Question

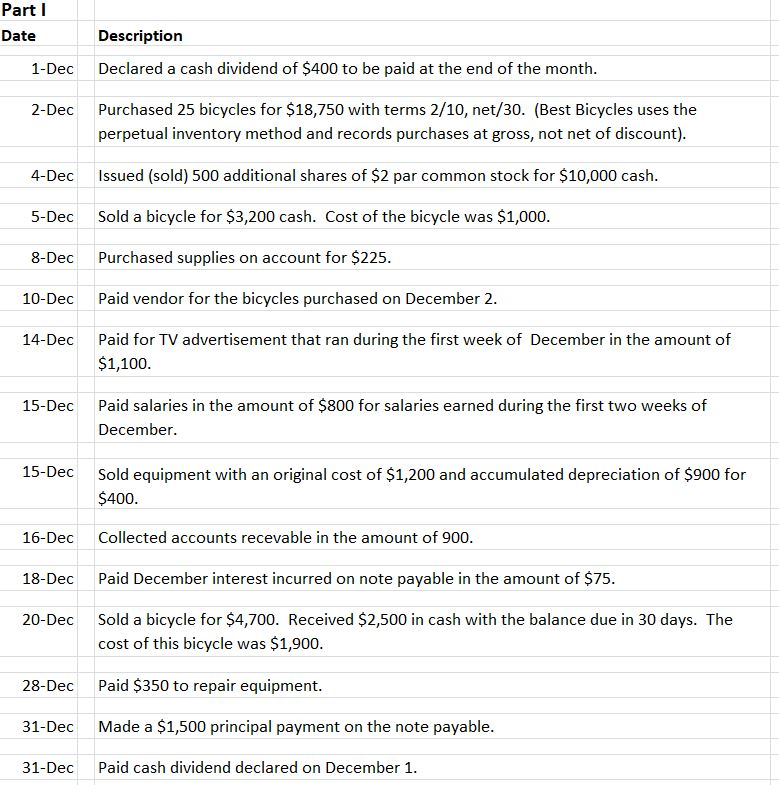

To start this project, go to the Transactions tab and prepare journal entries to record each of the Part I transactions. Record each Part I

To start this project, go to the Transactions tab and prepare journal entries to record each of the Part I transactions. Record each Part I journal entry on the General Journal tab

Hey, Chegg I really need some help in my accounting class. The transactions are in the photo, and the instructions and list of available accounts are posted. Essentially this is for creating a general journal. Normally this would be fairly easy, but there are a few new types of transactions and I really want to make sure I do this correctly.

Accounts

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Inventory Equipment

Accumulated Depreciation Equipment

Accounts Payable

Salaries Payable

Dividends Payable

Income Taxes Payable

Note Payable

Common Stock

Additional Paid In Capital

Retained Earnings

Dividends

Bicycle Sales Revenue

Cost of Goods Sold

Advertising Expense

Salaries Expense

Supplies Expense

Interest Expense

Insurance Expense

Depreciation Expense

Income Taxes Expense

Gain on Sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started