charitable contributions of $7,761 to Brooklyn Law School and $6,039 to Hunter College. (The combined amount is reported on lines 11 and 14 of Schedule A). Next, they paid $5,924 in mortgage interest. (This is reported on lines 8a, 8e and 10 of Schedule A). Finally, the couple paid $5,213 in Child Care expenses to: Wendy Wagner 65-21 Main Street Flushing, NY, 11367 SS# 473-51-1993 Required: Prepare the couple's 2019 Federal Income Tax Return, using the applicable forms & schedules. The spouses are both under 65, not blind, and file jointly. Neither spouse contributes to the Presidential Election Campaign Fund. a - Miles driven for business purposes are deductible at a rate of 58 cents ($0.58) per mile. b - Meals and Entertainment are deductible at a rate of 50%. 126% Zaam + Add Page Tv Insert ul Chart T Text View Table Shape Media Comment Collaborate Format Document INCOME TAX RETURN PROBLEM Elizabeth Pavao (SS# 114-48-1998) is a self-employed commercial attomey. Her Date of birth is June 3, 1976. She uses the accrual method of accounting and her principal business code is 541100. Her office is located at 370 Lexington Avenue, New York, N.Y., 10022. Her revenue and expenses include the following: Revenue Legal Fees Earned $1,083,560 Sch. C, Lines 1, 3, 5, & 7 Expenses Bad Debts Insurance Travel (1,663 business miles driven) Utilities Office Rent Taxes & Licenses Accounting Fees Advertising Salaries Depreciation Legal Fees Repairs and Maintenance Supplies Meals and Entertainment Bad Debts 6,823 Sch. C, Line 27a 42,176 Sch. C, Line 15 ? Sch. C, Line 24a -a 48.430 Sch. C, Line 25 16,037 Sch. C, Line 18 142,826 Sch. C, Line 20b 54,130 Sch. C, Line 23 47,239 Sch. C, Line 10 38,055 Sch. C, Line 8 269,057 Sch. C, Line 26 147,015 Sch. C, Line 13 77,081Sch. C, Line 17 20,013 Sch. C, Line 21 59,024 Sch. C, Line 22 37,016 Sch. C, Line 24b-b 6,243 Sch. C, Line 27a Nothing selected. Select an object or text to format Elizabeth is married to Harvey Pavao (SS# 098-64-1999) who is employed as a college professor. His date of birth is March 11, 1972. They reside at 149-32 Third Avenue, Whitestone, NY, 11357. They have 3 children, Laura (SS #092-70-1996), age 15, date of birth is September 23, 2004; Molly (SS# 104-58-1993), age 10, date of birth is April 5, 2009; and Roland (SS# 111-43-1954), age 7, date of birth is November 17, 2012. All of the children are full time students and are fully supported by their parents. Harvey's salary for the year amounted to $114.480 on Form 1040, Line 1). Federal tax withheld was $20,058 (this is reported on Form 1040, Line 16), State taxes withheld were $13,552 & Local taxes withheld were $7,035. (The itemized deductions for his state & local taxes will be reported on Schedule A, Line 5a). Other income includes interest of $380 from Microsoft, $473 from American Express, and $367 from General Electric (this is reported on Schedule B, lines 1 thru 4 and also Form 1040, Line 2b). INCOME TAX RETURN PROBLEM Elizabeth Pavao (SS# 114-48-1998) is a self- employed commercial attorney. Her Date of birth is June 3, 1976. She uses the accrual method of accounting and her principal business code is 541100. Her office is located at 370 Lexington Avenue, New York, N.Y., 10022. Her revenue and expenses include the following: Revenue Legal Fees Earned $1,083,560 Sch. C, Lines 1, 3, 5, & 7 6,823 42,176 48,430 16,037 142,826 54,130 47,239 Expenses Bad Debts Sch. C, Line 27a Insurance Sch. C, Line 15 Travel (1,663 business miles driven) Sch. C, Line 24a -a Utilities Sch. C, Line 25 Office Sch. C, Line 18 Rent Sch. C, Line 20b Taxes & Licenses Sch. C, Line 23 Accounting Fees Sch. C, Line 10 Advertising Sch. C, Line 8 Salaries Sch. C, Line 26 Depreciation Sch. C, Line 13 Legal Fees 77,061 Sch. C, Line 17 Repairs and Maintenance Sch. C, Line 21 Supplies Sch. C, Line 22 Meals and Entertainment Sch. C, Line 24b-b Bad Debts 38,055 269,057 147,015 20,013 59,024 37,016 6,243 37,016 Meals and Entertainment Sch. C, Line 24b-b Bad Debts Sch. C, Line 27a 6,243 Elizabeth is married to Harvey Pavao (SS# 098-64- 1999) who is employed as a college professor. His date of birth is March 11, 1972. They reside at 149-32 Third Avenue, Whitestone, NY, 11357. They have 3 children, Laura (SS #092-70-1996). age 15, date of birth is September 23, 2004; Molly (SS# 104-58-1993), age 10, date of birth is April 5, 2009; and Roland (SS# 111-43-1954), age 7, date of birth is November 17, 2012. All of the children are full time students and are fully supported by their parents. Harvey's salary for the year amounted to $114,480 on Form 1040, Line 1 ). Federal tax withheld was $20,058 (this is reported on Form 1040, Line 16 ). State taxes withheld were $13,552 & Local taxes withheld were $7,035. (The itemized deductions for his state & local taxes will be reported on Schedule A, Line 5a). Other income includes interest of $380 from Microsoft, $473 from American Express, and $367 from General Electric (this is reported on Schedule B, lines 1 thru 4 and also Form 1040, Line 2b). The couple also received dividend distributions of $1,355 from Bank of America, and $671 from T.D. Bank this is reported on Schedule B, lines 5 thru 6 and also Form 1040, Line 3b). During the year, Elizabeth paid $9,864 in estimated federal taxes every quarter (this is reported on Form 1040, Line 18d and Schedule 3, Lines 8 and 14), $5,413 in estimated state taxes every quarter, and $2,899 in estimated local taxes every quarter. (The itemized deductions for her state & local taxes will be reported on Schedule A, Line 5a). They had medical & dental expenses of $26,552. (The deductible amount is reported on line 4 of Schedule A), and they paid $5,446 in state & local real estate taxes during the year (This is reported on line 5b of Schedule A). ULTUUR LICY Peru UUTUH JLCC real estate taxes during the year (This is reported on line 5b of Schedule A). In addition, Elizabeth made charitable contributions of $11,448 to Fordham Law School and $8,774 to Long Island University. Harvey also made charitable contributions of $7,761 to Brooklyn Law School and $6,039 to Hunter College. (The combined amount is reported on lines 11 and 14 of Schedule A). Next, they paid $5,924 in mortgage interest. (This is reported on lines 8a, 8e and 10 of Schedule A). Finally, the couple paid $5,213 in Child Care expenses to: Wendy Wagner 65-21 Main Street Flushing, NY, 11367 SS# 473-51-1993 Required: Prepare the couple's 2019 Federal Income Tax Return, using the applicable forms & schedules The spouses are both under 65, not blind, and file jointly. Neither spouse contributes to the Presidential Election Campaign Fund. a - Miles driven for business purposes are deductible at a rate of 58 cents ($0.58) per mile. b - Meals and Entertainment are deductible at a rate of 50% TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: for the self-employed 1) Prepare Schedule taxpayer. TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self- employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self-employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. TO PREPARE A MANUAL TAX RETURN, FOLLOW THIS SEQUENCE: 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self- employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self-employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. 1) Prepare Schedule C for the self-employed taxpayer. 2) Transfer Schedule C profit to Schedule 1, Lines 3 and 9, Line 2 of Schedule SE, and Form 1040, Line 7a. 3) Prepare Schedule SE 4) Transfer self-employment tax liability to Schedule 2, Lines 4 and 10, and Form 1040, Line 15. 5) Prepare Schedule B, and transfer the taxable interest to Form 1040, Line 2b and transfer the ordinary dividends to Form 1040, Line 3b. 6) Transfer deductible amount of the self- employment tax from Line 6 of Schedule SE to Lines 14 and 22 of Schedule 1. Then transfer this amount to Form 1040, Line 8a. 7) Prepare form 1040 to Line 8b (Adjusted Gross Income). 8) Prepare Schedule A. Then transfer the itemized deduction (if greater than the standard deduction to Form 1040, Line 9. 9) Prepare Schedule 3 (Report the quarterly tax payments for the self-employed individual on Lines 8 and 14, and transfer the amount to form 1040, Line 17). 10) Prepare Form 2441. 11) Transfer child and dependent care credit to Schedule 3, Lines 2 and 7. Then report the amount to Form 1040, Line 13. 12) Report the amount of the child tax credit on Form 1040, Line 13a. 13) Complete Form 1040