Answered step by step

Verified Expert Solution

Question

1 Approved Answer

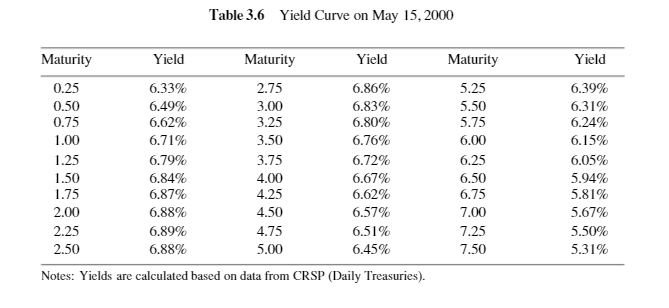

Today is May15,2000, and the current , semi-annually compounded yield curve is in Table3.6.Compute the duration for the following securities: (d) 6-year coating rate bond

Today is May15,2000, and the current , semi-annually compounded yield curve is in Table3.6.Compute the duration for the following securities:

(d) 6-year coating rate bond with a zero spread, paying semi annually

(f)41/4year coating rate bond with 50 basis point spread , paid semi annually

Please explain using excel. Thank you.

Table 3.6 Yield Curve on May 15, 2000 Maturity Yield Maturity Yield Maturity Yield 0.25 6.33% 2.75 6.86% 5.25 6.39% 0.50 6.49% 3.00 6.83% 5.50 6.31% 0.75 6.62% 3.25 6.80% 5.75 6.24% 1.00 6.71% 3.50 6.76% 6.00 6.15% 1.25 6.79% 3.75 6.72% 6.25 6.05% 1.50 6.84% 4.00 6.67% 6.50 5.94% 1.75 6.87% 4.25 6.62% 6.75 5.81% 2.00 6.88% 4.50 6.57% 7.00 5.67% 2.25 6.89% 4.75 6.51% 7.25 5.50% 2.50 6.88% 5.00 6.45% 7.50 5.31% Notes: Yields are calculated based on data from CRSP (Daily Treasuries).

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the duration of the bonds using Excel d 6year zeroco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started