Question

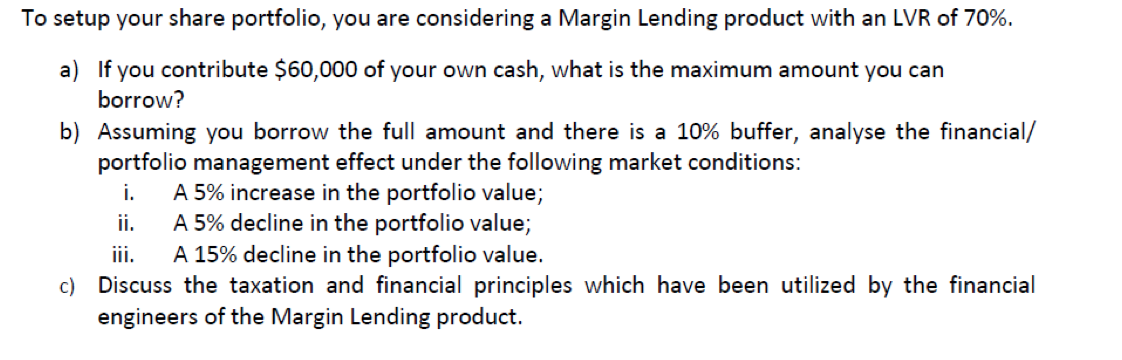

To setup your share portfolio, you are considering a Margin Lending product with an LVR of 70%. a) If you contribute $60,000 of your

To setup your share portfolio, you are considering a Margin Lending product with an LVR of 70%. a) If you contribute $60,000 of your own cash, what is the maximum amount you can borrow? b) Assuming you borrow the full amount and there is a 10% buffer, analyse the financial/ portfolio management effect under the following market conditions: i. A 5% increase in the portfolio value; ii. A 5% decline in the portfolio value; iii. A 15% decline in the portfolio value. c) Discuss the taxation and financial principles which have been utilized by the financial engineers of the Margin Lending product.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Margin Loan Analysis a Maximum Borrowable Amount With a 70 LVR and your 60000 contribution the maxim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elements Of Chemical Reaction Engineering

Authors: H. Fogler

6th Edition

013548622X, 978-0135486221

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App