Answered step by step

Verified Expert Solution

Question

1 Approved Answer

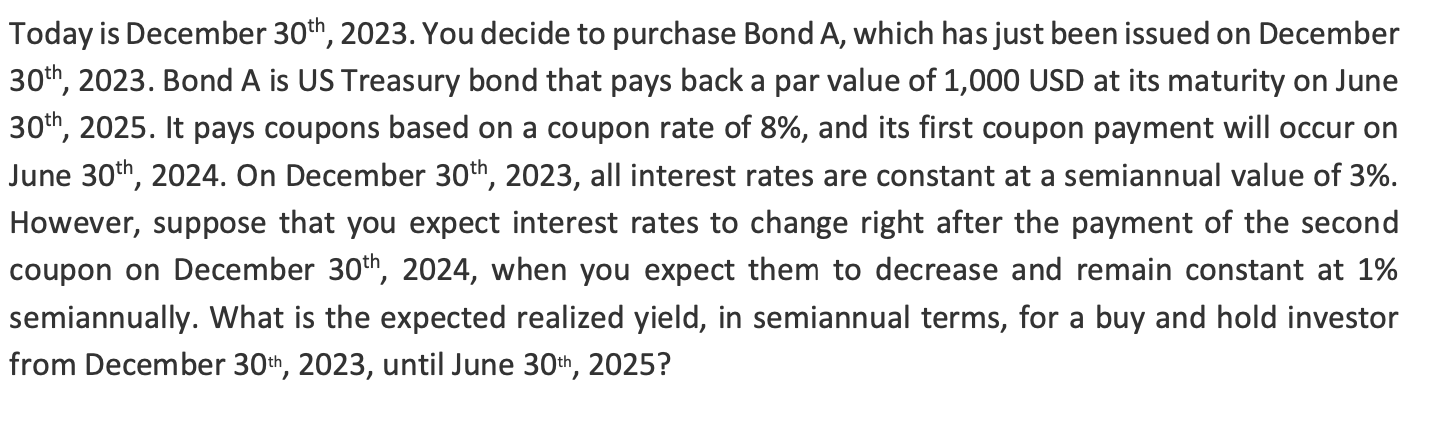

Today is December 3 0 t h , 2 0 2 3 . You decide to purchase Bond A , which has just been issued

Today is December You decide to purchase Bond A which has just been issued on December

Bond A is US Treasury bond that pays back a par value of USD at its maturity on June

It pays coupons based on a coupon rate of and its first coupon payment will occur on

June On December all interest rates are constant at a semiannual value of

However, suppose that you expect interest rates to change right after the payment of the second

coupon on December when you expect them to decrease and remain constant at

semiannually. What is the expected realized yield, in semiannual terms, for a buy and hold investor

from December th until June th

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started