Today is April 30, 2016, and you have just started your new job with a financial planning firm. In addition to studying for all your

Today is April 30, 2016, and you have just started your new job with a financial planning firm. In addition to studying for all your license exams, you have been asked to review a portion of a clients stock portfolio to determine the risk/return profiles of 12 stocks in the portfolio. Specifically, you have been asked to determine the monthly average returns and standard deviations for the 12 stocks for the past five years. The stocks (with their symbols in parentheses) are:

Archer Daniels Midland (ADM)

Boeing (BA)

Caterpillar (CAT)

Deere & Co. (DE)

General Mills, Inc. (GIS)

eBay, Inc. (EBAY)

Hershey (HSY)

International Business Machines Corporation (IBM)

JPMorgan Chase & Co. (JPM)

Microsoft (MSFT)

Procter and Gamble (PG)

Walmart (WMT)

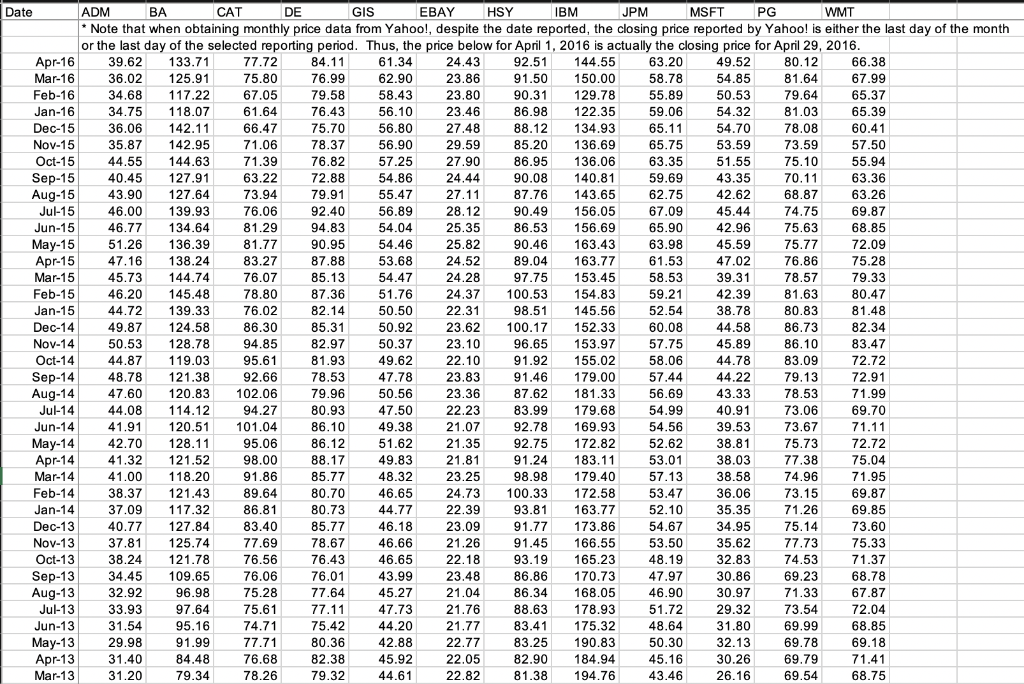

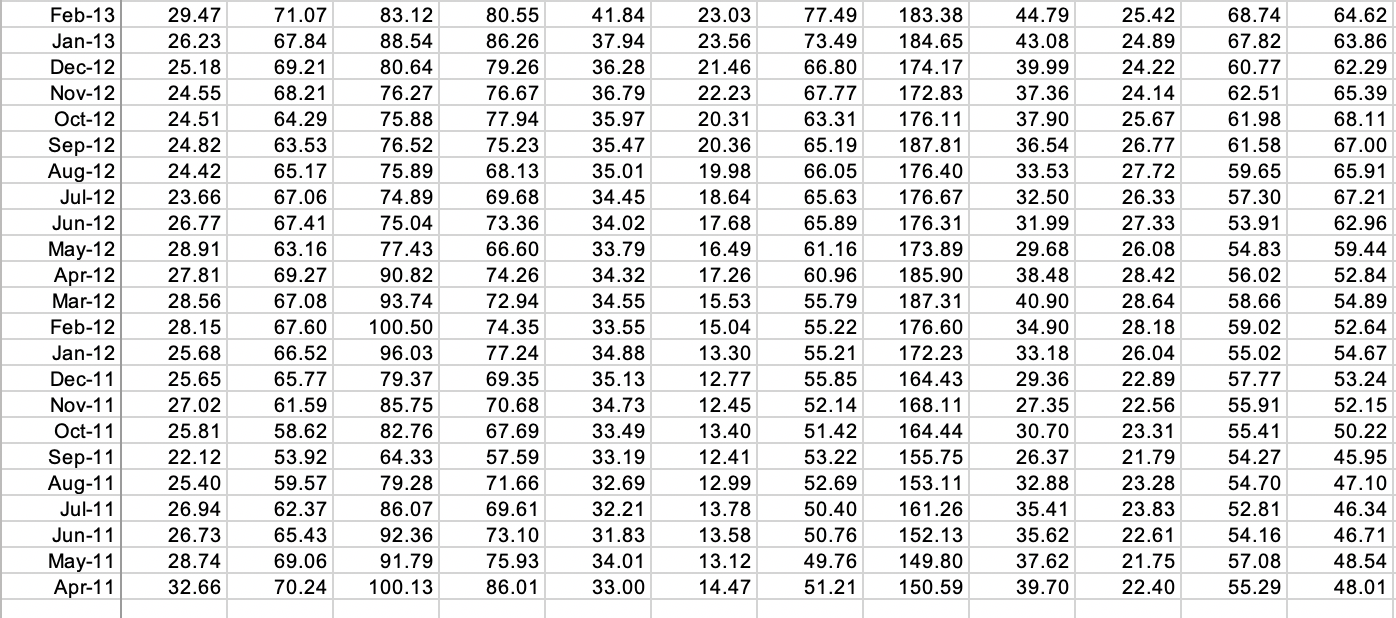

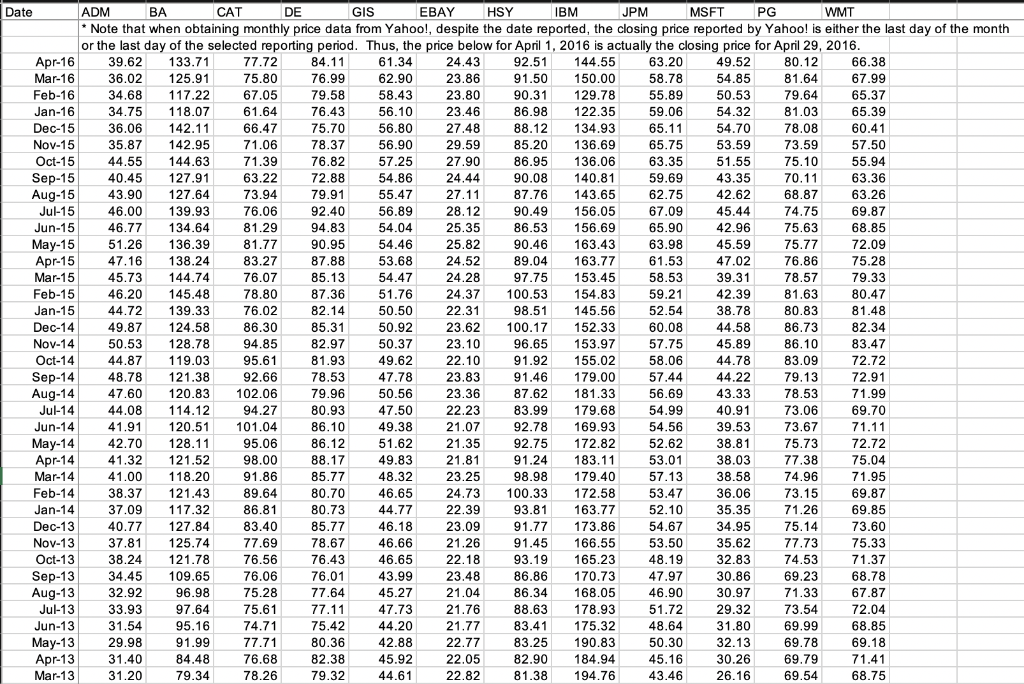

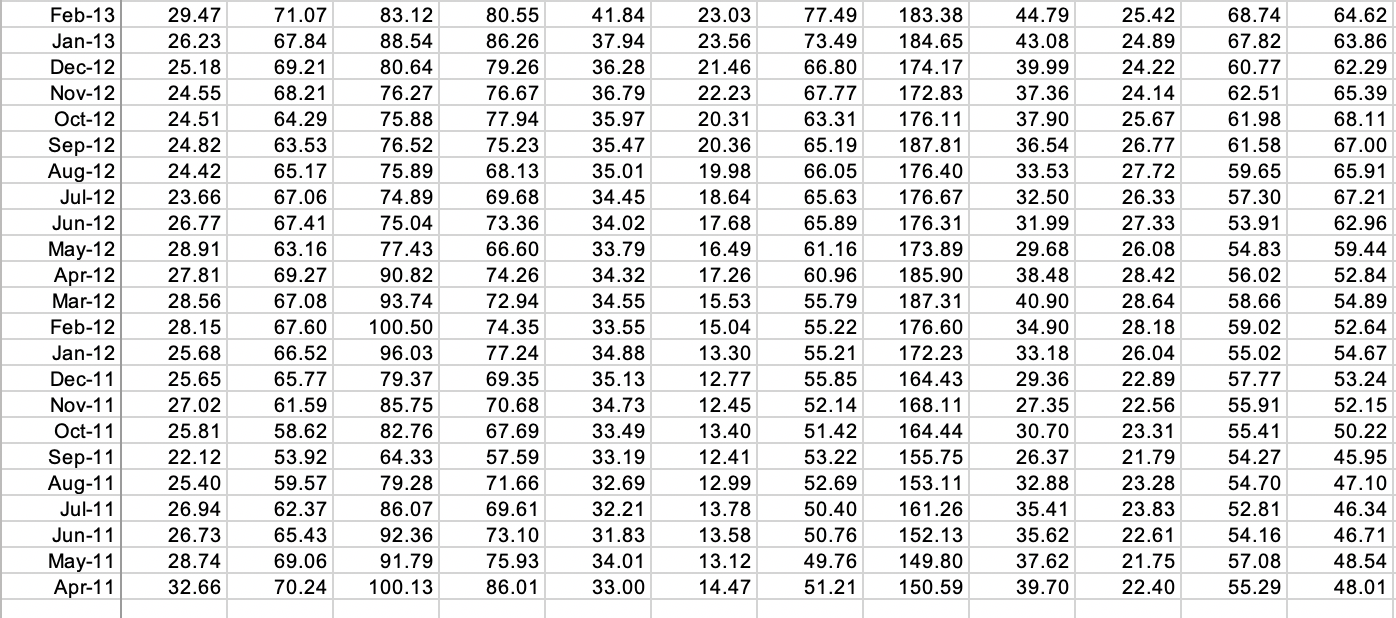

Your supervisor gave you the price information for each stock collected from Yahoo! Finance in an excel file. (you can see the file attached here.)

1. Convert these prices to monthly returns as the percentage change in the monthly prices. For this, create a separate worksheet within the Excel file. Note that to compute a return for each month, you need a beginning and ending price, so you will not be able to compute the return for the first month.

2. Compute the mean monthly returns and standard deviations for the monthly returns of each of the stocks. Convert the monthly statistics to annual statistics for easier interpretation (multiply the mean monthly return by 12, and multiply the monthly standard deviation by 12).

3. Add a column in your Excel worksheet with the average return across stocks for each month. This is the monthly return to an equally weighted portfolio of these 12 stocks. Compute the mean and standard deviation of monthly returns for the equally weighted portfolio. Double-check that the average return on this equally weighted portfolio is equal to the average return of all of the individual stocks. Convert these monthly statistics to annual statistics (as described in step 2) for interpretation.

4. What do you notice about the average of the volatilities of the individual stocks, compared to the volatility of the equally weighted portfolio?

118.07 60.41 140.81 55.47 Date ADM BA CAT DE GIS EBAY HSY IBM JPM MSFT PG WMT * Note that when obtaining monthly price data from Yahoo!, despite the date reported, the closing price reported by Yahoo! is either the last day of the month or the last day of the selected reporting period. Thus, the price below for April 1, 2016 is actually the closing price for April 29, 2016. Apr-16 39.62 133.71 77.72 84.11 61.34 24.43 92.51 144.55 63.20 49.52 80.12 66.38 Mar-16 36.02 125.91 75.80 76.99 62.90 23.86 91.50 150.00 58.78 54.85 81.64 67.99 Feb-16 34.68 117.22 67.05 79.58 58.43 23.80 90.31 129.78 55.89 50.53 79.64 65.37 Jan-16 34.75 61.64 76.43 56.10 23.46 86.98 122.35 59.06 54.32 81.03 65.39 Dec-15 36.06 142.11 66.47 75.70 56.80 27.48 88.12 134.93 65.11 54.70 78.08 Nov-15 35.87 142.95 71.06 78.37 56.90 29.59 85.20 136.69 65.75 53.59 73.59 Oct-15 57.50 44.55 144.63 71.39 76.82 57.25 27.90 86.95 136.06 63.35 51.55 75.10 55.94 Sep-15 40.45 127.91 63.22 72.88 54.86 24.44 90.08 59.69 43.35 70.11 63.36 Aug-15 43.90 127.64 73.94 79.91 27.11 87.76 1962 2 25 143.65 62.75 42.62 228 78 63.26 68.87 Jul-15 46.00 139.93 76.06 20 92.40 56.89 28.12 90.49 24 156.05 41 67.09 45.44 74.75 Jun-15 69.87 46.77 134.64 81.29 94.83 ge 54.04 25.35 86.53 156.69 65.90 42.96 75.63 68.85 May-15 51.26 136.39 81.77 90.95 54.46 25.82 90.46 163.43 63.98 45.59 75.77 72.09 Apr-15 47.16 138.24 83.27 87.88 53.68 24.52 89.04 163.77 61.53 47.02 76.86 75.28 Mar-15 45.73 144.74 76.07 85.13 54.47 24.28 97.75 153.45 58.53 39.31 78.57 79.33 Feb-15 46.20 145.48 78.80 87.36 51.76 24.37 100.53 154.83 59.21 42.39 81.63 80.47 Jan-15 44.72 139.33 76.02 82.14 50.50 22.31 98.51 145.56 52.54 38.78 80.83 81.48 Dec-14 49.87 124.58 86.30 85.31 50.92 23.62 100.17 152.33 60.08 44.58 86.73 82.34 Nov-14 50.53 128.78 94.85 82.97 50.37 23.10 96.65 153.97 57.75 45.89 86.10 83.47 Oct-14 44.87 119.03 95.61 81.93 49.62 22.10 91.92 155.02 58.06 44.78 83.09 72.72 Sep-14 48.78 121.38 92.66 78.53 47.78 23.83 91.46 179.00 57.44 44.22 79.13 Aug-14 47.60 120.83 72.91 102.06 79.96 50.56 23.36 87.62 181.33 56.69 43.33 78.53 71.99 Jul-14 44.08 114.12 94.27 80.93 47.50 22.23 83.99 179.68 54.99 40.91 73.06 69.70 Jun-14 41.91 120.51 101.04 86.10 49.38 21.07 92.78 169.93 54.56 39.53 73.67 71.11 May-14 42.70 128.11 95.06 86.12 51.62 21.35 92.75 172.82 52.62 38.81 75.73 72.72 Apr-14 41.32 121.52 98.00 88.17 49.83 21.81 91.24 183.11 53.01 38.03 77.38 75.04 Mar-14 41.00 118.20 91.86 85.77 48.32 23.25 98.98 179.40 57.13 38.58 74.96 71.95 Feb-14 38.37 121.43 89.64 80.70 46.65 24.73 100.33 172.58 53.47 36.06 Jan-14 73.15 69.87 37.09 117.32 86.81 80.73 44.77 22.39 163.77 52.10 35.35 71.26 69.85 Dec-13 40.77 127.84 83.40 85.77 46.18 23.09 173.86 34.95 54.67 27 75.14 za Nov-13 37.81 73.60 125.74 77.69 78.67 46.66 04 21.26 91.45 166.55 53.50 35.62 2012 22 77.73 75.33 Oct-13 38.24 121.78 76.56 76.43 0227 46.65 22.18 93.19 165.23 48.19 32.83 74.53 71.37 Sep-13 34.45 109.65 76.06 76.01 43.99 23.48 86.86 170.73 47.97 30.86 69.23 68.78 Aug-13 32.92 96.98 75.28 77.64 45.27 21.04 86.34 168.05 46.90 30.97 71.33 67.87 Jul-13 33.93 97.64 75.61 77.11 47.73 21.76 88.63 178.93 51.72 29.32 73.54 72.04 Jun-13 31.54 95.16 74.71 75.42 44.20 21.77 83.41 175.32 48.64 31.80 69.99 68.85 May-13 29.98 91.99 77.71 80.36 42.88 22.77 83.25 190.83 50.30 32.13 69.78 69.18 Apr-13 31.40 84.48 76.68 82.38 45.92 22.05 82.90 184.94 45.16 30.26 69.79 71.41 Mar-13 31.20 79.34 78.26 79.32 44.61 22.82 81.38 194.76 43.46 26.16 69.54 68.75 93.81 91.77 Feb-13 Jan-13 Dec-12 Nov-12 Oct-12 Sep-12 Aug-12 Jul-12 Jun-12 May-12 Apr-12 Mar-12 Feb-12 Jan-12 Dec-11 Nov-11 Oct-11 Sep-11 Aug-11 Jul-11 Jun-11 May-11 Apr-11 29.47 26.23 25.18 24.55 24.51 24.82 24.42 23.66 26.77 28.91 27.81 28.56 28.15 25.68 25.65 27.02 25.81 22.12 25.40 26.94 26.73 28.74 32.66 71.07 67.84 69.21 68.21 64.29 63.53 65.17 67.06 67.41 63.16 69.27 67.08 67.60 66.52 65.77 61.59 58.62 53.92 59.57 62.37 65.43 69.06 70.24 83.12 88.54 80.64 76.27 75.88 76.52 75.89 74.89 75.04 77.43 90.82 93.74 100.50 96.03 79.37 85.75 82.76 64.33 79.28 86.07 92.36 91.79 100.13 80.55 86.26 79.26 76.67 77.94 75.23 68.13 69.68 73.36 66.60 74.26 72.94 74.35 77.24 69.35 70.68 67.69 57.59 71.66 69.61 73.10 75.93 86.01 41.84 37.94 36.28 36.79 35.97 35.47 35.01 34.45 34.02 33.79 34.32 34.55 33.55 34.88 35.13 34.73 33.49 33.19 32.69 32.21 31.83 34.01 33.00 23.03 23.56 21.46 22.23 20.31 20.36 19.98 18.64 17.68 16.49 17.26 15.53 15.04 13.30 12.77 12.45 13.40 12.41 12.99 13.78 13.58 13.12 14.47 77.49 73.49 66.80 67.77 63.31 65.19 66.05 65.63 65.89 61.16 60.96 55.79 55.22 55.21 55.85 52.14 51.42 53.22 52.69 50.40 50.76 49.76 51.21 183.38 184.65 174.17 172.83 176.11 187.81 176.40 176.67 176.31 173.89 185.90 187.31 176.60 172.23 164.43 168.11 164.44 155.75 153.11 161.26 152.13 149.80 150.59 44.79 43.08 39.99 37.36 37.90 36.54 33.53 32.50 31.99 29.68 38.48 40.90 34.90 33.18 29.36 27.35 30.70 26.37 32.88 35.41 35.62 37.62 39.70 25.42 24.89 24.22 24.14 25.67 26.77 27.72 26.33 27.33 26.08 28.42 28.64 28.18 26.04 22.89 22.56 23.31 21.79 23.28 23.83 22.61 21.75 22.40 68.74 67.82 60.77 62.51 61.98 61.58 59.65 57.30 53.91 54.83 56.02 58.66 59.02 55.02 57.77 55.91 55.41 54.27 54.70 52.81 54.16 57.08 55.29 64.62 63.86 62.29 65.39 68.11 67.00 65.91 67.21 62.96 59.44 52.84 54.89 52.64 54.67 53.24 52.15 50.22 45.95 47.10 46.34 46.71 48.54 48.01 118.07 60.41 140.81 55.47 Date ADM BA CAT DE GIS EBAY HSY IBM JPM MSFT PG WMT * Note that when obtaining monthly price data from Yahoo!, despite the date reported, the closing price reported by Yahoo! is either the last day of the month or the last day of the selected reporting period. Thus, the price below for April 1, 2016 is actually the closing price for April 29, 2016. Apr-16 39.62 133.71 77.72 84.11 61.34 24.43 92.51 144.55 63.20 49.52 80.12 66.38 Mar-16 36.02 125.91 75.80 76.99 62.90 23.86 91.50 150.00 58.78 54.85 81.64 67.99 Feb-16 34.68 117.22 67.05 79.58 58.43 23.80 90.31 129.78 55.89 50.53 79.64 65.37 Jan-16 34.75 61.64 76.43 56.10 23.46 86.98 122.35 59.06 54.32 81.03 65.39 Dec-15 36.06 142.11 66.47 75.70 56.80 27.48 88.12 134.93 65.11 54.70 78.08 Nov-15 35.87 142.95 71.06 78.37 56.90 29.59 85.20 136.69 65.75 53.59 73.59 Oct-15 57.50 44.55 144.63 71.39 76.82 57.25 27.90 86.95 136.06 63.35 51.55 75.10 55.94 Sep-15 40.45 127.91 63.22 72.88 54.86 24.44 90.08 59.69 43.35 70.11 63.36 Aug-15 43.90 127.64 73.94 79.91 27.11 87.76 1962 2 25 143.65 62.75 42.62 228 78 63.26 68.87 Jul-15 46.00 139.93 76.06 20 92.40 56.89 28.12 90.49 24 156.05 41 67.09 45.44 74.75 Jun-15 69.87 46.77 134.64 81.29 94.83 ge 54.04 25.35 86.53 156.69 65.90 42.96 75.63 68.85 May-15 51.26 136.39 81.77 90.95 54.46 25.82 90.46 163.43 63.98 45.59 75.77 72.09 Apr-15 47.16 138.24 83.27 87.88 53.68 24.52 89.04 163.77 61.53 47.02 76.86 75.28 Mar-15 45.73 144.74 76.07 85.13 54.47 24.28 97.75 153.45 58.53 39.31 78.57 79.33 Feb-15 46.20 145.48 78.80 87.36 51.76 24.37 100.53 154.83 59.21 42.39 81.63 80.47 Jan-15 44.72 139.33 76.02 82.14 50.50 22.31 98.51 145.56 52.54 38.78 80.83 81.48 Dec-14 49.87 124.58 86.30 85.31 50.92 23.62 100.17 152.33 60.08 44.58 86.73 82.34 Nov-14 50.53 128.78 94.85 82.97 50.37 23.10 96.65 153.97 57.75 45.89 86.10 83.47 Oct-14 44.87 119.03 95.61 81.93 49.62 22.10 91.92 155.02 58.06 44.78 83.09 72.72 Sep-14 48.78 121.38 92.66 78.53 47.78 23.83 91.46 179.00 57.44 44.22 79.13 Aug-14 47.60 120.83 72.91 102.06 79.96 50.56 23.36 87.62 181.33 56.69 43.33 78.53 71.99 Jul-14 44.08 114.12 94.27 80.93 47.50 22.23 83.99 179.68 54.99 40.91 73.06 69.70 Jun-14 41.91 120.51 101.04 86.10 49.38 21.07 92.78 169.93 54.56 39.53 73.67 71.11 May-14 42.70 128.11 95.06 86.12 51.62 21.35 92.75 172.82 52.62 38.81 75.73 72.72 Apr-14 41.32 121.52 98.00 88.17 49.83 21.81 91.24 183.11 53.01 38.03 77.38 75.04 Mar-14 41.00 118.20 91.86 85.77 48.32 23.25 98.98 179.40 57.13 38.58 74.96 71.95 Feb-14 38.37 121.43 89.64 80.70 46.65 24.73 100.33 172.58 53.47 36.06 Jan-14 73.15 69.87 37.09 117.32 86.81 80.73 44.77 22.39 163.77 52.10 35.35 71.26 69.85 Dec-13 40.77 127.84 83.40 85.77 46.18 23.09 173.86 34.95 54.67 27 75.14 za Nov-13 37.81 73.60 125.74 77.69 78.67 46.66 04 21.26 91.45 166.55 53.50 35.62 2012 22 77.73 75.33 Oct-13 38.24 121.78 76.56 76.43 0227 46.65 22.18 93.19 165.23 48.19 32.83 74.53 71.37 Sep-13 34.45 109.65 76.06 76.01 43.99 23.48 86.86 170.73 47.97 30.86 69.23 68.78 Aug-13 32.92 96.98 75.28 77.64 45.27 21.04 86.34 168.05 46.90 30.97 71.33 67.87 Jul-13 33.93 97.64 75.61 77.11 47.73 21.76 88.63 178.93 51.72 29.32 73.54 72.04 Jun-13 31.54 95.16 74.71 75.42 44.20 21.77 83.41 175.32 48.64 31.80 69.99 68.85 May-13 29.98 91.99 77.71 80.36 42.88 22.77 83.25 190.83 50.30 32.13 69.78 69.18 Apr-13 31.40 84.48 76.68 82.38 45.92 22.05 82.90 184.94 45.16 30.26 69.79 71.41 Mar-13 31.20 79.34 78.26 79.32 44.61 22.82 81.38 194.76 43.46 26.16 69.54 68.75 93.81 91.77 Feb-13 Jan-13 Dec-12 Nov-12 Oct-12 Sep-12 Aug-12 Jul-12 Jun-12 May-12 Apr-12 Mar-12 Feb-12 Jan-12 Dec-11 Nov-11 Oct-11 Sep-11 Aug-11 Jul-11 Jun-11 May-11 Apr-11 29.47 26.23 25.18 24.55 24.51 24.82 24.42 23.66 26.77 28.91 27.81 28.56 28.15 25.68 25.65 27.02 25.81 22.12 25.40 26.94 26.73 28.74 32.66 71.07 67.84 69.21 68.21 64.29 63.53 65.17 67.06 67.41 63.16 69.27 67.08 67.60 66.52 65.77 61.59 58.62 53.92 59.57 62.37 65.43 69.06 70.24 83.12 88.54 80.64 76.27 75.88 76.52 75.89 74.89 75.04 77.43 90.82 93.74 100.50 96.03 79.37 85.75 82.76 64.33 79.28 86.07 92.36 91.79 100.13 80.55 86.26 79.26 76.67 77.94 75.23 68.13 69.68 73.36 66.60 74.26 72.94 74.35 77.24 69.35 70.68 67.69 57.59 71.66 69.61 73.10 75.93 86.01 41.84 37.94 36.28 36.79 35.97 35.47 35.01 34.45 34.02 33.79 34.32 34.55 33.55 34.88 35.13 34.73 33.49 33.19 32.69 32.21 31.83 34.01 33.00 23.03 23.56 21.46 22.23 20.31 20.36 19.98 18.64 17.68 16.49 17.26 15.53 15.04 13.30 12.77 12.45 13.40 12.41 12.99 13.78 13.58 13.12 14.47 77.49 73.49 66.80 67.77 63.31 65.19 66.05 65.63 65.89 61.16 60.96 55.79 55.22 55.21 55.85 52.14 51.42 53.22 52.69 50.40 50.76 49.76 51.21 183.38 184.65 174.17 172.83 176.11 187.81 176.40 176.67 176.31 173.89 185.90 187.31 176.60 172.23 164.43 168.11 164.44 155.75 153.11 161.26 152.13 149.80 150.59 44.79 43.08 39.99 37.36 37.90 36.54 33.53 32.50 31.99 29.68 38.48 40.90 34.90 33.18 29.36 27.35 30.70 26.37 32.88 35.41 35.62 37.62 39.70 25.42 24.89 24.22 24.14 25.67 26.77 27.72 26.33 27.33 26.08 28.42 28.64 28.18 26.04 22.89 22.56 23.31 21.79 23.28 23.83 22.61 21.75 22.40 68.74 67.82 60.77 62.51 61.98 61.58 59.65 57.30 53.91 54.83 56.02 58.66 59.02 55.02 57.77 55.91 55.41 54.27 54.70 52.81 54.16 57.08 55.29 64.62 63.86 62.29 65.39 68.11 67.00 65.91 67.21 62.96 59.44 52.84 54.89 52.64 54.67 53.24 52.15 50.22 45.95 47.10 46.34 46.71 48.54 48.01