Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today, the gross price of a 10-year bond with $1,000 principal amount is 119.277. At the same moment, the price of the 10-year futures

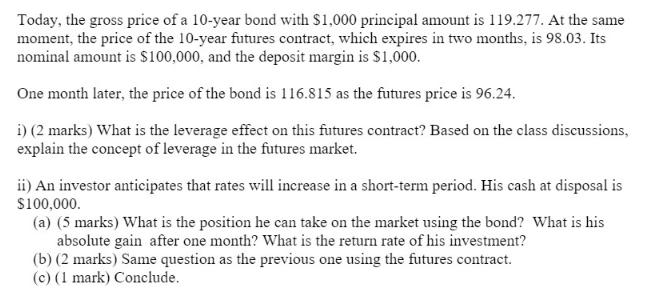

Today, the gross price of a 10-year bond with $1,000 principal amount is 119.277. At the same moment, the price of the 10-year futures contract, which expires in two months, is 98.03. Its nominal amount is $100,000, and the deposit margin is $1,000. One month later, the price of the bond is 116.815 as the futures price is 96.24. i) (2 marks) What is the leverage effect on this futures contract? Based on the class discussions, explain the concept of leverage in the futures market. ii) An investor anticipates that rates will increase in a short-term period. His cash at disposal is $100,000. (a) (5 marks) What is the position he can take on the market using the bond? What is his absolute gain after one month? What is the return rate of his investment? (b) (2 marks) Same question as the previous one using the futures contract. (c) (1 mark) Conclude.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

for the future contract leverage to be effectively calculated the following methodformula can be used leverage futures contract nominal amount Deposit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started