Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today is February 8, 2021, and GameStop Corp.' stock is trading for USD 59.04 in the spot market, down from USD 469.4194 on January 29,

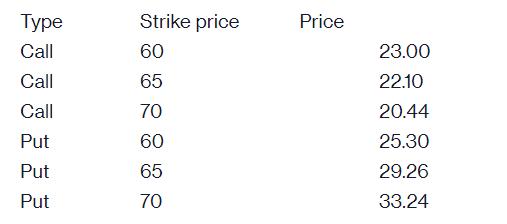

Today is February 8, 2021, and GameStop Corp.' stock is trading for USD 59.04 in the spot market, down from USD 469.4194 on January 29, 2021. It has been quite a ride, both for hedge fund types, who were short prior to the stock's meteoric rise, and for retail investors, who were reportedly long. The table below reports the price of American call and put options on the stock. These options will expire on April 16, 2021. The risk-free interest rate for the period corresponding to the life of these options is equal to 20 basis points per year, using the Actual/360 convention. GameStop suspended dividend payments several months ago.

A) Calculate the implied volatility for each option and describe the pattern that you observe. Is this pattern surprising to you? Does it contravene the law of one price in the option market? Please, discuss briefly.

B) Calculate the delta, gamma, vega, theta, and rho of each option. Present your results in a neat table displaying each Greek in a separate column.

C) Assume that you are short 10 contracts of each call option contract and long 10 contracts of each put option and calculate the Greeks of your portfolio.

Type Call Call Call Put Put Put Strike price 60 65 70 60 65 70 Price 23.00 22.10 20.44 25.30 29.26 33.24

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started