Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To the right of the journal entry template is the payroll register for Darma Fine Foods for the biweekly pay period ending March 4.

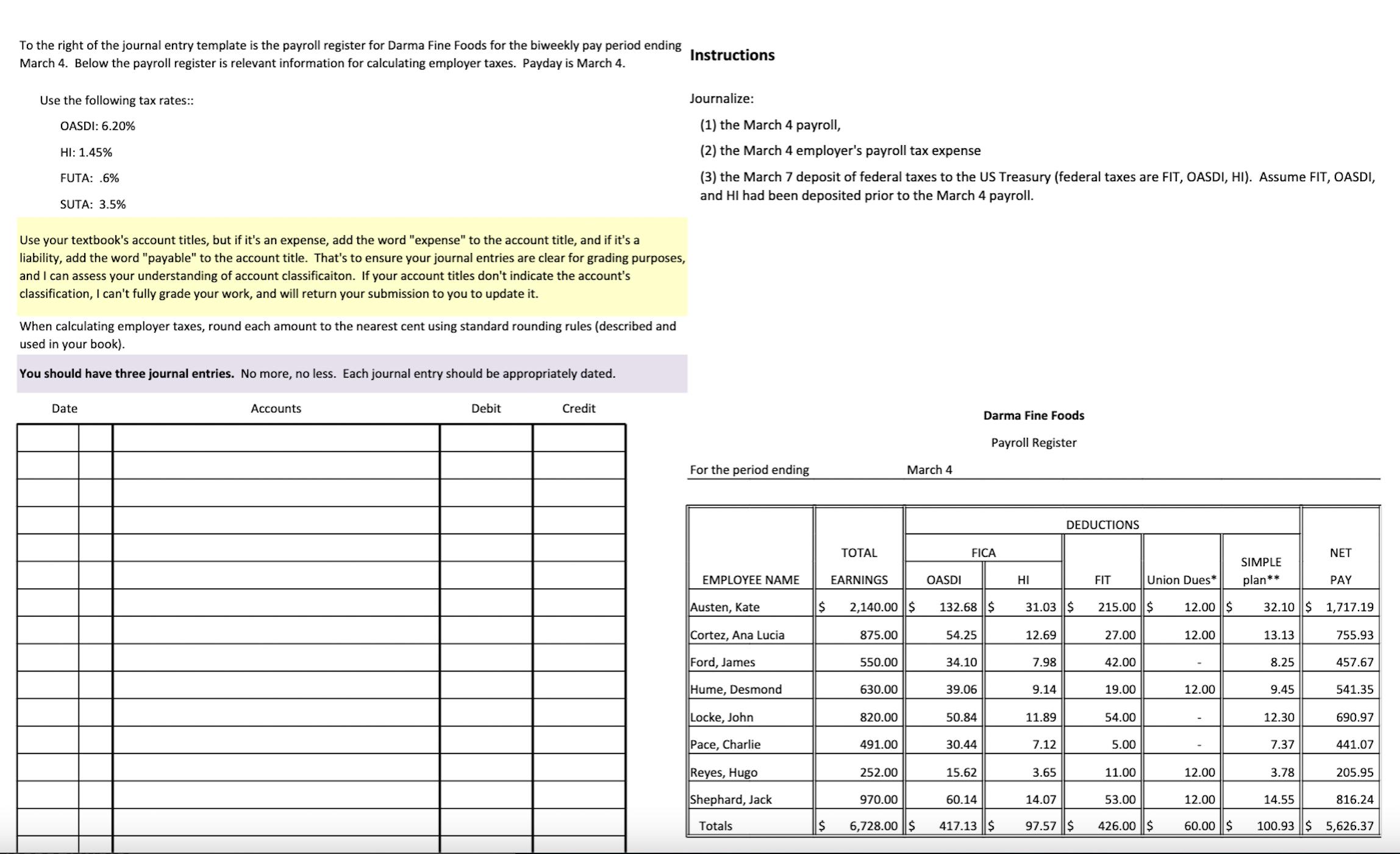

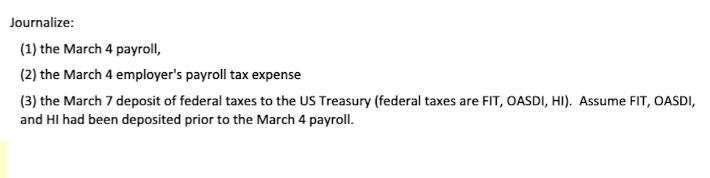

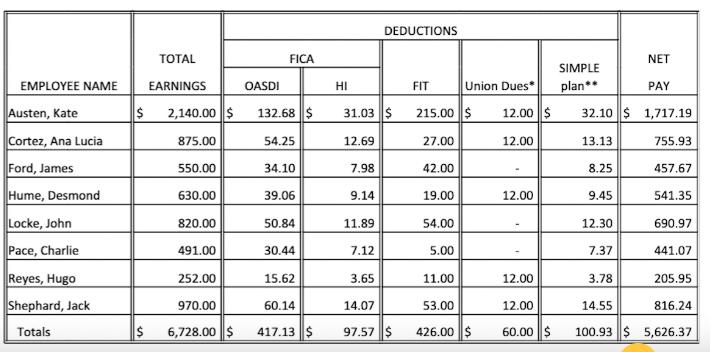

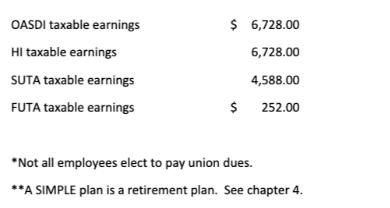

To the right of the journal entry template is the payroll register for Darma Fine Foods for the biweekly pay period ending March 4. Below the payroll register is relevant information for calculating employer taxes. Payday is March 4. Use the following tax rates:: OASDI: 6.20% HI: 1.45% FUTA: .6% SUTA: 3.5% Use your textbook's account titles, but if it's an expense, add the word "expense" to the account title, and if it's a liability, add the word "payable" to the account title. That's to ensure your journal entries are clear for grading purposes, and I can assess your understanding of account classificaiton. If your account titles don't indicate the account's classification, I can't fully grade your work, and will return your submission to you to update it. When calculating employer taxes, round each amount to the nearest cent using standard rounding rules (described and used in your book). You should have three journal entries. No more, no less. Each journal entry should be appropriately dated. Date Accounts Debit Credit Instructions Journalize: (1) the March 4 payroll, (2) the March 4 employer's payroll tax expense (3) the March 7 deposit of federal taxes to the US Treasury (federal taxes are FIT, OASDI, HI). Assume FIT, OASDI, and HI had been deposited prior to the March 4 payroll. For the period ending EMPLOYEE NAME Austen, Kate Cortez, Ana Lucia Ford, James Hume, Desmond Locke, John Pace, Charlie Reyes, Hugo Shephard, Jack Totals $ $ TOTAL EARNINGS 2,140.00 $ 875.00 550.00 630.00 820.00 491.00 252.00 March 4 970.00 OASDI FICA 132.68 $ 54.25 34.10 39.06 50.84 Darma Fine Foods Payroll Register 30.44 15.62 60.14 6,728.00 $ 417.13 $ HI 31.03 $ 12.69 7.98 9.14 11.89 7.12 DEDUCTIONS 3.65 14.07 97.57 $ FIT 215.00 $ 27.00 42.00 19.00 54.00 5.00 Union Dues* 11.00 53.00 426.00 $ 12.00 $ 12.00 12.00 12.00 12.00 60.00 $ SIMPLE plan** 32.10 $ 1,717.19 13.13 8.25 9.45 12.30 NET 7.37 PAY 755.93 457.67 541.35 690.97 441.07 3.78 14.55 100.93 $ 5,626.37 205.95 816.24 Use the following tax rates:: OASDI: 6.20% HI: 1.45% FUTA: .6% SUTA: 3.5% Journalize: (1) the March 4 payroll, (2) the March 4 employer's payroll tax expense (3) the March 7 deposit of federal taxes to the US Treasury (federal taxes are FIT, OASDI, HI). Assume FIT, OASDI, and HI had been deposited prior to the March 4 payroll. EMPLOYEE NAME Austen, Kate Cortez, Ana Lucia Ford, James Hume, Desmond Locke, John Pace, Charlie Reyes, Hugo Shephard, Jack Totals TOTAL EARNINGS $ 2,140.00 $ 875.00 550.00 $ 630.00 820.00 491.00 OASDI FICA 132.68 $ 54.25 34.10 39.06 50.84 30.44 252.00 15.62 970.00 60.14 6,728.00 $ 417.13 $ HI 31.03 $ 12.69 7.98 9.14 11.89 7.12 DEDUCTIONS 3.65 14.07 97.57 $ FIT Union Dues* 215.00 $ 12.00 $ 27.00 42.00 19.00 54.00 5.00 11.00 53.00 426.00 $ 12.00 12.00 12.00 12.00 60.00 $ SIMPLE plan** 8.25 32.10 $ 1,717.19 13.13 755.93 457.67 9.45 12.30 7.37 3.78 NET 14.55 PAY 541.35 690.97 441.07 205.95 816.24 100.93 $ 5,626.37 OASDI taxable earnings HI taxable earnings SUTA taxable earnings FUTA taxable earnings $ 6,728.00 6,728.00 4,588.00 $ 252.00 *Not all employees elect to pay union dues. **A SIMPLE plan is a retirement plan. See chapter 4.

Step by Step Solution

★★★★★

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

It looks like youve been given a task to prepare three journal entries related to payroll and payroll taxes Ill guide you through each entry step by step using the provided information and tax rates T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started