Answered step by step

Verified Expert Solution

Question

1 Approved Answer

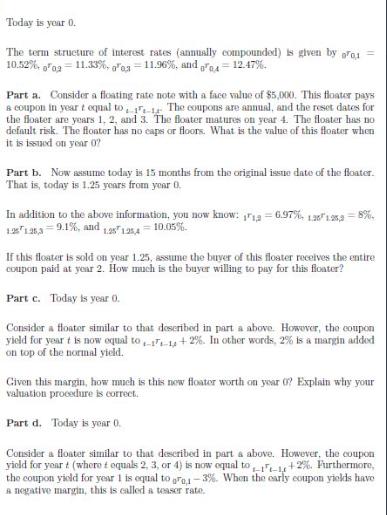

Today is year 0. The term structure of interest rates (annually compounded) is given by 001 = 10.52%, 002-11.33%, 00-11.96%, and 04 = 12.47%.

Today is year 0. The term structure of interest rates (annually compounded) is given by 001 = 10.52%, 002-11.33%, 00-11.96%, and 04 = 12.47%. Part a. Consider a floating rate note with a face value of $5,000. This floater pays a coupon in year t equal to 1 The coupons are annual, and the reset dates for the floater are years 1. 2, and 3. The floater matures on year 4. The floater has no default risk. The floater has no caps or floors. What is the value of this floater when it is issued on your 07 Part b. Now assume today is 15 months from the original issue date of the floater. That is, today is 1.25 years from year 0. In addition to the above information, you now know: 11,2 -6.97% 1.28125,98%. 1.25 1.25,3 9.1%, and 1.25 1.25,4 10.05%. If this floater is sold on year 1.25, assume the buyer of this floster receives the entire coupon paid at year 2. How much is the buyer willing to pay for this floater? Part c. Today is year 0. Consider a floater similar to that described in part a above. However, the coupon yield for year t is now equal to 17-1+2%. In other words, 2% is a margin added on top of the normal yield. Civen this margin, how much is this new floater worth on year 0? Explain why your valuation procedure is correct. Part d. Today is year 0. Consider a floater similar to that described in part a above. However, the coupon yield for your t (where t equals 2, 3, or 4) is now equal to 1-1-1+2%. Furthermore, the coupon yield for year 1 is equal to pra1-3%. When the early coupon yields have a negative margin, this is called a teaser rate.

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

What is the value of this floater when it is issued on year 0 How does this compare to the value of the floater in part a Part a To value the floater we need to calculate the expected cash flows at ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started