Answered step by step

Verified Expert Solution

Question

1 Approved Answer

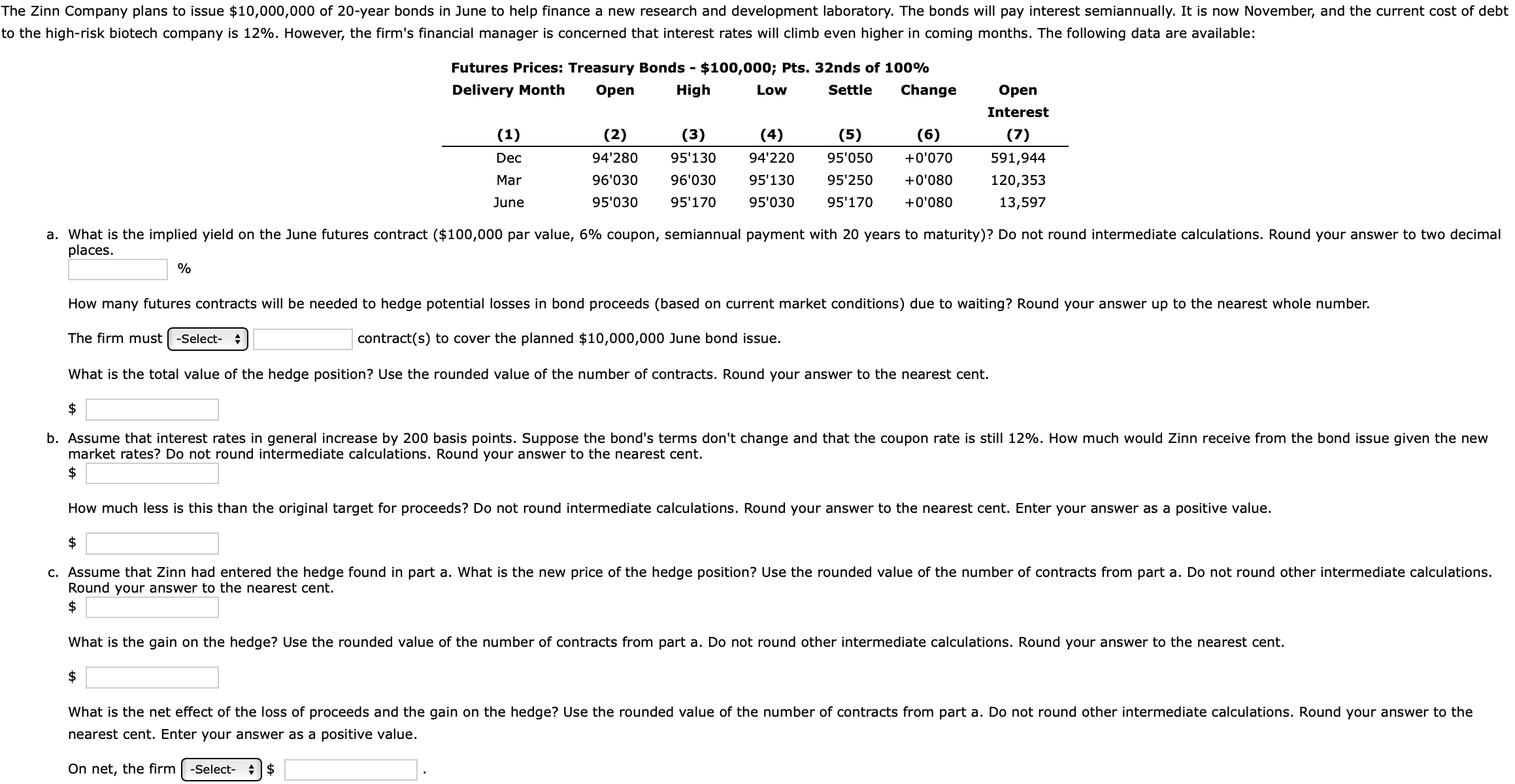

to the high - risk biotech company is 1 2 % . However, the firm's financial manager is concerned that interest rates will climb even

to the highrisk biotech company is However, the firm's financial manager is concerned that interest rates will climb even higher in coming months. The following data are available:

places.

The firm must contracts to cover the planned $ June bond issue.

What is the total value of the hedge position? Use the rounded value of the number of contracts. Round your answer to the nearest cent.

$

market rates? Do not round intermediate calculations. Round your answer to the nearest cent.

$

How much less is this than the original target for proceeds? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value.

$

Round vour ancwer to the nearest cent.

$

What is the gain on the hedge? Use the rounded value of the number of contracts from part a Do not round other intermediate calculations. Round your answer to the nearest cent.

$

nearest cent. Enter your answer as a positive value.

On net, the firm

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started