To view image larger, right-click and select "open image in new tab"

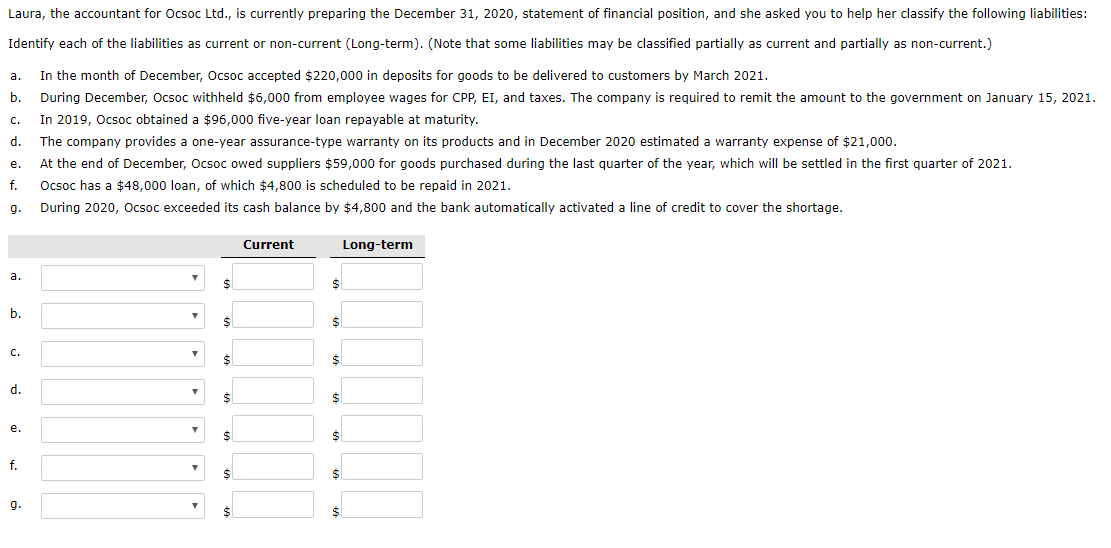

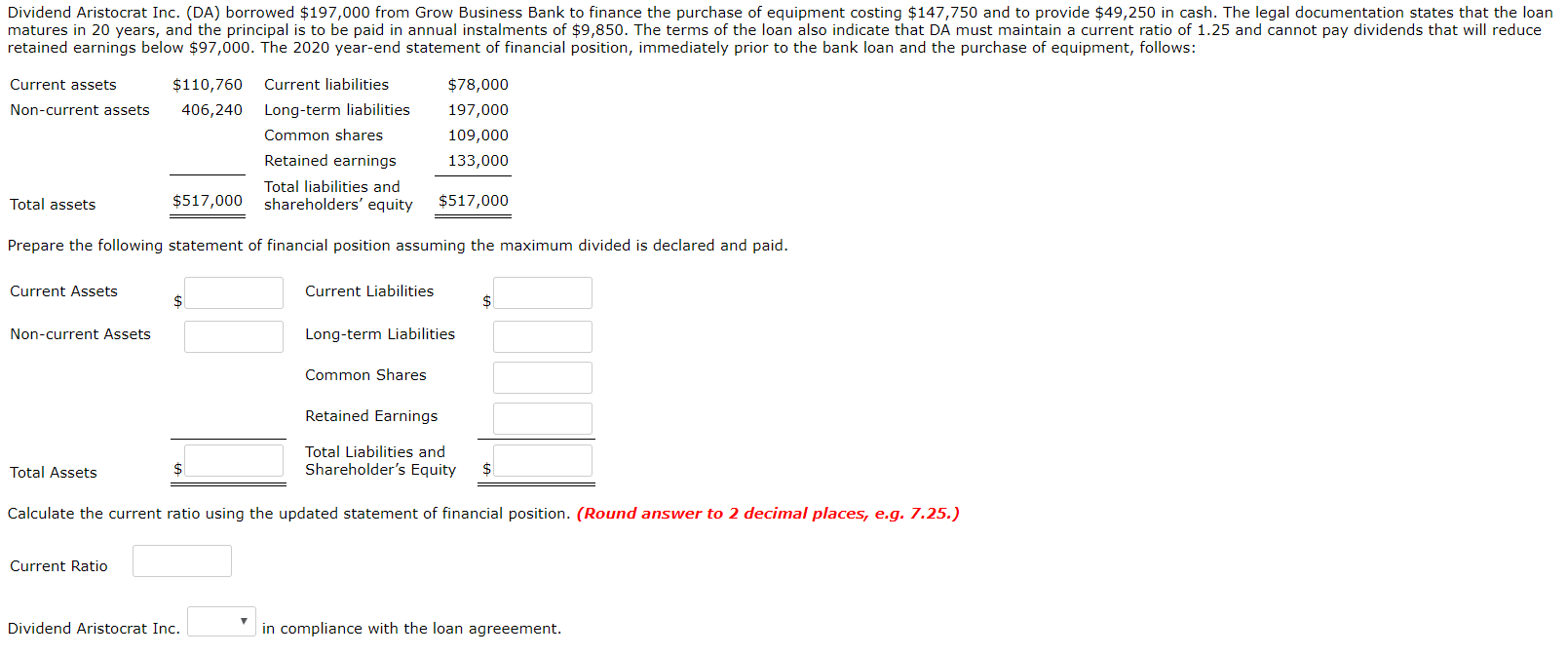

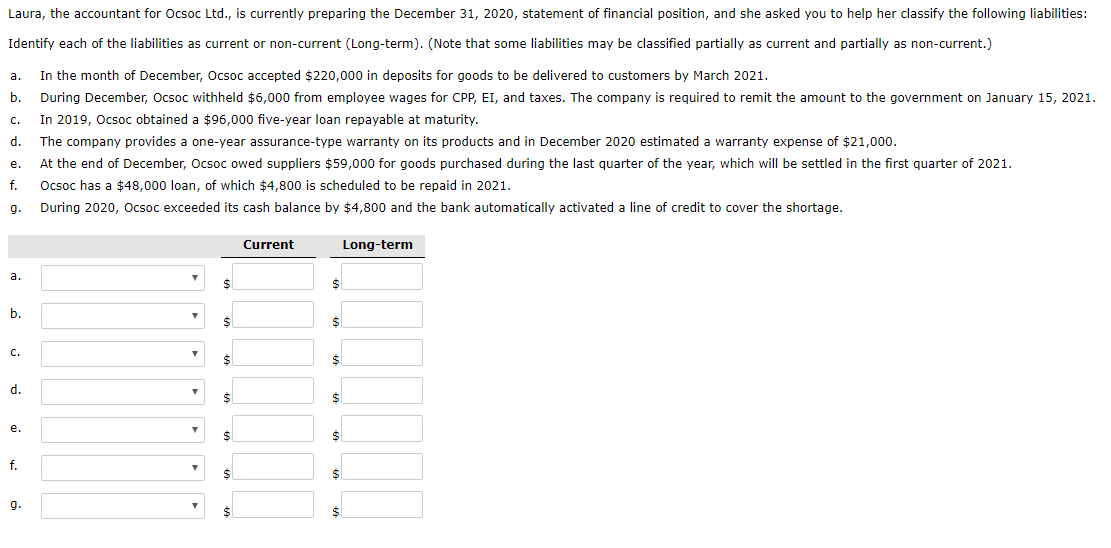

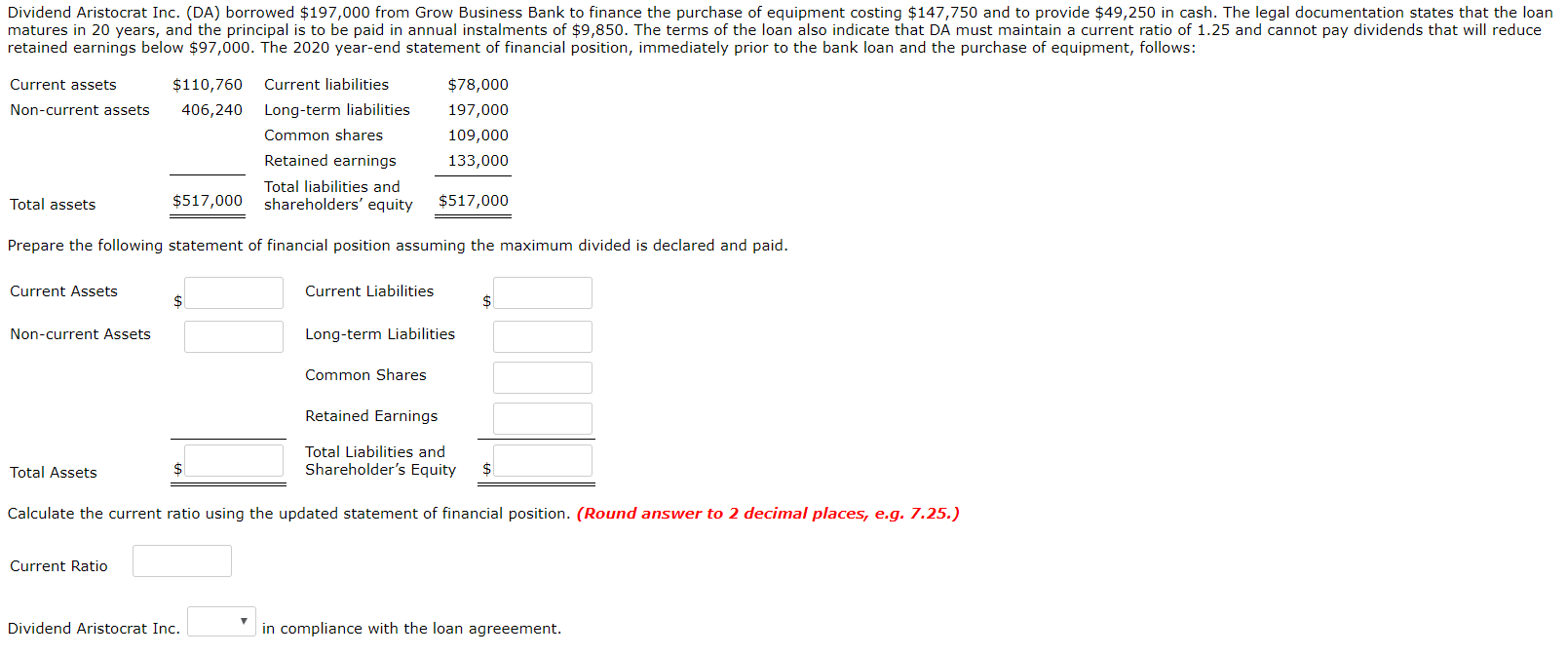

Laura, the accountant for Ocsoc Ltd., is currently preparing the December 31, 2020, statement of financial position, and she asked you to help her classify the following liabilities: Identify each of the liabilities as current or non-current (Long-term). (Note that some liabilities may be classified partially as current and partially as non-current.) a. b. c. d. e. f. 9. In the month of December, Ocsoc accepted $220,000 in deposits for goods to be delivered to customers by March 2021. During December, Ocsoc withheld $6,000 from employee wages for CPP, EI, and taxes. The company is required to remit the amount to the government on January 15, 2021. In 2019, Ocsoc obtained a $96,000 five-year loan repayable at maturity. The company provides a one-year assurance-type warranty on its products and in December 2020 estimated a warranty expense of $21,000. At the end of December, Ocsoc owed suppliers $59,000 for goods purchased during the last quarter of the year, which will be settled in the first quarter of 2021. Ocsoc has a $48,000 loan, of which $4,800 is scheduled to be repaid in 2021. During 2020, Ocsoc exceeded its cash balance by $4,800 and the bank automatically activated a line of credit to cover the shortage. Current Long-term Dividend Aristocrat Inc. (DA) borrowed $197,000 from Grow Business Bank to finance the purchase of equipment costing $147,750 and to provide $49,250 in cash. The legal documentation states that the loan matures in 20 years, and the principal is to be paid in annual instalments of $9,850. The terms of the loan also indicate that DA must maintain a current ratio of 1.25 and cannot pay dividends that will reduce retained earnings below $97,000. The 2020 year-end statement of financial position, immediately prior to the bank loan and the purchase of equipment, follows: Current assets Non-current assets $110,760 406,240 Current liabilities Long-term liabilities Common shares Retained earnings Total liabilities and shareholders' equity $78,000 197,000 109,000 133,000 Total assets 00 $517,000 Prepare the following statement of financial position assuming the maximum divided is declared and paid. Current Assets Current Liabilities Non-current Assets Long-term Liabilities Common Shares Retained Earnings Total Liabilities and Shareholder's Equity Total Assets Calculate the current ratio using the updated statement of financial position. (Round answer to 2 decimal places, e.g. 7.25.) Current Ratio Dividend Aristocrat Inc. in compliance with the loan agreeement