Question

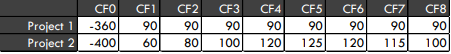

Today (T=0), Company Y is evaluating Project 1 and Project 2 Each projects initial cash outlay and future cash flows are forecasted below Managements primary

Today (T=0), Company Y is evaluating Project 1 and Project 2

Each projects initial cash outlay and future cash flows are forecasted below

Managements primary goal is to maximize firm value by maximizing NPV

The current cost of capital for the project is 10%

1.Calculate the discounted payback period for both projects using the current cost of capital. Be careful not to round intermediate steps! Six decimal places should be enough. Assume there are 360 days in a year and round your final answer up to the nearest whole day.

Which of the following statements is most likely TRUE:

a. Project 1s discounted payback period is 104 days faster

b. Project 2s discounted payback period is 104 days faster

c. Project 1s discounted payback period is 106 days faster

d. Project 1s discounted payback period is 106 days longer

e. Project 2s discounted payback period is 106 days longe

2.Assume managements total budget is $1000 and use the current cost of capital.

What is managements best course of action?

a. Management should only accept project 1

b. Management should only accept project 2

c. Management should accept both projects

d. Management should reject both projects

e. Insufficient information to answer this problem

3.Assume managements total budget is $500 and use the current cost of capital.

What is managements best course of action?

a. Management should only accept project 1

b. Management should only accept project 2

c. Management should accept both projects

d. Management should reject both projects

e. Insufficient information to answer this problem

Project 1 Project 2 CFO -360 -400 CF1 90 60 CF2 90 80 CF3 90 100 CF4 90 120 CF5 90 125 CF6 901 120 CF7 90 115 CF8 90 100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started