Answered step by step

Verified Expert Solution

Question

1 Approved Answer

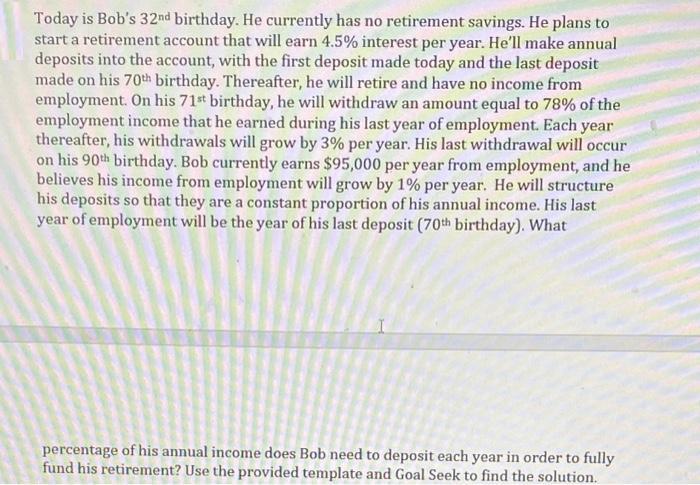

Today is Bob's 32nd birthday. He currently has no retirement savings. He plans to start a retirement account that will earn 4.5% interest per

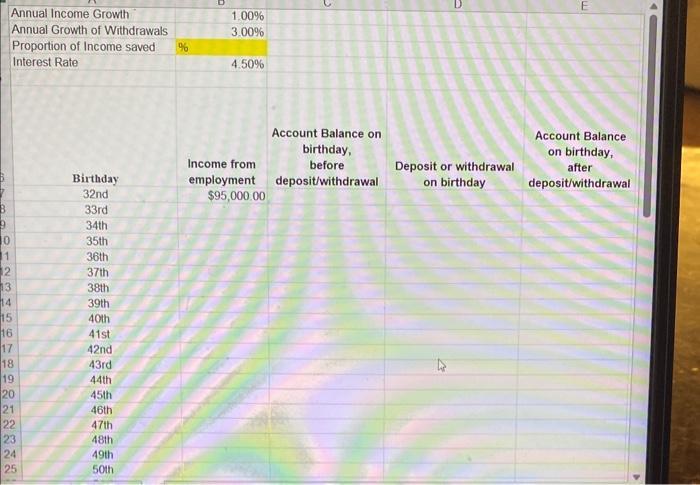

Today is Bob's 32nd birthday. He currently has no retirement savings. He plans to start a retirement account that will earn 4.5% interest per year. He'll make annual deposits into the account, with the first deposit made today and the last deposit made on his 70th birthday. Thereafter, he will retire and have no income from employment. On his 71st birthday, he will withdraw an amount equal to 78% of the employment income that he earned during his last year of employment. Each year thereafter, his withdrawals will grow by 3% per year. His last withdrawal will occur on his 90th birthday. Bob currently earns $95,000 per year from employment, and he believes his income from employment will grow by 1% per year. He will structure his deposits so that they are a constant proportion of his annual income. His last year of employment will be the year of his last deposit (70th birthday). What percentage of his annual income does Bob need to deposit each year in order to fully fund his retirement? Use the provided template and Goal Seek to find the solution. 9 10 Annual Income Growth Annual Growth of Withdrawals Proportion of Income saved % Interest Rate 1 12 13 14 15 16 17 18 19 20 72822 21 23 24 25 Birthday 32nd 33rd 34th 35th 36th 37th 38th 39th 40th 41st 42nd 43rd 44th 45th 46th 47th 48th 49th 50th 1.00% 3.00% 4.50% Income from employment $95,000.00 Account Balance on birthday, before deposit/withdrawal D Deposit or withdrawal on birthday Account Balance on birthday, after deposit/withdrawal

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started