Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today is March 1. The swap contract has residual maturity of 9 months. Its notional principal is $1,000. You receive [8% fixed rate paid

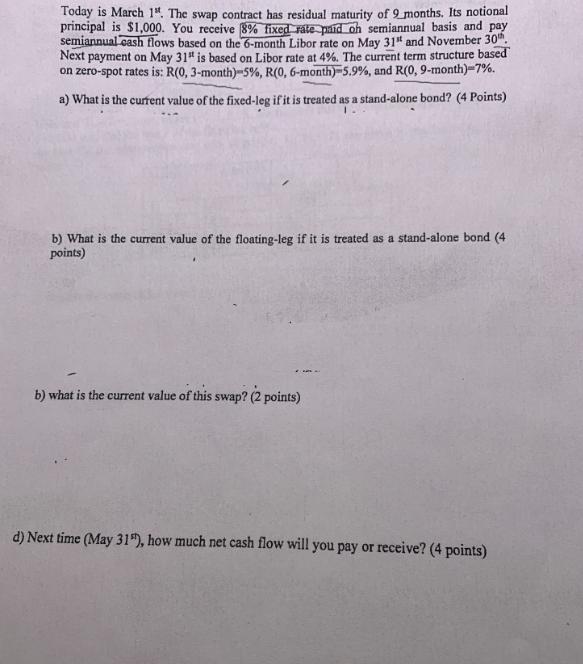

Today is March 1". The swap contract has residual maturity of 9 months. Its notional principal is $1,000. You receive [8% fixed rate paid oh semiannual basis and pay semiannual cash flows based on the 6-month Libor rate on May 31" and November 30th Next payment on May 31" is based on Libor rate at 4%. The current term structure based on zero-spot rates is: R(0, 3-month) -5%, R(0, 6-month)-5.9%, and R(0, 9-month) -7%. a) What is the current value of the fixed-leg if it is treated as a stand-alone bond? (4 Points) b) What is the current value of the floating-leg if it is treated as a stand-alone bond (4) points) b) what is the current value of this swap? (2 points) d) Next time (May 31"), how much net cash flow will you pay or receive? (4 points)

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the current value of the fixedleg we need to discount each of the semiannual cash flo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started