Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To properly calculate the Weighted Average Cost of Capital (WACC) you need to know several things. One of which would be the target capital

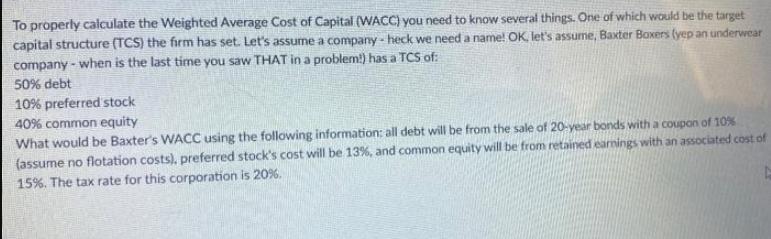

To properly calculate the Weighted Average Cost of Capital (WACC) you need to know several things. One of which would be the target capital structure (TCS) the firm has set. Let's assume a company - heck we need a name! OK let's assume, Baxter Boxers (yep an underwear company - when is the last time you saw THAT in a problem!) has a TCS of: 50% debt 10% preferred stock 40% common equity What would be Baxter's WACC using the following information: all debt will be from the sale of 20-year bonds with a coupon of 10% (assume no flotation costs), preferred stock's cost will be 13%, and common equity will be from retained earmings with an associated cost of 15%. The tax rate for this corporation is 20%.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

For calculating WACC we need the weights of the each source of funding and their respecti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started