Answered step by step

Verified Expert Solution

Question

1 Approved Answer

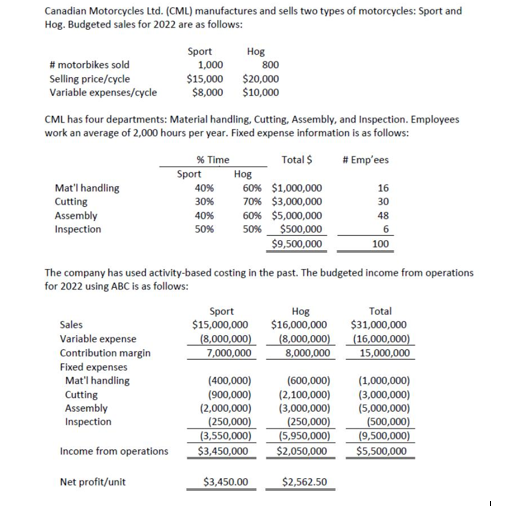

Canadian Motorcycles Ltd. (CML) manufactures and sells two types of motorcycles: Sport and Hog. Budgeted sales for 2022 are as follows: #motorbikes sold Selling

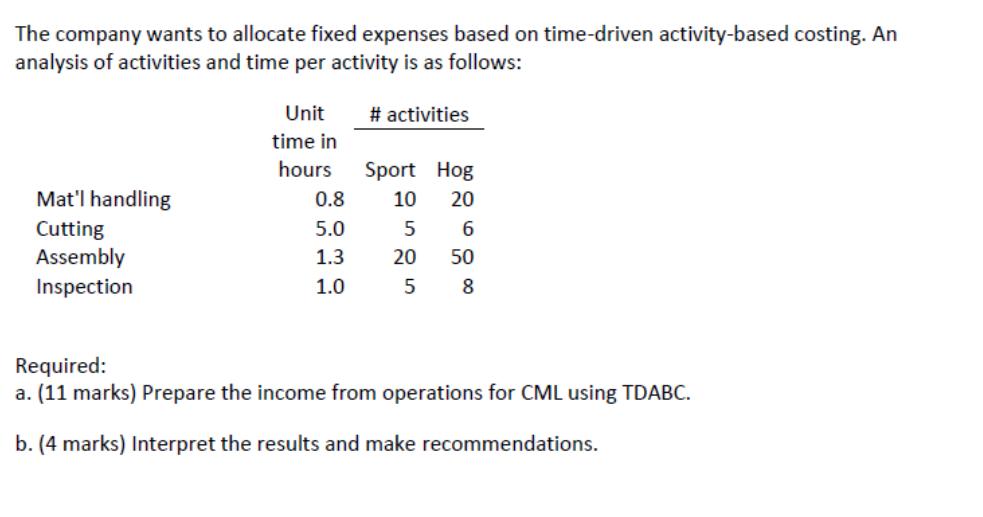

Canadian Motorcycles Ltd. (CML) manufactures and sells two types of motorcycles: Sport and Hog. Budgeted sales for 2022 are as follows: #motorbikes sold Selling price/cycle Variable expenses/cycle Mat'l handling Cutting Assembly Inspection Sales Variable expense Contribution margin Sport CML has four departments: Material handling, Cutting, Assembly, and Inspection. Employees work an average of 2,000 hours per year. Fixed expense information is as follows: Total $ # Emp'ees Fixed expenses Mat'l handling Cutting Assembly Inspection Income from operations 1,000 $15,000 $8,000 Net profit/unit % Time Sport Hog 40% 30% 40% 50% 800 $20,000 $10,000 Hog 60% 70% 60% 50% The company has used activity-based costing in the past. The budgeted income from operations for 2022 using ABC is as follows: Sport $15,000,000 (8,000,000) 7,000,000 $1,000,000 $3,000,000 $5,000,000 $500,000 $9,500,000 $3,450.00 16 30 48 6 100 Hog Total $16,000,000 $31,000,000 (16,000,000) 15,000,000 (8,000,000) 8,000,000 (400,000) (600,000) (900,000) (2,100,000) (2,000,000) (3,000,000) (5,000,000) (250,000) (250,000) (500,000) (3,550,000) (5,950,000) (9,500,000) $3,450,000 $2,050,000 $5,500,000 $2,562.50 (1,000,000) (3,000,000) The company wants to allocate fixed expenses based on time-driven activity-based costing. An analysis of activities and time per activity is as follows: Mat'l handling Cutting Assembly Inspection Unit time in hours 0.8 5.0 1.3 1.0 # activities Sport Hog 10 20 5 6 20 50 5 8 Required: a. (11 marks) Prepare the income from operations for CML using TDABC. b. (4 marks) Interpret the results and make recommendations.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Income from operations using TDABC Sport bikes Sales 1000 bikes x 15000bike 15000000 Variable expense 1000 bikes x 8000bike 8000000 Contribution mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started