Question

Toby and Norma are married at 18 and quickly have three children. Eventually, Toby and Norma separate and their children grow into adults and have

Toby and Norma are married at 18 and quickly have three children. Eventually, Toby and Norma separate and their children grow into adults and have their own families. Norman ever remarries and passes at the age of 78 after retiring from teaching in the School District of Philadelphia. At her death, she owned a home in East Oak Lane and left substantial assets. She never made a will.

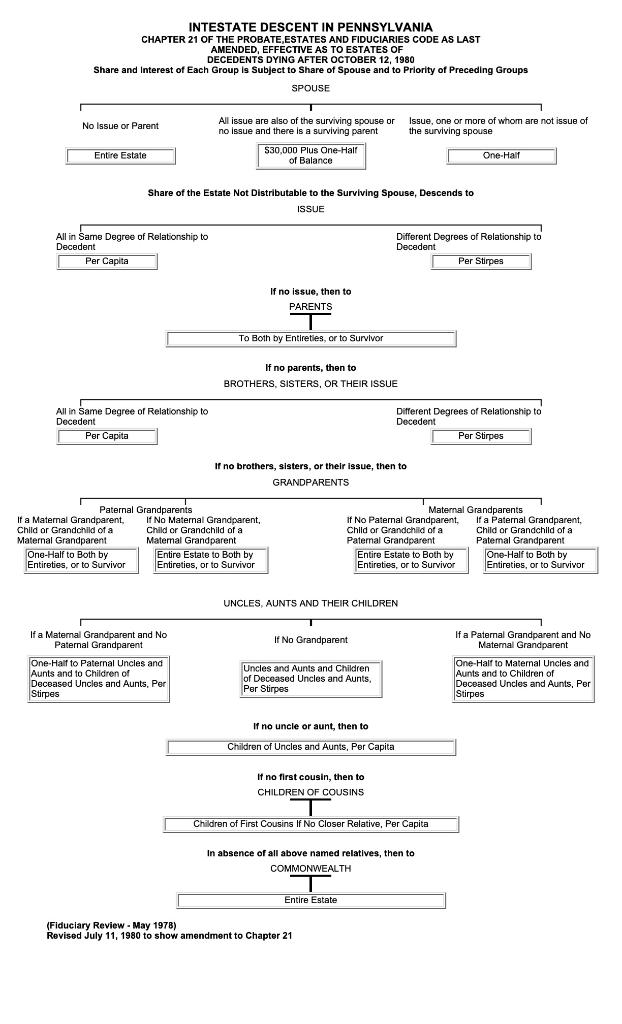

Read PA Intestate Succession.doc and look at PA Intestate Chart.pdf

Dying Without a Will - the law of Intestate Succession in Pennsylvania |

|

|

| What happens if I die without having a PA will? What happens if I have a will and it does not dispose all of my property? Will the Commonwealth of Pennsylvania get everything? These are common questions, and this article will hopefully clear up some common misconceptions. A person who dies without a will in PA is said to have died ?intestate.? When this occurs, a common misconception is that the state will take everything. However, in most cases, this is untrue. The Commonwealth of Pennsylvania has developed a set of laws which guide the disposition of a person?s property if he or she dies intestate or if all his or her property is not disposed of by a will. These laws are commonly referred to as the law of Intestate Succession in PA, and they can be found at 20 Pa.C.S.A. §2101 et seq. These laws spell out who gets what in these situations. In general, whether a person can be an heir depends on his or her relationship to the deceased. The Pennsylvania laws of Intestate Succession are designed to protect and provide for the surviving spouse and children of the decedent. Pennsylvania wants to assure that these individuals are provided for in the event of the untimely demise of a loved one. In addition to the surviving spouse and children, the law may also provide an inheritance for the decedent?s parents, siblings, aunts, uncles, and their children and grandchildren. So how does this law work? As complicated as the concept may seem, the law is laid out quite simply. If the decedent is survived by a spouse, the amount he or she will receive varies depending on which other relatives of the decedent also survive. The law controlling what portion of the decedent?s estate the surviving spouse receives can be found at 20 Pa.C.S.A. § 2102. It can be summarized as follows:

What if there is no surviving spouse? What about the portion of the estate that is not going to the surviving spouse? The laws of Intestate Succession at 20 Pa.C.S.A. § 2103, provide for the share of the estate, if any, that is not going to the surviving spouse or which passes if there is no surviving spouse. This section of the statute regulates the passing of the remaining share.

It is important to recognize that there are many different scenarios that can take place when distributing an intestate estate in PA. The law of Intestate Succession at 20 Pa.C.S.A. § 2104provides for two methods of distribution, and which method is used depends on the degree of the relationship of the survivors. There is per stirpes distribution, which is used when the decedent?s ancestors are not all in the same degree of relationship, and there is per capita distribution, which is used when all ancestors are in an equal degree of relationship. The confusion that is created in this area is why it is important to sit down with an attorney to discuss the specifics of the family?s relationships in the event that a loved one passes on without a will. It should be noted that before the decedent?s estate is distributed, the decedent?s debts, taxes, funeral expenses, and the expenses of administration are paid first, just like in PA estates where there is a will. What remains is what makes up the decedent?s distributable estate. It should also be noted that so-called ?will substitutes? such as joint tenancy property, life insurance pay able to beneficiaries other than the estate, bank accounts payable on death to specified individuals, etc., will pass in accordance with their terms and will not be part of the decedent?s estate to be distributed by the laws of Intestate Succession. Needless to say, one can achieve a great peace of mind by having a will professionally drafted. This will allow one to know exactly who will receive what without worrying about the laws of intestacy and with the added benefit of being able to designate an executor to handle the administration of the estate. However, in the event that a person dies without a will in Pennsylvania, rest assured that the Commonwealth, in most cases, does not get every thing! Is Toby entitled to any portion of her estate, even if they haven't seen each other in more than 40 years? If so, what does he get? |

DECEDENTS DYING AFTER OCTOBER 12, 1980 Share and Interest of Each Group is Subject to Share of Spouse and to Priority of Preceding Groups SPOUSE T All issue are also of the surviving spouse or no issue and there is a surviving parent No Issue or Parent Entire Estate INTESTATE DESCENT IN PENNSYLVANIA CHAPTER 21 OF THE PROBATE, ESTATES AND FIDUCIARIES CODE AS LAST AMENDED, EFFECTIVE AS TO ESTATES OF Per Capita All in Same Degree of Relationship to Decedent Per Capita All in Same Degree of Relationship to Decedent If a Maternal Grandparent, Child or Grandchild of a Maternal Grandparent Paternal Grandparents One-Half to Both by Entireties, or to Survivor Share of the Estate Not Distributable to the Surviving Spouse, Descends to ISSUE If a Maternal Grandparent and No Paternal Grandparent $30,000 Plus One-Half of Balance If No Maternal Grandparent, Child or Grandchild of a Maternal Grandparent One-Half to Paternal Uncles and Aunts and to Children of Deceased Uncles and Aunts, Per Stirpes To Both by Entireties, or to Survivor Entire Estate to Both by Entireties, or to Survivor If no issue, then to PARENTS If no parents, then to BROTHERS, SISTERS, OR THEIR ISSUE If no brothers, sisters, or their issue, then to GRANDPARENTS Uncles and Aunts and Children of Deceased Uncles and Aunts, Per Stirpes UNCLES, AUNTS AND THEIR CHILDREN T If No Grandparent If no uncle or aunt, then to Children of Uncles and Aunts, Per Capita If no first cousin, then to CHILDREN OF COUSINS Issue, one or more of whom are not issue of the surviving spouse Different Degrees of Relationship to Decedent Entire Estate If No Paternal Grandparent, Child or Grandchild of a Paternal Grandparent Entire Estate to Both by Entireties, or to Survivor (Fiduciary Review - May 1978) Revised July 11, 1980 to show amendment to Chapter 21 Different Degrees of Relationship to Decedent Per Stirpes Children of First Cousins If No Closer Relative, Per Capita In absence of all above named relatives, then to COMMONWEALTH One-Half Per Stirpes Maternal Grandparents If a Paternal Grandparent, Child or Grandchild of a Patemal Grandparent One-Half to Both by Entireties, or to Survivor If a Paternal Grandparent and No Maternal Grandparent One-Half to Maternal Uncles and Aunts and to Children of Deceased Uncles and Aunts, Per Stirpes

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer According to the laws of Intestate Succession in Pennsylvania if Norma dies without a will To...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started