Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To see how we might calculate the discounted payback period, suppose we require a 12.5 percent return on new investments. We have an investment

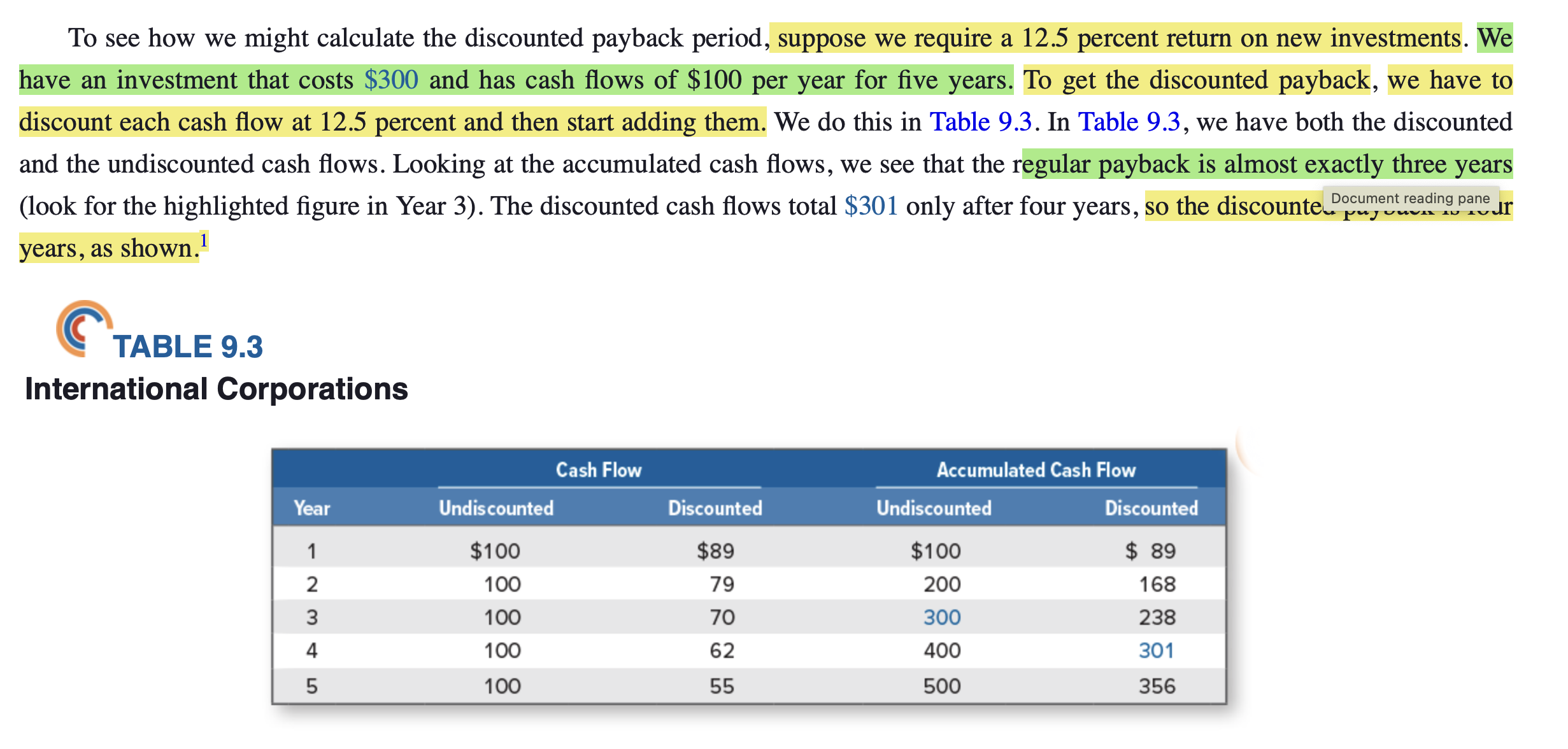

To see how we might calculate the discounted payback period, suppose we require a 12.5 percent return on new investments. We have an investment that costs $300 and has cash flows of $100 per year for five years. To get the discounted payback, we have to discount each cash flow at 12.5 percent and then start adding them. We do this in Table 9.3. In Table 9.3, we have both the discounted and the undiscounted cash flows. Looking at the accumulated cash flows, we see that the regular payback is almost exactly three years (look for the highlighted figure in Year 3). The discounted cash flows total $301 only after four years, so the discounte years, as shown. Document reading pane puyoun TABLE 9.3 International Corporations Cash Flow Accumulated Cash Flow Year Undiscounted Discounted Undiscounted Discounted 12345 $100 $89 $100 $ 89 2 100 79 200 168 100 70 300 238 100 62 400 301 100 55 500 356

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started