Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today is April 15 (denoted time 0). XYZ stock may or may not pay dividends before September 1. (No data on this.) Consider the

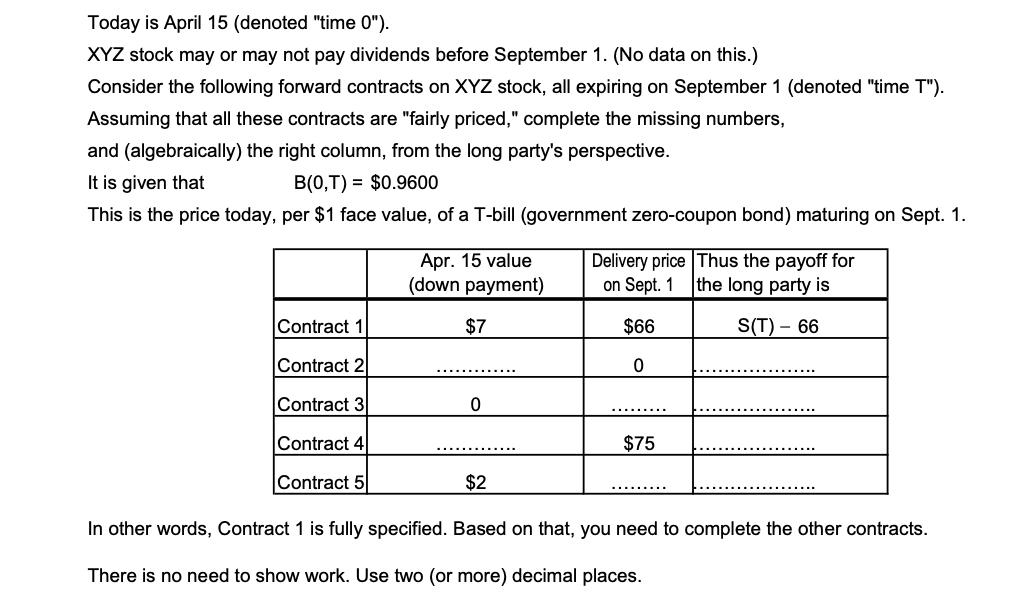

Today is April 15 (denoted "time 0"). XYZ stock may or may not pay dividends before September 1. (No data on this.) Consider the following forward contracts on XYZ stock, all expiring on September 1 (denoted "time T"). Assuming that all these contracts are "fairly priced," complete the missing numbers, and (algebraically) the right column, from the long party's perspective. It is given that B(0,T) = $0.9600 This is the price today, per $1 face value, of a T-bill (government zero-coupon bond) maturing on Sept. 1. Contract 1 Contract 2 Contract 3 Contract 4 Contract 5 Apr. 15 value (down payment) $7 0 Delivery price on Sept. 1 $66 0 *******.. $75 Thus the payoff for the long party is S(T) - 66 $2 In other words, Contract 1 is fully specified. Based on that, you need to complete the other contracts. There is no need to show work. Use two (or more) decimal places. ......... .....

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Appears that you have provided information about forward contracts on XYZ stock including the down p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started